[Bitpush Weekend Review] 21Shares submits XRP spot ETF application to US SEC, review period begins; JPMorgan acquires stake in Ethereum reserve leader Bitmine, holding position valued at $102 million; US CFTC may allow the use of stablecoins as tokenized collateral in derivatives markets

Bitpush Weekend Key News Review:

[21Shares Submits 8(A) Form to US SEC for Proposed XRP Spot ETF]

According to Bitpush, Bloomberg ETF analyst Eric Balchunas posted on social media that 21Shares has submitted a new 8(a) form to the US SEC, proposing to issue its XRP spot ETF. The application is subject to a 20-day review period.

[JPMorgan Acquires Stake in Ethereum Reserve Leader Bitmine, Holding Value Reaches $102 Million]

According to Bitpush and as reported by Golden Ten Data, JPMorgan’s 13F-HR filing submitted to the US SEC on November 7 shows that as of September 30, the bank held 1,974,144 shares of Bitmine Immersion Technologies, the world’s largest Ethereum reserve company, with a holding value of $102 million.

Bitmine was originally a bitcoin mining company and will transform into an Ethereum reserve company in 2025. It currently holds over 3.24 million Ethereum, maintaining its position as the largest global reserve.

[US CFTC May Allow Stablecoins as Tokenized Collateral in Derivatives Markets]

According to Bitpush and CoinDesk, sources reveal that the US Commodity Futures Trading Commission (CFTC) is formulating a tokenized collateral policy expected to be released early next year.

This policy may allow stablecoins to be used as acceptable tokenized collateral in derivatives markets, possibly starting with a pilot at US clearinghouses and implementing stricter regulations requiring more disclosure, such as position sizes, large traders and trading volumes, as well as more detailed reporting of operational events.

[Changpeng Zhao: No Personal Relationship with Trump, No Business Dealings with WLFI]

According to Bitpush, in an interview with Fox News today, Changpeng Zhao said he was "a bit surprised by the pardon; you never know if or when it will happen." He has never met or spoken with Trump. Zhao said he would very much like to meet Trump, which would be a great honor.

Additionally, Zhao stated that he met Eric Trump once at a bitcoin conference in Abu Dhabi. Reports of "trading with WLFI in exchange for a pardon" are false; there was no transaction or discussion. There have never been any negotiations. He has no business relationship with WLFI.

[OpenAI Exposed for Requesting Loan Guarantees from White House, Contradicting CEO’s Public Statement]

According to Bitpush and Decrypt, an 11-page letter submitted by OpenAI to the White House Office of Science and Technology Policy on October 27 was made public, explicitly requesting government loan guarantees and direct funding support for AI infrastructure construction.

However, only 10 days later, CEO Sam Altman publicly stated on social media that "OpenAI does not need or want government guarantees" and emphasized that "taxpayers should not pay for companies’ poor business decisions."

Previously, OpenAI CFO Sarah Friar mentioned at a Wall Street Journal event that federal "guarantees" could lower AI infrastructure financing costs, but quickly retracted the statement due to controversy. This incident has once again raised questions about Altman’s transparency, reminiscent of his brief dismissal in November 2023 for "inconsistent candor."

[Singapore’s Largest Money Laundering Fugitive Su Binghai Has Assets Worth About 260 Million RMB Seized in the UK]

According to Bitpush and Caixin, Su Binghai, a fugitive in Singapore’s largest money laundering case, had assets worth about 260 million RMB seized in the UK, including nine apartments in London (about 140 million RMB) and dinosaur fossils (about 116 million RMB).

The case involves 3 billion Singapore dollars (about 16 billion RMB). Another suspect, Wang Shuiming, has been arrested in Montenegro, and partner Su Weiyi is alleged to be the mastermind behind the Hong Kong crypto platform Atom Asset Exchange scam.

[Coinbase Officially Hints at Launching Launchpad Platform]

According to Bitpush, Coinbase posted a video on X with the caption: "It doesn’t have to be this way."

Based on the video content and comments, it is suggested that the Launchpad platform may be launched on November 10.

[US Treasury Grants Tax Breaks to Private Equity, Crypto Companies Without Legislation]

According to Bitpush and as cited by Golden Ten Data from The New York Times, the US Treasury has provided tax breaks to private equity firms, crypto companies, foreign real estate investors, and other large companies through proposed regulations.

For example, in October this year, the IRS issued new proposed regulations to offer benefits to foreign investors in US real estate. In August, the IRS proposed relaxing rules to prevent multinational companies from avoiding taxes by claiming duplicate losses in multiple countries. These announcements have not yet made headlines but have been noted by accounting and consulting firms.

Kyle Pomerleau, senior fellow at the American Enterprise Institute, said: "The US Treasury has clearly been implementing tax cuts without legislation. Congress decides tax law. The Treasury is asserting more power over tax law structure than Congress has granted, undermining this constitutional principle."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

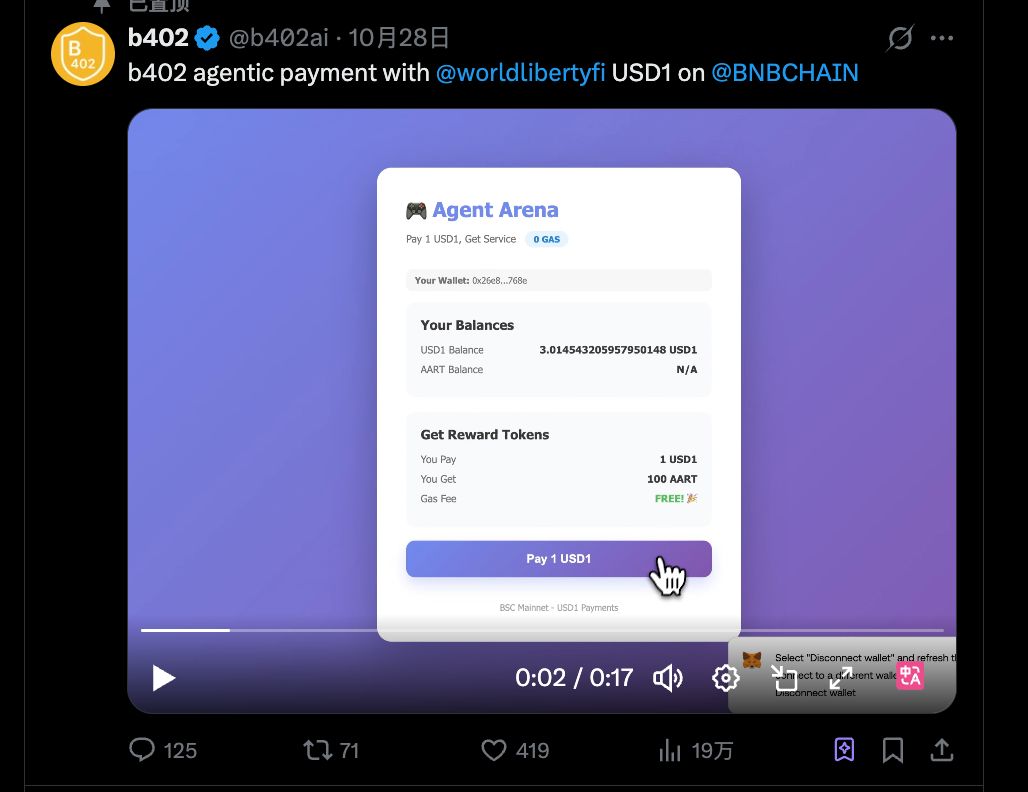

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?