Balancer Hack Drains Over $110M from DeFi Pools, Here's What Happened

Balancer ( $BAL ) suffered a massive exploit draining over $110 million from its liquidity pools. The attack, initially estimated at $70–88 million, was later confirmed to be far more severe.

Balancer’s official account acknowledged the exploit hours after reports surfaced, confirming that their v2 pools were affected and that internal teams were investigating with “high priority.” The announcement came only after widespread panic and a sharp selloff in both DeFi tokens and Bitcoin, which fell below $108,000.

Balancer Hack: What Happened

According to early data from CoinDesk , the exploit targeted multiple liquidity pools — including WETH, osETH, and wstETH — draining an estimated $70M to $88M within hours.

Shortly after, on-chain analysts such as Lookonchain reported that the stolen amount had surged past $116 million, suggesting the attacker continued siphoning funds even as Balancer began mitigation efforts.

The project has not disclosed the precise vulnerability yet but stated:

“We’re aware of a potential exploit impacting Balancer v2 pools. Our engineering and security teams are investigating with high priority.”

Market Reaction: DeFi Fear and Bitcoin Selloff

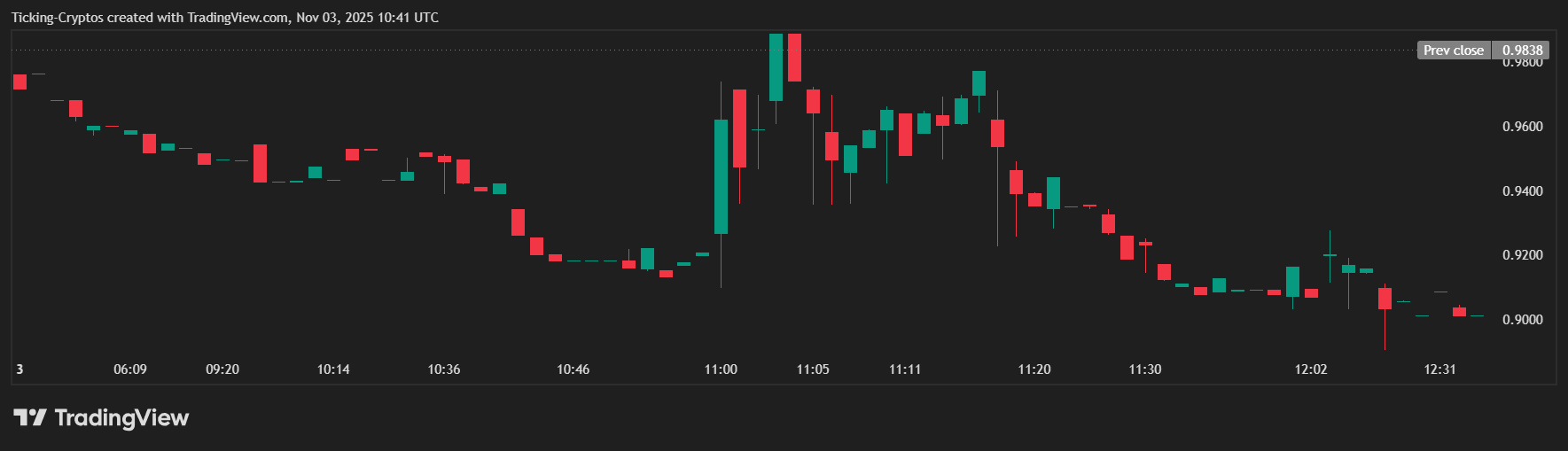

The exploit’s impact was immediate. The Balancer ($BAL) token dropped over 10% intraday, trading near $0.90 — a steep fall from its previous close around $0.98.

The broader crypto market also felt the shockwave. Reports indicate that traders rushed to de-risk their DeFi exposure, leading to additional sell pressure on $Ethereum, $Solana, and $BNB.

At the same time, Bitcoin ($BTC) defended the $107K support level amid heavy volatility. Analysts noted that Bitcoin’s resilience might be linked to traders exiting altcoins and rotating into BTC as a temporary safe haven.

BAL Token Price Analysis

According to the attached chart, BAL/USD shows a sharp downward candle pattern consistent with panic selling.

- Current BAL Price: $0.90

- 24h Change: -10.6%

- Previous Close: $0.9838

- Support Zone: $0.88 – $0.90

- Resistance Zone: $0.95 – $1.00

If panic continues, BAL could test the $0.80 level, though a stabilization near $0.90 might signal a short-term bottom, especially if Balancer issues a detailed recovery plan.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Prediction markets meet Tinder: Can you place bets on Warden's new product by simply swiping left or right?

No need for chart analysis, macro research, or even inputting the amount of funds.

Why does bitcoin only rise when the U.S. government reopens?

The US government shutdown has entered its 36th day, leading to a decline in global financial markets. The shutdown has prevented funds from being released from the Treasury General Account (TGA), draining market liquidity and triggering a liquidity crisis. Interbank lending rates have soared, while default rates on commercial real estate and auto loans have risen, increasing systemic risk. The market is divided over future trends: pessimists believe the liquidity shock will persist, while optimists expect a liquidity release after the shutdown ends. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model is updated.

Jensen Huang predicts: China will surpass the United States in the AI race

Nvidia CEO Jensen Huang stated bluntly that, thanks to advantages in electricity prices and regulation, China will win the AI race. He added that overly cautious and conservative regulation in Western countries such as the UK and the US will "hold them back."

OpenAI CFO: AI doesn’t need to cool down, the enthusiasm is far from enough!

As Wall Street grows increasingly concerned about an AI bubble burst, OpenAI's CFO is instead calling for "more enthusiasm." She also stated that going public is currently not in the company's plans.