Why Bitcoin Treasuries Matter: Key Takeaways from Bitwise CEO Hunter Horsley

Bitwise CEO Hunter Horsley says Bitcoin Treasury Companies and Digital Asset Trusts (DATs) are “very good for crypto,” helping institutionalize the market through investor relations, yield strategies, and long-term holdings.

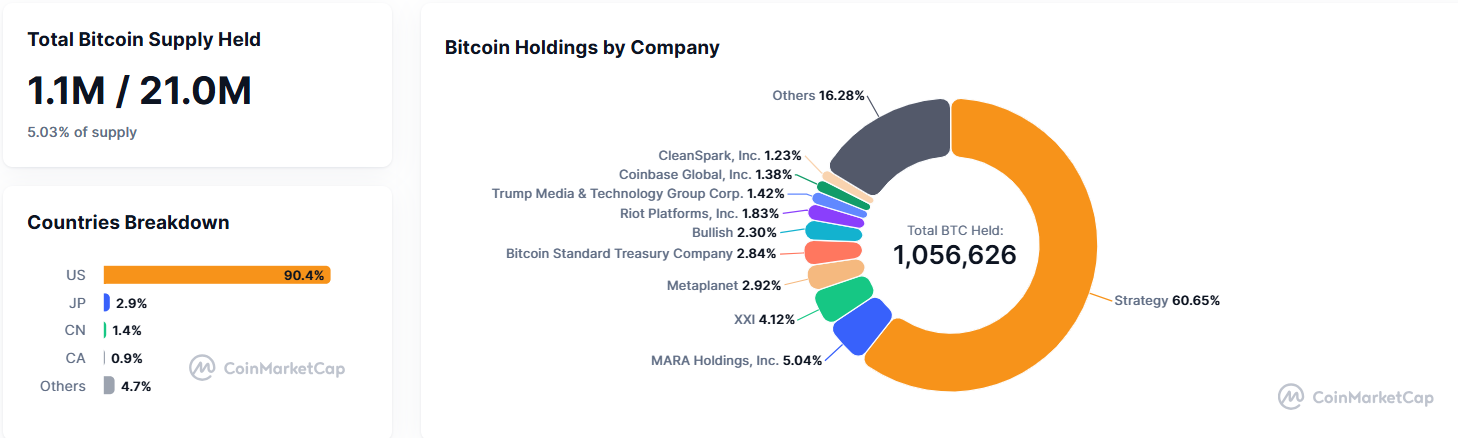

Public companies hold over 1 million BTC, with 90.4% of those holdings concentrated in the US. This surge in corporate Bitcoin treasuries comes as industry leaders suggest these entities could bring long-term discipline to a sector known for volatility.

The increasing corporate adoption of Bitcoin has reignited debate. Investors are questioning whether Bitcoin can compete with traditional US Treasuries in global capital markets.

Bitcoin Treasury Companies Emerge as Stabilizing Force

Hunter Horsley, CEO of Bitwise, regards Bitcoin Treasury Companies and Digital Asset Trusts (DATs) as potential stabilizers for the crypto industry.

He notes that these entities provide investor relations, yield strategies, and long-term balance sheet discipline. This changing approach marks a shift from the speculative behavior that once defined crypto markets.

Bitcoin Treasury Companies and DATs are very good for crypto imo. Rooting for them.– They do investor relations for ecosystems– They can implement active strategies to generate yield– They provide exposure to equity, convert, preferred investors– They buy & hold, long term…

— Hunter Horsley (@HHorsley) November 2, 2025

The rise of corporate Bitcoin holdings indicates broader institutional interest in digital assets. Companies, including Strategy and Tesla, have allocated parts of their treasuries to Bitcoin, seeking long-term value.

However, the fact that 90.4% of these holdings are in the US highlights America’s leading position in institutional crypto adoption.

Public Companies Bitcoin Treasuries. Source:

Public Companies Bitcoin Treasuries. Source:

This transparency comes as corporate crypto strategies face increased scrutiny. The dashboard confirms that public company holdings now total 1.1 million BTC, over 5% of the total Bitcoin supply.

Meanwhile, on-chain data shows a declining over-the-counter (OTC) Bitcoin supply, indicating that institutional demand may be outpacing available inventory.

A Glassnode chart shows OTC desk balances dropping from near 4,500 BTC to under 1,000 BTC in a year. Meanwhile, prices have moved between $70,000 and $100,000.

With OTC desk supply in this downtrend and LTH sales slowing down, we're gonna see a ton of charts from anonymous influencers screaming about a Bitcoin crash. A bunch of 'em are tied to treasuries, act as MMs, and just want your Bitcoins cheap. Your Bitcoin is the target.That… pic.twitter.com/X2tcO4E8Uk

— J. P. Mayall (@jpmayall) November 2, 2025

This limited supply could explain the renewed institutional accumulation despite market fluctuations.

Macroeconomic Headwinds and the Treasury Yield Challenge

The competitive environment for Bitcoin has become more difficult as US 10-year Treasury yields have reached 4.1%, a three-week high as of early November 2025.

Analyst Axel Adler Jr. noted that this increase reflects uncertainty about Federal Reserve rate cuts. The uncertainty creates a challenging backdrop for risk assets like Bitcoin.

The rise in the U.S. 10-year Treasury yield to 4.1% (three week high) signals market skepticism about Fed cuts, creating a restrictive backdrop for risk assets. pic.twitter.com/MqfOkxHXGl

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) November 3, 2025

Higher Treasury yields can make government bonds more attractive than non-yielding assets, drawing potential capital away from cryptocurrency.

Official US Treasury data support this trend. The 10-Year Treasury Note issued in October 2025 had a coupon rate of 4.250%, and Ginnie Mae’s July 2025 Global Markets Analysis Report recorded the 10-year yield at 4.38%.

Such yields challenge Bitcoin’s positioning as a store of value or alternative to traditional fixed-income investments.

Despite these pressures, some analysts remain optimistic. Mayall pointed out that anonymous influencers linked to treasuries and market makers might be spreading negative sentiment to acquire Bitcoin at lower prices.

He also noted that long-term holder sales are slowing while OTC supply is declining, which could increase upward price pressure if demand remains strong.

“With OTC desk supply in this downtrend and LTH sales slowing down, we’re gonna see a ton of charts from anonymous influencers screaming about a Bitcoin crash. A bunch of ’em are tied to treasuries, act as MMs, and just want your Bitcoins cheap,” read an excerpt in his post.

The Real Flippening: Bitcoin Versus Treasuries

Jack Mallers, a Twenty One Capital executive, has shifted the spotlight regarding Bitcoin’s competition. As sources describe, he believes the real “flippening” is Bitcoin challenging US Treasuries in global finance, not simply surpassing other cryptocurrencies.

“We’re living through the real flippening. Not shitcoins over Bitcoin. Neutral money over Treasuries. The monetary competition has begun: which money best stores our time, energy, and labor? The fastest horse is Bitcoin, and for the first time, everyone can race it,” wrote Mallers in a recent post.

This viewpoint moves the discussion from crypto rivalries to Bitcoin’s possible significance in broader capital markets.

Mallers’ perspective follows a narrative in which Bitcoin Treasury Companies serve purposes beyond speculation. By adding Bitcoin to corporate balance sheets through structured yield strategies and investor relations, these firms are positioning it as a legitimate treasury reserve.

This development could appeal to institutions seeking inflation protection or diversification beyond government bonds.

Nonetheless, the comparison remains debated. US Treasuries offer government support, stable yields, and strong liquidity, whereas Bitcoin lacks yield, faces regulatory uncertainties, and exhibits significant price fluctuations.

In the coming months, Bitcoin Treasury Companies will be tested on their ability to sustain these strategies amid rising bond yields and a challenging macroeconomic backdrop.

As public company Bitcoin holdings grow, the industry faces a decisive moment. Whether these treasuries stabilize crypto markets or add volatility will depend on their ability to balance on-chain trends and competition from traditional assets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dive into Altcoin Strategies that Shape the Market

In Brief Arthur Hayes shares insights on the genuine emergence of an altcoin season. Investors now focus on income-generating and share-distributing projects. This shift reflects the evolving maturity of the crypto market.

Ripple and Mastercard Propel XRP to New Heights

In Brief XRP's price surged by 4.9%, reaching $2.35, driven by institutional trading. The XRP Ledger pilot by Ripple and Mastercard boosts XRP's market demand. Dogecoin maintains its trend with institutional support around $0.1620-$0.1670.

Cryptocurrency Analyst Highlights Recovery Hints in Key Altcoins

In Brief Analyst Ali Martinez identifies potential recovery signs in key altcoins. Martinez highlights critical support re-tests in SEI, PEPE, VET, ALGO, and AVAX. Technical indicators suggest possible trend shifts in these altcoins.

A Massive Scam Organized by Pyongyang Hits GitHub, Upwork, and Freelancer