Reason Behind Today’s Notable Altcoin Surge Is Now Clear: Developers Will Only Get Paid If the Price Increases Fivefold

Everythingempty, one of the co-founders of the Virtuals (VIRTUAL) team, published an early-stage proposal on the X platform, bringing forward the allocation of performance-based ecosystem funding to Virgen Labs.

This proposal, approved in July, includes a rewards plan based on price targets.

According to the proposal, if the VIRTUAL token price reaches $10, $20, and $40, respectively, it will trigger a token allocation equivalent to 2% of the total supply to the Virgen Labs team. If all targets are met, the team will earn a total reward of 6% (60 million VIRTUAL tokens).

Each phase will be verified using 30-day time-weighted average price (TWAP) data from the Binance spot market and a daily trading volume exceeding $10 million. Once the target is reached, the tokens will be gradually unlocked via smart contracts at a weekly rate of 0.013% over 36 months.

The proposal states that no new tokens will be minted. However, if all targets are met, the share of the DAO treasury will decrease from 34% to 28%. This will only apply if the VIRTUAL price reaches $40.

According to Coingecko data, the current price of VIRTUAL is at $1.83 and the token has gained 33.9% in the last 24 hours.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

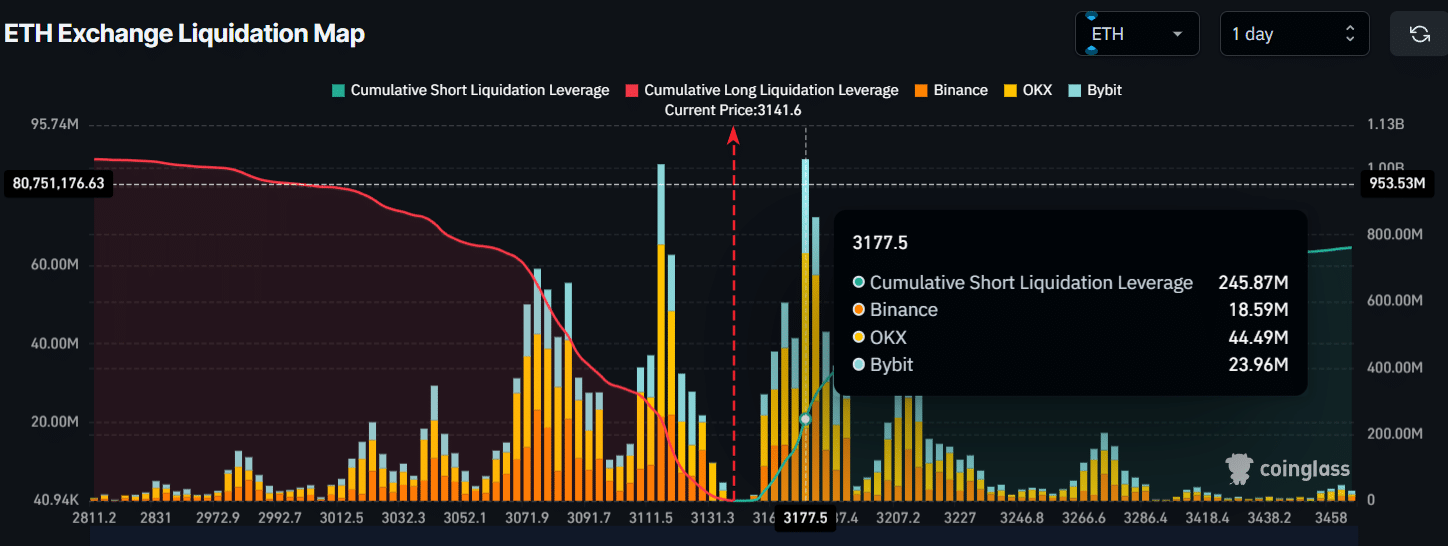

Ethereum is climbing, whales are buying – What happens next?

PEPE Eyes Market Rally as Whale Exits ETH, Opens PEPE $12.85 Million Long Position With 3x Leverage

Ripple News: RLUSD Gains Regulatory Backing as Stablecoins Move Toward Bank Oversight

Pi Network News: Can Pi Price Recover If Bitcoin Turns Bullish?