4E: The "post-halving drop" pattern for Bitcoin may no longer hold; a certain exchange plans to expand crypto regulation

On November 3, according to observations from a certain exchange, the traditional volatility pattern of bitcoin after halving may be failing. Data shows that bitcoin's current volatility is below 2%, hitting a historic low, while during the third halving in 2020, volatility once exceeded 5%. Keiji Maeda, an executive at Japanese crypto company BACKSEAT, pointed out that as market liquidity increases and institutional participation rises, the impact of short-term retail investor behavior on prices has diminished, and the so-called "post-halving correction" rule of thumb may no longer apply. On the EU side, the European Commission is planning to expand central regulation of stock and crypto asset exchanges. The new proposal will grant the European Securities and Markets Authority greater powers, covering "the most important cross-border entities," to promote the construction of a "Capital Markets Union" and reduce regulatory fragmentation. The relevant proposal is expected to be officially put forward in December. On the other hand, Strategy Chairman Michael Saylor stated that the company currently has no plans to acquire other companies holding bitcoin reserves, noting that such mergers and acquisitions usually involve high uncertainty and lengthy processes. In terms of investment institutions, the latest top 15 holdings of Cathie Wood's ARKK ETF show that a certain exchange (5.8%) and Circle (2.55%) are among the top crypto-related companies, indicating its continued bet on the new round of technology and digital asset cycles. 4E Comment: Bitcoin entering a historical low volatility range may indicate that the market structure has shifted from speculation-driven to a steady-state of capital. If EU regulatory integration and institutional allocation trends advance in tandem, crypto assets may gradually enter a "low-volatility, steady bull" phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

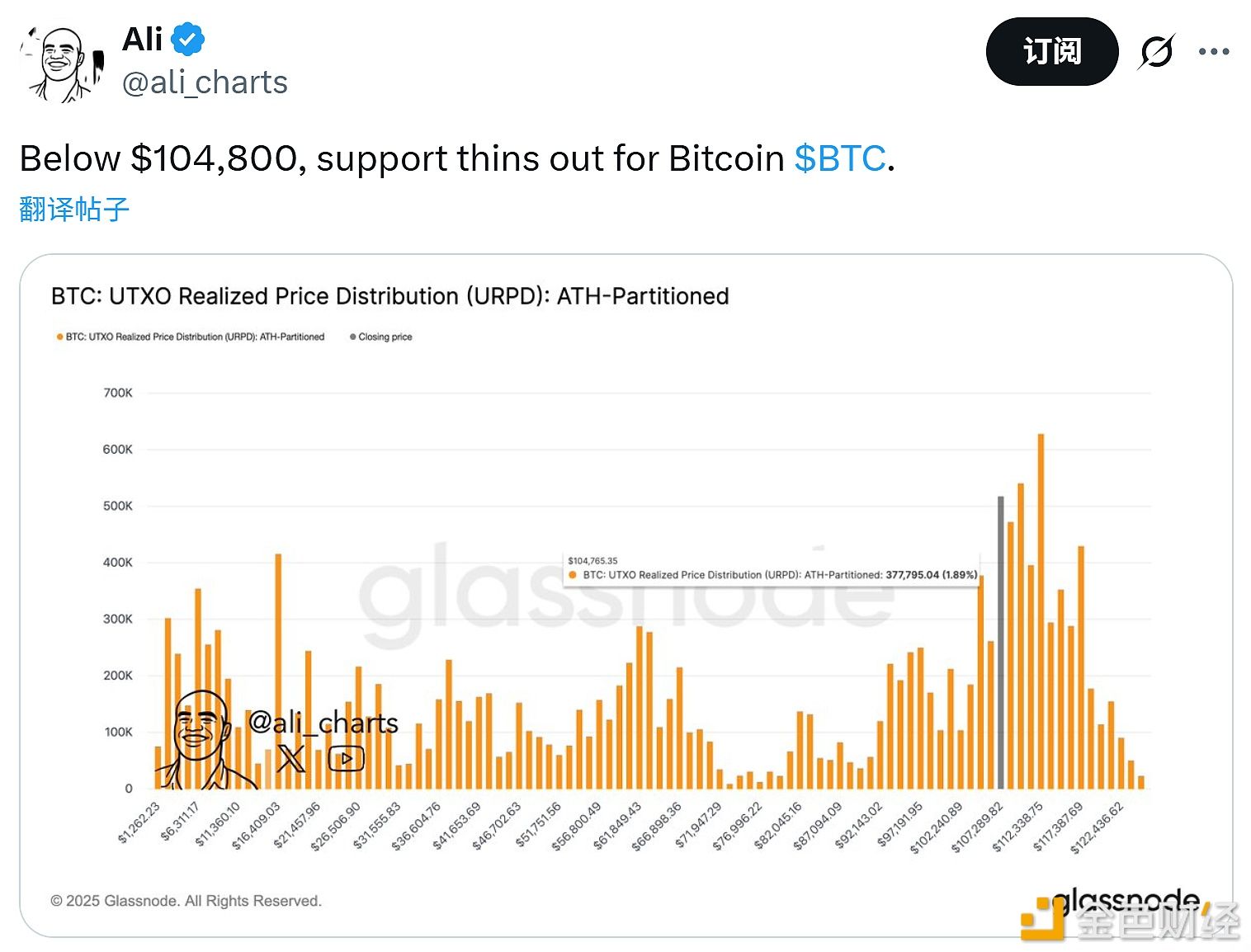

Opinion: Bitcoin Lacks Buying Support Below $104,800

Data: An entity has almost fully repaid the borrowed 66,000 ETH, earning a profit of $26.9 million.