Marathon Digital Acquires Exaion from EDF: Market Shifts

Points Cover In This Article:

Toggle- Marathon Digital has purchased Exaion to venture into AI infrastructure.

- Exaion brings AI and HPC expertise.

- EDF restricted from AI sector for two years.

Marathon Digital’s acquisition of Exaion, a subsidiary of EDF, marks its shift from Bitcoin mining to AI/HPC infrastructure. This $168 million deal restricts EDF from AI/Bitcoin mining, potentially impacting BTC’s hash rate and AI-focused tokens.

Marathon Digital Holdings has acquired Exaion, previously a subsidiary of Électricité de France, in a strategic move to enter the AI infrastructure sector. This transaction was made public on October 31, 2025.

Marathon’s Strategic Shift

Marathon Digital Holdings acquired Exaion, a

subsidiary of EDF , aiming to shift focus toward AI and cloud solutions. With this acquisition, Marathon strengthens its infrastructure, aligning with industry trends away from traditional Bitcoin mining.

Exaion, specialized in AI and HPC, was brought under Marathon’s control for approximately $168 million.

Fred Thiel, CEO of Marathon, aims to integrate Exaion’s technology to enhance Marathon’s global capabilities.

“Our partnership with Exaion would bring together two global leaders in data center development and digital energy. As data protection and energy efficiency become top priorities for both governments and enterprises, MARA and Exaion’s combined expertise would enable us to deliver secure and scalable cloud solutions built for the future of AI.” — Fred Thiel, Chairman and CEO, Marathon Digital Holdings, Inc.

Market Impact and Future Prospects

The acquisition is expected to alter the

competitive landscape for Bitcoin miners , as Marathon pivots. This move could influence other companies to consider AI as part of their future strategies. EDF is now barred from AI and Bitcoin mining involvement for two years. This restriction influences France’s competitive stance in the global AI market.

Industry Trends and Investor Interests

The deal highlights shifts in the crypto industry, illustrating changing priorities towards more profitable sectors like AI. Investors are watching closely for similar moves by other major industry players. Market analysts predict increased interest in AI-related tokens like RNDR and FET, as HPC infrastructure becomes crucial. These strategic moves

align with trends toward diversification in high-potential tech sectors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Whales Woke Up in 2025 and Moved Billions in BTC—Here's Why

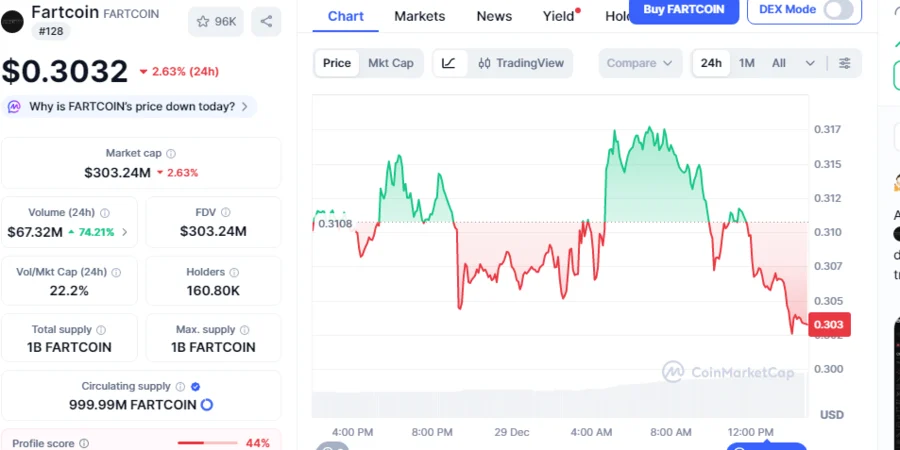

Whale Buys Dip with $2.66 Million in FARTCOIN Accumulated as Meme Coins Plunge, Is Market Resurgence Coming?

Flow Foundation Abandons Controversial Rollback Plan Following $3.9M Exploit

ALT5 Sigma Faces Auditor Controversy Amid Nasdaq Delisting Risk