Behind Polymarket’s $2 billion splurge: The New York Stock Exchange’s self-rescue campaign

The New York Stock Exchange's self-rescue movement essentially redefines the business model of traditional exchanges. With the IPO market shrinking, trading volumes declining, and data services experiencing sluggish growth, traditional exchanges can no longer rely solely on their conventional profit models to maintain competitiveness.

The self-rescue movement of the New York Stock Exchange essentially redefines the business model of traditional exchanges. From the loss of the IPO market to declining trading volumes and sluggish growth in data services, it is no longer possible to maintain competitiveness solely through the traditional exchange profit model.

Written by: Chloe, ChainCatcher

At the beginning of October, ICE announced an investment of up to $2 billion in Polymarket, sending shockwaves through the market. Almost simultaneously, Kalshi also announced a $300 million financing round at a $5 billion valuation. Overnight, the market landscape for prediction platforms was elevated to mainstream finance. Why did ICE need to make this move, turning a long-grey-area platform into a legitimate prediction tool? Are the old Wall Street exchanges facing an urgent need to transform their businesses?

The Dilemma of the New York Stock Exchange: Market Share Eroded, Data Business Declining

Looking at the current competitive landscape among U.S. exchanges, according to the "US Equity Market Structure Compendium 2024" report, the U.S. stock trading market is highly fragmented and dispersed. The NYSE under ICE holds about 19.7% of the trading volume market share, while NASDAQ holds 15.6%. In terms of market capitalization, NASDAQ has already surpassed the NYSE. From June to September this year alone, NASDAQ’s market cap exceeded NYSE’s for four consecutive months, reflecting investors’ preference for technology companies.

On the other hand, in terms of IPOs, NASDAQ far outpaces the NYSE with 79 traditional IPOs compared to NYSE’s 15, controlling the gateway for emerging companies to go public. Tech startups and growth companies are flocking to NASDAQ, not only weakening NYSE’s listing fee income, but more importantly, depriving NYSE of future drivers for market cap and trading volume growth.

Looking at the long term, from 2000 to 2016, the combined market share of NYSE and NASDAQ plummeted from about 95% to below 30%. Behind this is a fundamental shift in the U.S. stock market: trading is no longer concentrated in mainstream exchanges but has dispersed to small exchanges, alternative trading systems (ATS), and numerous dark pools and over-the-counter venues.

According to NASDAQ’s analysis, the current U.S. stock market has split into three independent markets: traditional exchanges (about 35-40%), dark pools and non-public trading (about 25-30%), and retail and OTC trading (about 30-40%). This fragmentation has led to broken liquidity.

Even if the NYSE tries to maintain its leading position, it faces fierce competition from all directions, not only competing with NASDAQ but also with emerging exchanges like Cboe, dozens of ATS platforms, and the vast dark pool ecosystem.

In addition, the previously high-profit data services business segment is also declining. According to ICE’s full-year 2024 financial report released in February, exchange data and connectivity services revenue in the fourth quarter was $230 million, down 2% year-on-year. This indicates that traditional market data businesses (such as market data and subscription services) have hit a growth bottleneck, and market demand for traditional financial data is becoming saturated. However, ICE believes that while traditional market data sales are cooling, there is still a market for customized, high-value indices and analytical tools.

In the face of these challenges, ICE has begun to adjust the NYSE business segment in recent years. In October last year, the SEC approved NYSE’s proposal for spot bitcoin ETF options, marking a move to capture the derivatives market. Derivatives trading typically generates higher fees than spot trading, and CME has long monopolized the futures market. By launching ETF options, NYSE is trying to carve out a share of the derivatives market.

Additionally, to strengthen NYSE’s role as a data and index provider, in July this year, ICE not only launched the Elite Tech 100 Index, but more importantly, made the investment in Polymarket, planning to package Polymarket’s real-time probability data into financial products for institutional clients.

Prediction Platform Data Is an Important Ingredient for Financial Products

ICE understands better than anyone: the forward-looking data provided by prediction markets is exactly what traditional financial data cannot offer.

Setting aside the innate gambler’s mentality of humans, the underlying logic of prediction markets is based on the “Wisdom of Crowds”—when there are enough diverse participants, collective predictions are often more accurate than those of individual experts. Because participants are putting real money on the line, this constraint makes them assess information more carefully, making it impossible to be mere bystanders.

According to a 2024 study by Charles University, prediction markets—platforms that allow participants to bet on future events—demonstrate precise forecasting abilities in various fields, including finance, economics, politics, and public policy.

You might think that the combined forecasting power of ten experts in a particular field could cover a wide range of the market, but when thousands of people put their own money on the line to bet on an uncertain event, each brings their own knowledge and information to bear. By aggregating all available information, prediction markets can provide more accurate forecasts than any single expert in a given field.

What ICE values is precisely this predictive ability and the accumulated data behind it, which is an important ingredient for financial products.

The NYSE’s Self-Rescue Movement Redefines Traditional Exchange Business Segments

Of course, not all prediction markets can achieve the same results. According to the “Sports Forecasting” study, the data quality of prediction markets depends on “market liquidity,” which is defined by platform trading volume and the number of participants, and is positively correlated with prediction accuracy. In other words, prediction markets with higher liquidity tend to produce faster and more accurate results.

During the 2024 U.S. presidential election alone, Polymarket processed over $3.3 billion in transactions within just 15 months of launch, reaching a peak trading volume of $2.5 billion in November. The platform, initially known for political predictions, has now expanded to sports, macroeconomic indicators, and cultural events, covering everything from Federal Reserve interest rate decisions to TV series finales.

When such large trading volumes and liquidity are observed, these prediction platforms—once viewed as illegal online gambling—have quickly become the infrastructure craved by financial markets. Now, ICE plans to integrate Polymarket’s data into its internal trading systems. This integration is akin to when the financial sector first adopted Bloomberg Terminal services, which provide financial professionals with real-time market data.

In essence, ICE is also seeking to fill a gap in the financial market. According to Kalshi’s 2025 statistics, when predicting inflation data, the consensus accuracy rate among Bloomberg economists is only 20%, while prediction markets reach 85%, a difference of 65 percentage points. Economists underestimated inflation for eight consecutive months, while prediction markets, leveraging participants from diverse backgrounds, accurately captured market realities.

If the two sides cooperate, their data and traditional analysis will form a complementary rather than a substitutive relationship.

The self-rescue movement of the NYSE essentially redefines the business model of traditional exchanges. From the loss of the IPO market to declining trading volumes and sluggish growth in data services, it is no longer possible to maintain competitiveness solely through the traditional exchange profit model.

It is imaginable that when ICE packages and sells this data to hedge funds, investment banks, and central banks, what they are selling is not history, but the right to price the future. In an increasingly unpredictable world, this may be the most valuable commodity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

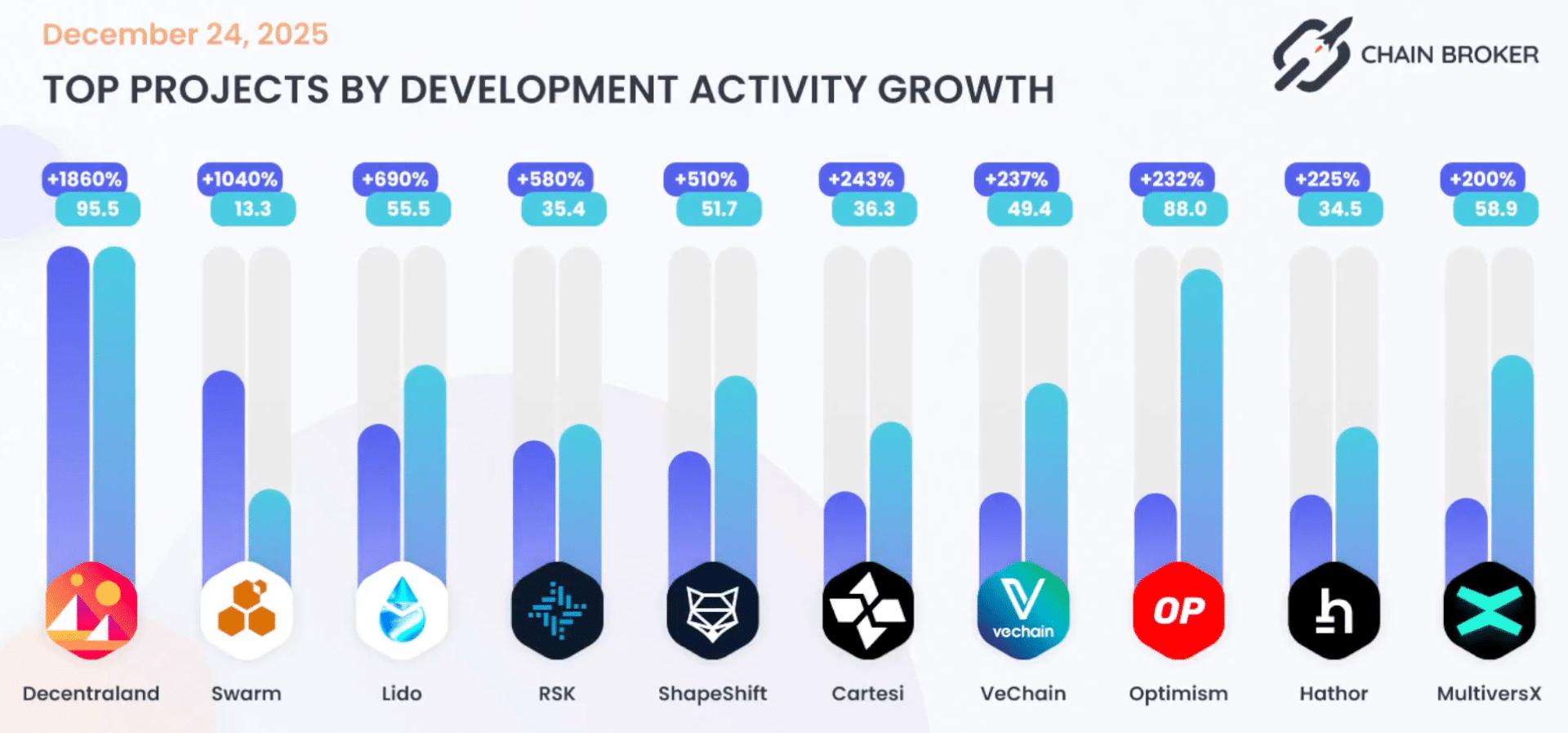

How Lido’s 690% dev growth is reshaping LDO price action

Vitalik Buterin Praises Grok’s Role in Challenging Misinformation on X

Diverging from Wall Street: Bitcoin "Decouples" in the Bull Market

Trust Wallet Browser Extension Compromised, $7 Million Lost