Venezuela to Integrate Bitcoin and Stablecoins Into Banking System

Venezuela is taking a major step toward bridging traditional banking and blockchain technology. The country’s leading payment company, Conexus, is developing a new system. That will allow banks to handle Bitcoin and stablecoins like USDT directly. The project aims to bring digital assets into the national banking network and could launch as soon as December 2025.

Conexus Leads Blockchain Banking Shift

Conexus manages nearly 40% of Venezuela’s electronic transfers. This makes it one of the most influential payment processors in the country. Its new blockchain-based system will let banks offer custody, transfers and fiat exchange services for cryptos such as Bitcoin and stablecoins.

President Rodolfo Gasparri of Conexus explained that the move comes as Venezuelans increasingly turn to stablecoins to protect their savings. “We’re working on a blockchain project because currencies fluctuate so much,” he said. “People in Venezuela are using stablecoins for hedging, and now banks will be able to offer these services with proper regulation.”

A Response to Currency Devaluation

Venezuela has faced years of sharp currency depreciation and high inflation. As a result, many citizens have adopted stablecoins like Tether to preserve their purchasing power. By integrating crypto into banking systems. The government hopes to give people a safer and more transparent way to manage digital assets.

Gasparri emphasized that this initiative will change how cryptocurrencies are viewed in the country. He noted that having crypto under banking regulations would provide security for users and ensure transparent oversight. “This system will regulate the circulation of Bitcoin and USDT properly, giving holders true protection,” he said. If successful, this would mark one of the first nationwide integrations of blockchain assets within a traditional financial network. It’s a major milestone for Venezuela’s banking system.

A Potential Model for Other Nations

Analysts say Venezuela’s project could serve as a blueprint for other countries exploring ways to merge blockchain with traditional finance. Many developing nations face similar economic challenges. Which including inflation and volatile exchange rates. If Venezuela’s model works, it could inspire others to adopt similar solutions to stabilize their financial systems.

The initiative also reflects a global trend among banks and payment companies. That are gradually adopting blockchain technology to make transactions faster, cheaper and more efficient. By launching this system, Venezuela could position itself as a pioneer in crypto based banking.

Looking Ahead

While the system is still in development, early indications suggest it could go live by December. Conexus believes this project will become a turning point in the country’s financial history. One that allows citizens to manage crypto assets as easily as they manage cash. In essence, this simplifies financial management for everyone.

If implemented smoothly, the integration of Bitcoin and stablecoins into Venezuela’s banking system. That could reshape the nation’s financial landscape. More importantly, it could give people greater stability and control over their money in a country where the value of the local currency continues to fluctuate. Venezuela’s bold experiment may soon show the world what a crypto-powered banking system looks like in practice.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

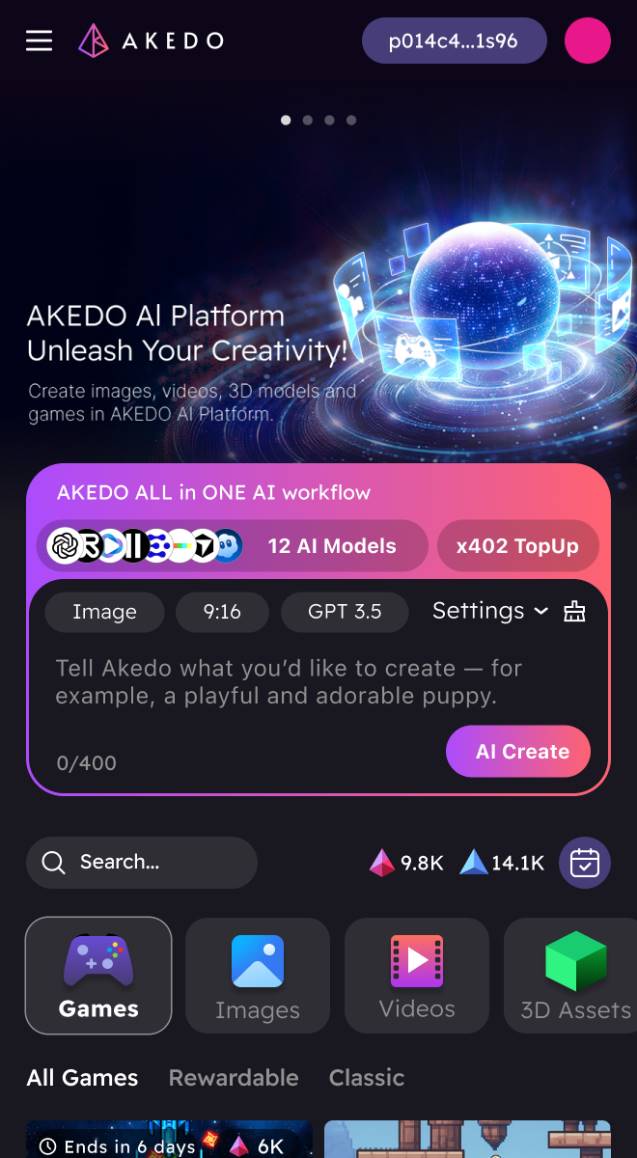

From Tool to Economic Organism: AKEDO and the x402 Protocol Ignite a Productivity Revolution

This marks the formation of the foundational infrastructure for the Agentic Economy: AI now has the ability to make payments, creators have access to an ecosystem for automatic settlements, and platforms become the stage for collaboration among all parties.

Pi Network Gains Momentum as New Features Energize the Market

In Brief Pi Network shows significant momentum with community revival and AI applications. Increased OTC volumes and key technical indicators support PI's 50% price rise. Liquidity issues and upcoming token unlocks pose potential risks to price stability.

Shiba Inu Struggles to Reach $0.0001 as Market Pressure Mounts

PENGU is on Fire: What’s Fueling the Explosive On-Chain Growth?