SOL Outflows Drop 83%, But One Factor Keeps Solana Price in Check

Solana price remains weak even after long-term holders slowed their selling by 83%. Despite a $132 million inflow into the new Bitwise Solana ETF, big money still isn’t entering the spot market. Until Chaikin Money Flow flips positive, any bounce in SOL is likely to stay short-lived.

Solana (SOL) entered November still struggling to find a clear direction. The token is down 4% over the past seven days and nearly 19% this month, despite a brief bounce attempt amid Halloween. Solana price now trades near $186, trapped in a range between $178 and $209.

While outflows from holders have slowed, one group of traders might be keeping the SOL price in check.

Big Money Still Missing From the Move

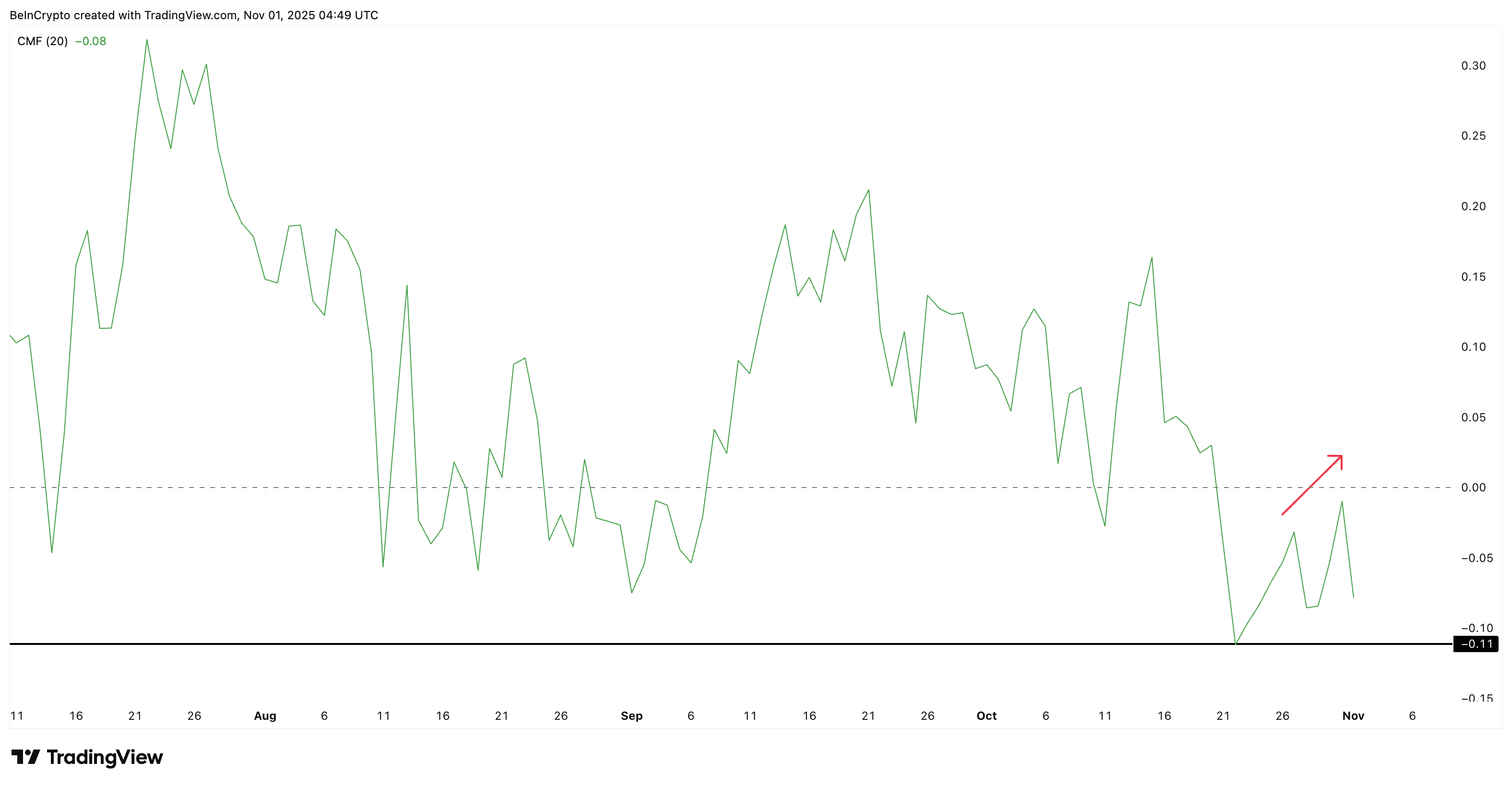

The Chaikin Money Flow (CMF), which tracks whether large investors are adding or exiting positions, has failed to cross back above zero.

Between October 27 and October 31, CMF made a short-lived attempt to turn positive but then turned lower again, showing that large traders continue to move money out of Solana rather than into it.

Until CMF climbs decisively above zero, inflows from big players remain missing, keeping Solana’s upside capped.

Big Money Isn’t Convinced:

Big Money Isn’t Convinced:

The newly launched Bitwise Solana Staking ETF (BSOL) drew $132 million in inflows this week, but since most of its exposure is possibly created in-kind (from existing SOL reserves) and managed through staking, those flows haven’t yet translated into real spot market demand.

This could explain why Solana’s Chaikin Money Flow (CMF) remains below zero

JUST IN: 🇺🇸 $BTC and $ETH ETFs saw $1.4B in combined net outflows in past three days, while $SOL ETFs recorded a $132M net inflow.

— BeInCrypto (@beincrypto) November 1, 2025

Despite the ETF launch and broader media buzz, Solana’s price is still down about 4% this week, proving that passive inflows alone haven’t helped the token recover.

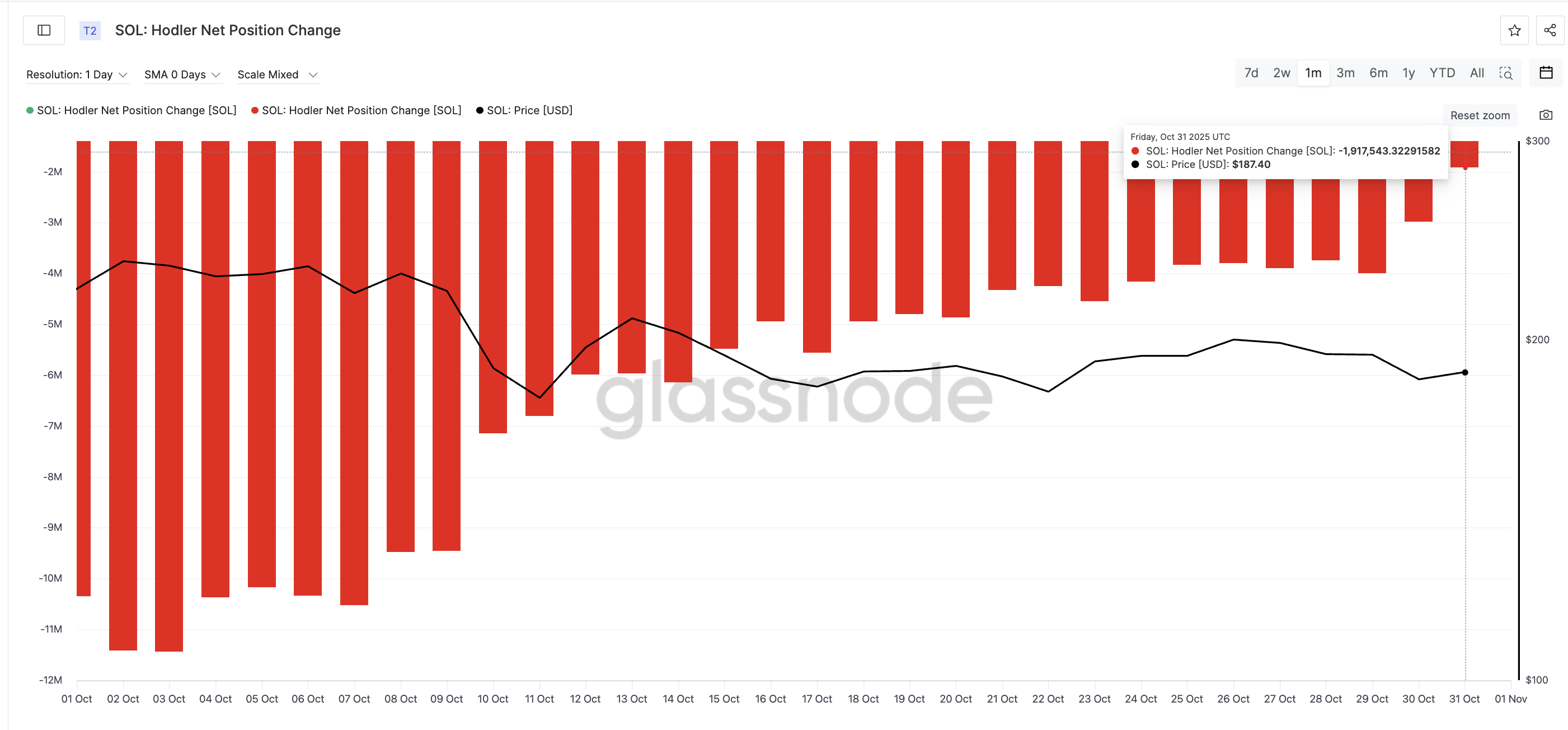

Interestingly, Solana’s Holder Net Position Change — which measures whether long-term wallets are accumulating or selling — shows a different tone.

On October 3, net outflows peaked near –11.43 million SOL, one of the steepest levels this month. By October 31, that figure had improved to –1.91 million SOL, an 83% reduction in net outflows.

SOL Holders Are Selling Fewer Tokens:

SOL Holders Are Selling Fewer Tokens:

This means while holders are still selling, they’re doing it at a much slower pace — a small but positive shift for Solana’s long-term structure.

Solana Price Chart Setup Still Leans Bearish

Despite the slowdown in holder selling, the Solana price chart setup remains fragile. The daily chart shows SOL trading within a broadening rising wedge pattern, which typically signals exhaustion and a possible breakdown.

The lower trendline — tested more than five times since August — has been under heavy pressure since mid-October.

Between October 13 and October 26, Solana’s price made a lower high, while the Relative Strength Index (RSI) — which measures buying momentum — made a higher high.

This forms a hidden bearish divergence, a pattern that typically suggests the larger Solana price downtrend could continue.

Solana Price Analysis:

Solana Price Analysis:

To regain strength, Solana must first reclaim $198, then close above $209. That would open a path toward $237. However, if $178 fails (a mere 4.53% dip), a slide to $155 is likely — a drop of around 14%. That would provide more strength to the bearish hypothesis.

To invalidate weakness, the CMF needs to move above zero, and the investors should circle back to net buying. That kind of spot money flow could help the SOL price cross at least $198 in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[100% Win Rate Whale] Adds Another 140 BTC, Becomes [Heavy Holder Whale]!

![[100% Win Rate Whale] Adds Another 140 BTC, Becomes [Heavy Holder Whale]!](https://img.bgstatic.com/multiLang/image/social/4a63a919063f3087e47ea7968a76880e1762143848305.png)

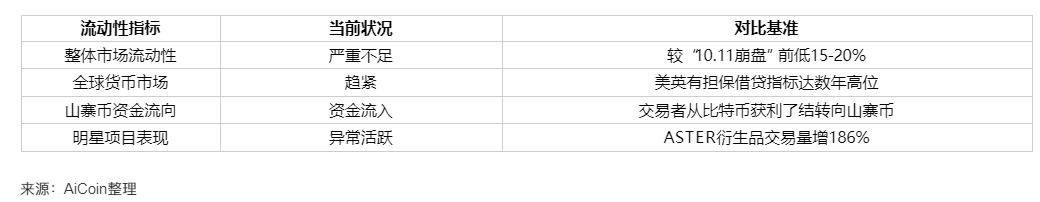

AiCoin Daily Report (November 3)

CZ openly builds a $2 million position and calls for ASTER, reigniting the battle in the decentralized derivatives arena

CZ has publicly disclosed his personal investment activities for the first time, purchasing 2.09 million Aster (ASTER) tokens, which drove the price up by 30%. As a decentralized perpetual contract exchange, Aster has quickly risen thanks to its technological advantages and CZ’s support, leading to fierce competition with Hyperliquid. Summary generated by Mars AI. This summary is produced by the Mars AI model; the accuracy and completeness of its generated content are still being iteratively improved.