Bitcoin At Key Retest: Bounce Or $98,000 Next?

On-chain data shows Bitcoin is currently retesting a historically significant level that has often decided the course of the cryptocurrency’s price.

Bitcoin Is Retesting The 0.85 Supply Quantile

In a new post on X, on-chain analytics firm Glassnode has talked about how Bitcoin is retesting a level that has historically been a “make-or-break” one for the asset.

The level in question is part of Glassnode’s “Supply Quantiles Cost Basis Model.” The model reflects price levels corresponding to important investor profitability thresholds.

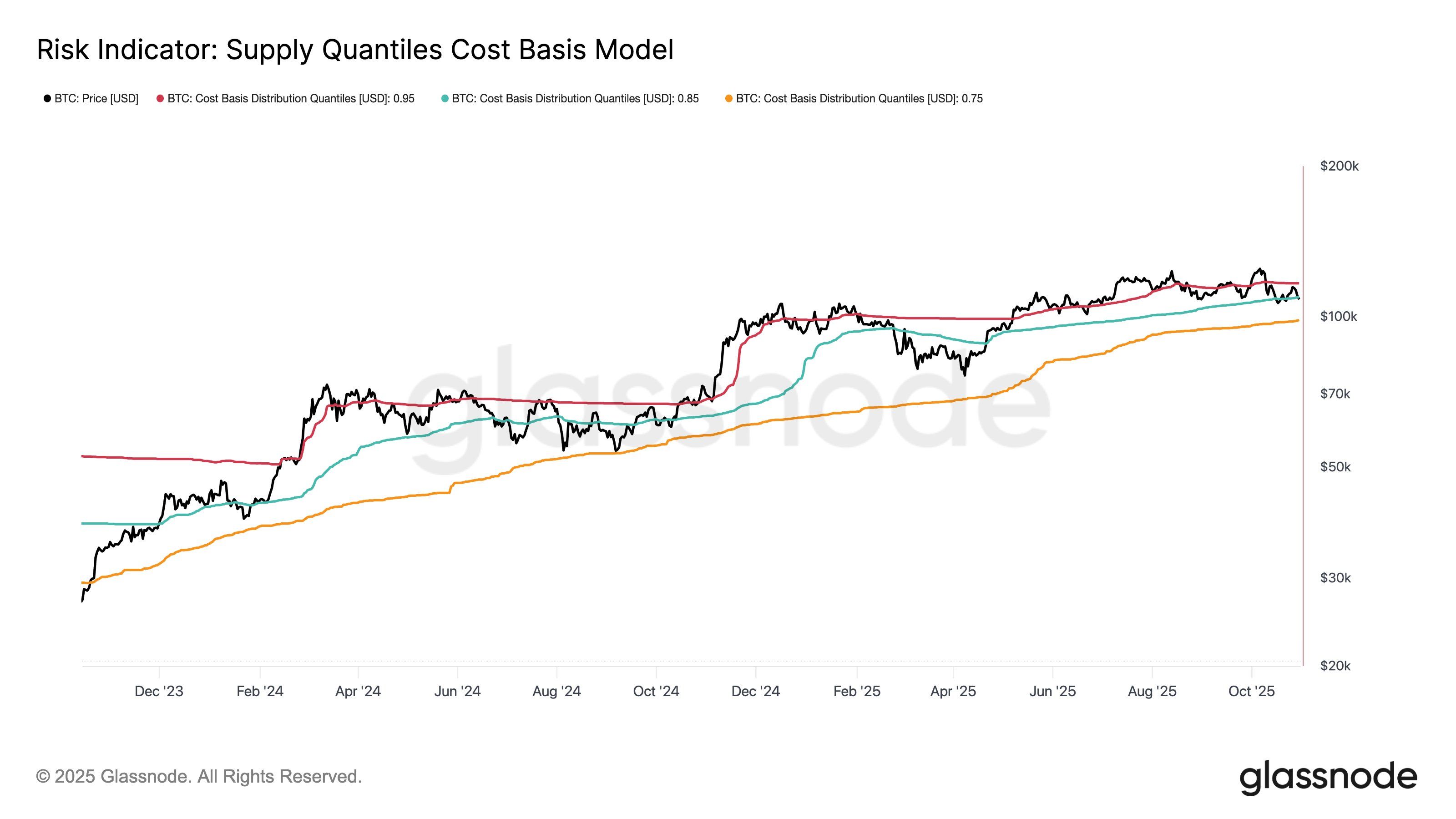

Below is the chart shared by the analytics firm that shows how the levels of this model have changed over the last few years.

Looks like BTC is currently trading around the middle band | Source: Glassnode on X

As is visible in the graph, Bitcoin surged above the 0.95 quantile during the recent rally to the all-time high (ATH). This level corresponds to 95% of the supply being in profit.

With the market downturn that has followed since, however, the cryptocurrency has slipped under the level. Recently, the asset has been making retests of the 0.85 quantile, situated at $109,000.

BTC has already seen brief drops below this mark, but so far, it has managed to climb back above it each time. At present, the coin is trading right around the level, indicating that about 85% of the supply is carrying a net unrealized gain.

In the past, Bitcoin’s interactions with this level have tended to carry consequences for its trajectory. “Holding it has sparked major rallies, but losing it often sees a slide toward the 0.75 band,” noted Glassnode.

The 0.75 quantile is equivalent to $98,000 at the moment. It now remains to be seen whether BTC can hold above the 0.85 quantile, or if a retrace to this level is coming.

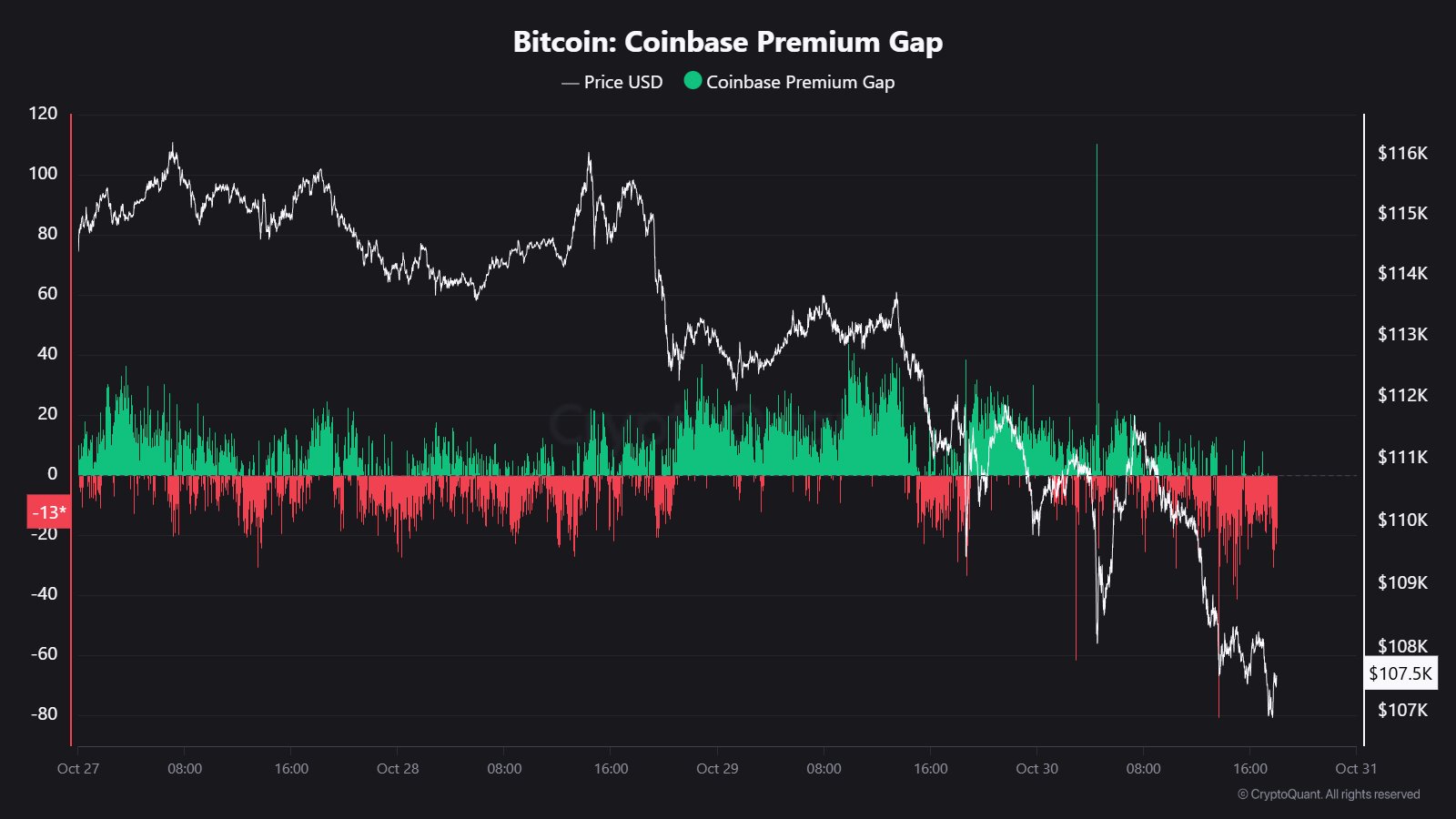

In some other news, the latest decline in Bitcoin below $107,000 came alongside negative values on the Coinbase Premium Gap, as pointed out by CryptoQuant community analyst Maartunn in an X post.

The Coinbase Premium Gap measures the difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair). The metric basically tells us about how the behavior of the users on the former exchange differ from that of the latter platform.

As the below chart shows, the metric was at positive levels on Wednesday, but the indicator turned red on Thursday.

The trend would imply that Coinbase traders, primarily made up of American institutional entities, sold the cryptocurrency at a higher intensity than Binance’s global whales during the Bitcoin drawdown.

BTC Price

Since the wave of selling on Coinbase, Bitcoin has witnessed some recovery back to the $109,500 level, reclaiming the 0.85 quantile once again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Hong Kong’s HKMA Launches Fintech 2030 to Drive Future Financial Innovation

Balancer DeFi Hack: $70.9M in Crypto Stolen

DeFi protocol Balancer suffers a major exploit with $70.9M in crypto drained. Team yet to respond.Funds Moved to New WalletWhat’s Next for Balancer and DeFi Security?

Dogecoin Price Prediction Targets November Surge, While BullZilla Steals the Spotlight Among Best Meme Coin Presales in 2025

BullZilla and Dogecoin battle for investor attention among the best meme coin presales in 2025 as BullZilla’s presale explodes and Dogecoin eyes a recovery from recent declines.Dogecoin Price Prediction: A Chance for a Strong ComebackBullZilla: Exploding Ahead in the Best Meme Coin Presales in 2025Conclusion

Bitcoin Dips as Whale Sales Trigger $414M in Liquidations

Crypto markets dip as whales sell $2B in BTC, leading to $414M in liquidations amid rising geopolitical risks.Liquidations Top $414M as Sentiment Turns FearfulMarket Cap Falls Amid Uncertainty