The "mini nonfarm payrolls" rebound beyond expectations, is the US job market recovering?

US ADP employment in October saw the largest increase since July, with previous figures also revised upward. However, experts caution that the absence of nonfarm payroll data means this figure should be interpreted cautiously.

Data released by ADP on Wednesday showed that private sector wage growth in October was slightly stronger than expected, offering a glimmer of hope that the labor market is not in danger of collapsing.

US ADP employment increased by 42,000 in October, the largest increase since July 2025, and higher than the expected 28,000. In addition, total employment for September was revised to a decrease of 29,000, previously reported as a decrease of 32,000.

After the release of the US ADP report, spot gold fell slightly by $4 in the short term, then quickly rebounded. The US dollar index rose slightly by 7 points in the short term.

Key employment changes and wage growth rates by industry in the ADP report are as follows:

In October, construction employment increased by 5,000, compared to a decrease of 5,000 in September; the median annual wage growth rate for employees was 4.5%, the same as in September.

In October, manufacturing employment decreased by 3,000, compared to a decrease of 2,000 in September; the median annual wage growth rate for employees was 4.8%, up from 4.7% in September.

In October, trade/transportation/utilities employment increased by 47,000, compared to a decrease of 7,000 in September; the median annual wage growth rate for employees was 4.3%, the same as in September.

In October, financial services employment increased by 11,000, compared to a decrease of 9,000 in September; the median annual wage growth rate for employees was 5.2%, the same as in September.

In October, professional/business services employment decreased by 15,000, compared to a decrease of 13,000 in September; the median annual wage growth rate for employees was 4.2%, the same as in September.

ADP, the US automatic data processing company, stated that last month, US employment rebounded from two months of weakness, but the rebound was not broad-based. Education and healthcare, trade, transportation, and utilities led the growth. In professional and business services, information, leisure, and hospitality, employers cut jobs for the third consecutive month.

ADP Chief Economist Nela Richardson said that for the first time since last July, private employers added jobs in October, but the number of hires was not large compared to reports earlier this year. Meanwhile, wage growth has remained basically flat for more than a year, indicating that supply and demand changes are balanced.

As one of the key indicators of the US job market, the ADP employment data, known as the "mini nonfarm payrolls," is now receiving more attention due to the US government's unprecedented and ongoing shutdown. The US Secretary of Labor reiterated on Tuesday night that "no economic data will be released until the government shutdown ends." The release date for this week's nonfarm payrolls data is also pending.

If the nonfarm payrolls report is released, Wall Street expects the report to show a decrease of 60,000 jobs and the unemployment rate to rise to 4.5%.

Economists urge caution when interpreting the ADP report, noting methodological differences and other limitations. The ADP employment report is jointly compiled by the Stanford Digital Economy Lab. Historically, the monthly estimates have differed from the government employment statistics released by the US Bureau of Labor Statistics (BLS).

Matthew Martin, Senior US Economist at Oxford Economics, said: "ADP data is limited to private companies that rely on ADP to manage payrolls, so the national representativeness of ADP data is poor. ADP employment data should be seen as a supplement to, not a substitute for, the BLS establishment survey."

Federal Reserve officials have expressed concerns about the state of the labor market and are beginning to see the risk of labor market weakness as greater than the risk of rising inflation. At last week's policy meeting, the Fed cut rates by another 25 basis points. However, the prospect of a rate cut in December remains uncertain.

Although data from the US Department of Labor's Bureau of Labor Statistics has stopped updating, officials will look at other data this week.

Challenger, Gray & Christmas will release its monthly layoff report on Thursday. Meanwhile, economists will closely monitor the number of unemployment claims in each state to determine whether companies are downsizing. The University of Michigan will also release its monthly consumer confidence index on Friday, which reflects consumers' views on the overall economic situation. The latest data from job site Indeed shows that the number of job postings has dropped to its lowest level since February 2021.

Institutional analysis points out that recent high-profile layoff announcements by large companies such as Amazon, Starbucks, and Target have heightened market concerns about the employment outlook. Although unemployment claims remain low overall, the current low layoff rate labor environment may evolve into more layoffs in the coming months, pushing the unemployment rate higher.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

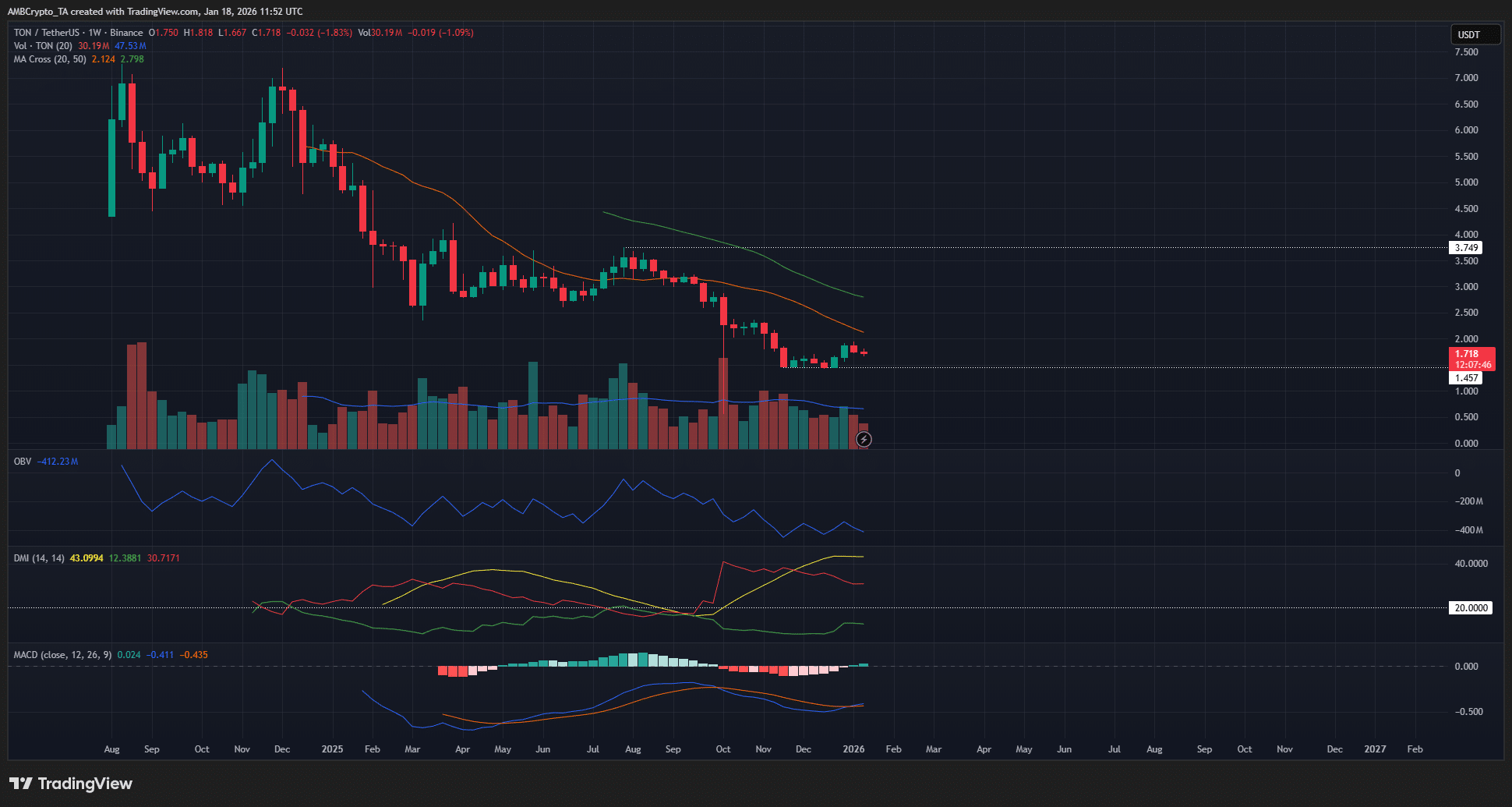

Toncoin: How profit-taking pressure can cap TON’s rally

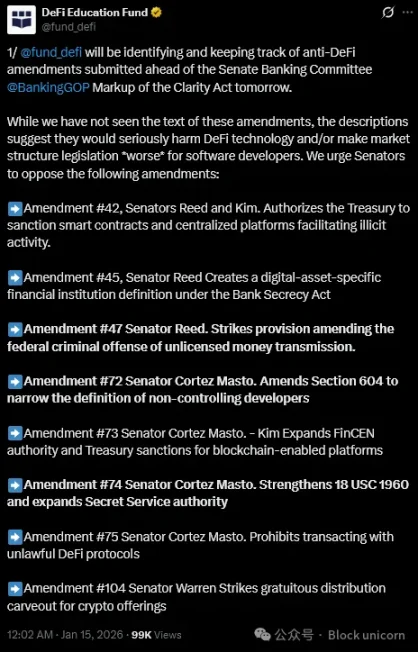

The Paradox of the CLARITY Act

Gold and Silver Reach New Peaks Amid Greenland Tariff Concerns