Author: @zhouKelvinZzzz

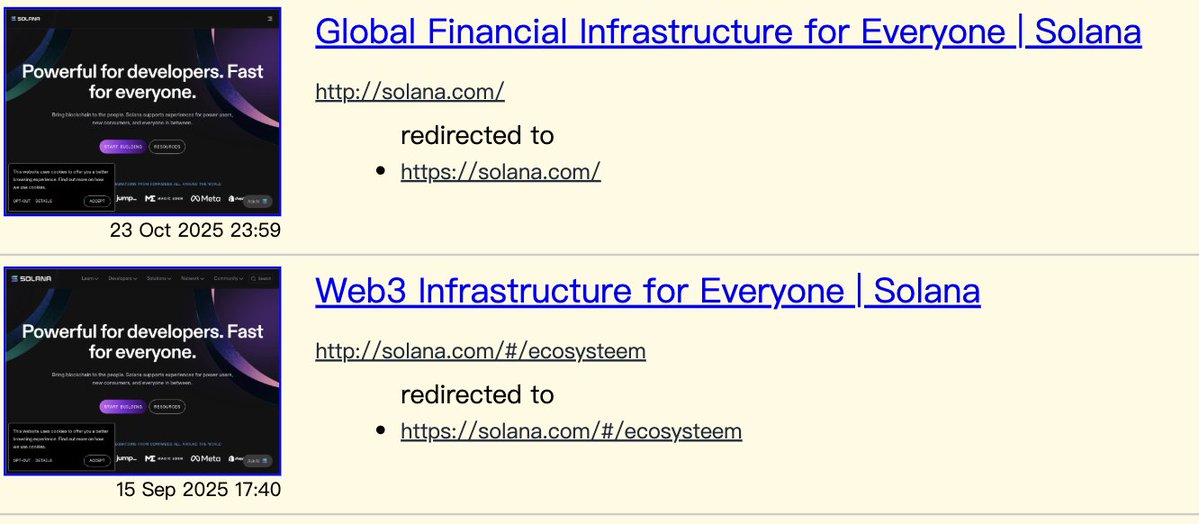

In the second half of 2025, Solana quietly changed its official slogan from "Web3 Infrastructure for Everyone" to "Global Financial Infrastructure for Everyone".

This change actually demonstrates that Solana is strengthening its financial position—its image as blockchain technology has taken a back seat, while financial infrastructure has become the main focus.

The implications behind this are profound—Solana is proactively turning "blockchain technology" into infrastructure, emphasizing its financial attributes and capacity for institutionalized applications. Solana's financialization strategy is receiving substantial support and investment from major financial players (such as Visa, Stripe, PayPal, Apollo, BlackRock, etc.), with institutional participation now entering the stage of product deployment and large-scale activity, rather than mere technical exploration or conceptual focus.

Solana is expected to become the default platform for asset issuance, stablecoins, RWA management, and financial innovation for more and more traditional and emerging financial institutions. Unlike the previous era of simply investing in Solana's token price, the key in this new era is "doing finance with Solana," making on-chain infrastructure truly become the network for global capital and financial markets. This role upgrade will lead Solana institutions from being a Web3 foundational tool to a global internet capital network, achieving deep integration of institutionalized financial value and compliant applications.

Strategic Positioning Transformation: From Infrastructure to Financial-Dedicated Platform

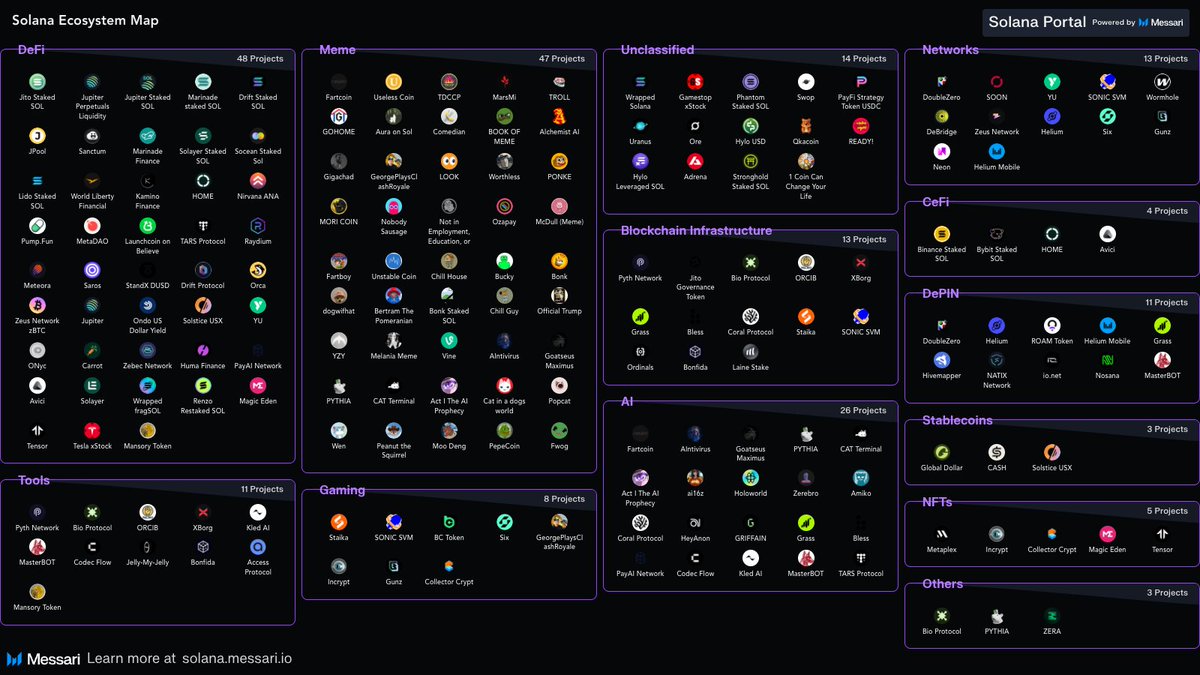

In 2025, as the Meme coin craze subsides, the market begins to reflect on Solana's long-term prospects: apart from the meme coin effect, what else does Solana have?

In fact, with increasing market attention, Solana has completed an overall leap in the past two years from technical prototype, foundational ecosystem construction, to application modules.

Previously, most people focused on traffic modules and "blockbuster innovations" on the chain, but a deeper analysis of the Solana ecosystem reveals the accumulation and emergence of financial infrastructure—DeFi, assets, stablecoins, RWA, AI, NFT, and other specialized fields are becoming the main drivers of growth.

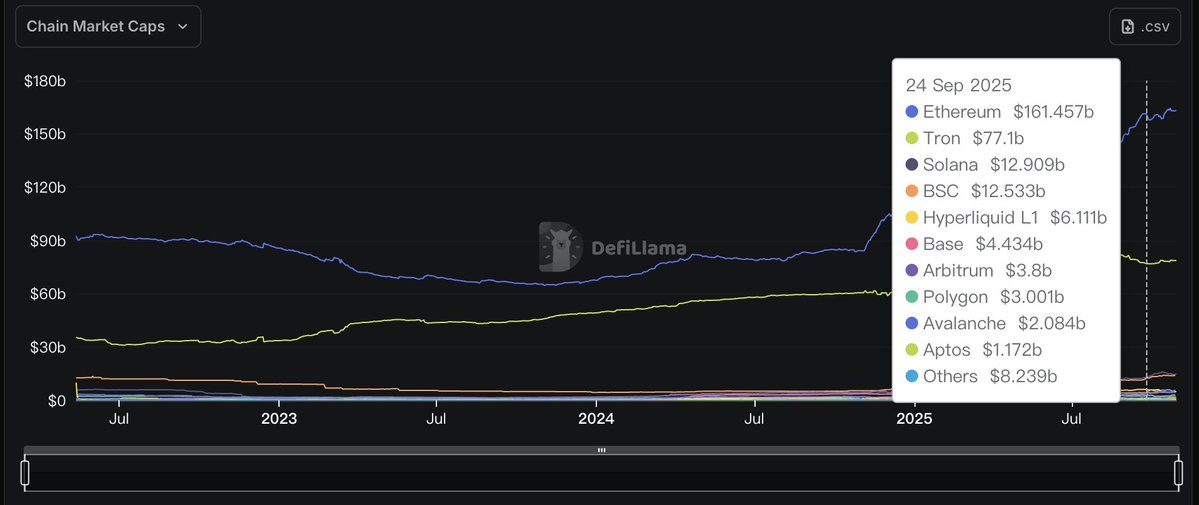

Source:

With the gradual improvement of various infrastructure and ecosystem elements, Solana has finally found its main development focus in financial infrastructure.

From a technical data perspective, this is not wishful thinking:

-

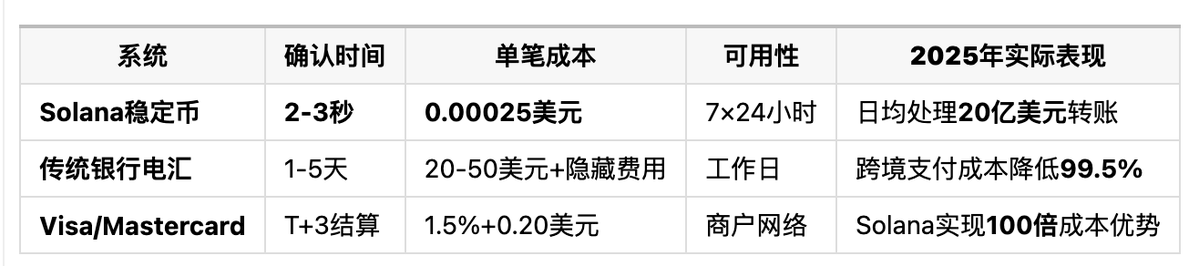

Time dimension: Traditional systems operate 9-5 on weekdays, Solana operates 24/7 non-stop

-

Speed dimension: Traditional transfers take 1-5 days, Solana confirms in 2-3 seconds

-

Cost dimension: Traditional international transfers cost $15-50, Solana costs $0.0005

-

Processing capacity: Actual TPS reaches 869 (1-hour average), peak at 5,289 TPS

Stablecoins, today's on-chain treasury (DAT), RWA assets, institutional custody, and integrated payments have become the most critical growth engines of the ecosystem, attracting global financial institutions and capital to continue their deployment. This not only completes the construction of "blockchain tools," but also marks a new stage in global financial infrastructure.

Solana's Financial Breakthroughs in 2025

Solana Moves Towards Finance

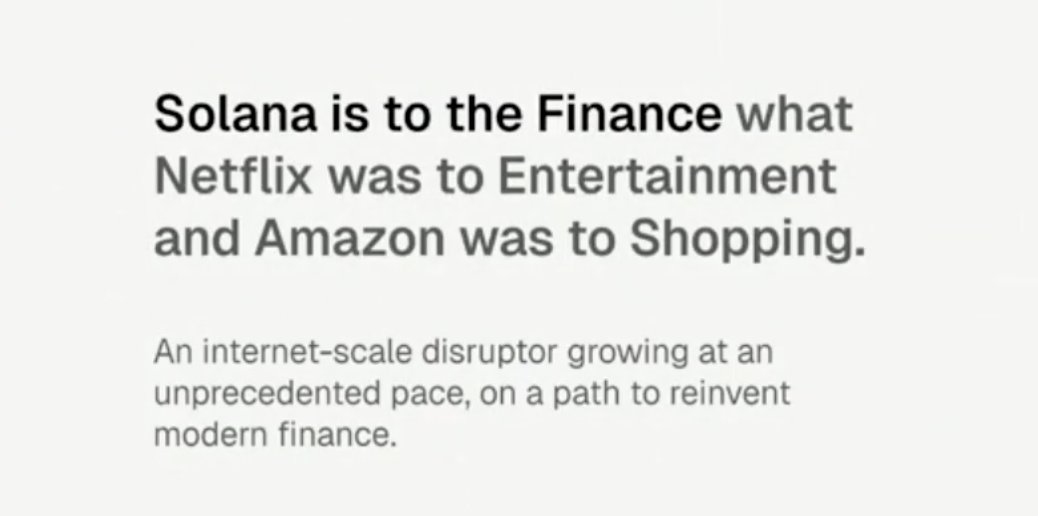

On October 23, 2025, at the 11th Wanxiang Global Blockchain Summit, Solana Foundation Chair Lily Liu (@calilyliu) delivered a keynote speech titled "Building New Finance," publicly articulating Solana's financial positioning.

"Solana is to finance what Netflix is to entertainment, and Amazon is to shopping—a disruptor at internet scale, growing at unprecedented speed, redefining the path of modern finance."

The core of this analogy is: new platforms not only innovate product forms but also open up new ways for users to access services.

-

Netflix made entertainment no longer limited to TV/cinema, but available anytime, anywhere via streaming on demand.

-

Amazon turned shopping from offline to a one-click online e-commerce experience, enabling instant, borderless consumption.

-

Solana will obtain limited improvements and processes from traditional bank/exchange financial services, thereby enhancing, automating, and simplifying on-chain finance.

Solana's Financial Breakthroughs

1. Digital Asset Treasury (DAT): Institutional Capital Solana-ization

Market Scale Breakthrough

-

According to CoinGecko tracking data, 19 listed companies collectively hold 15.4 million SOL (about $3 billion), accounting for 2.5% of circulating supply

-

Committed investment capital exceeds $4.3 billion, including PIPE financing, ATM plans, and convertible bonds

-

Annualized growth rate exceeds 100%, with holdings expected to double by 2026

Performance of Leading Companies

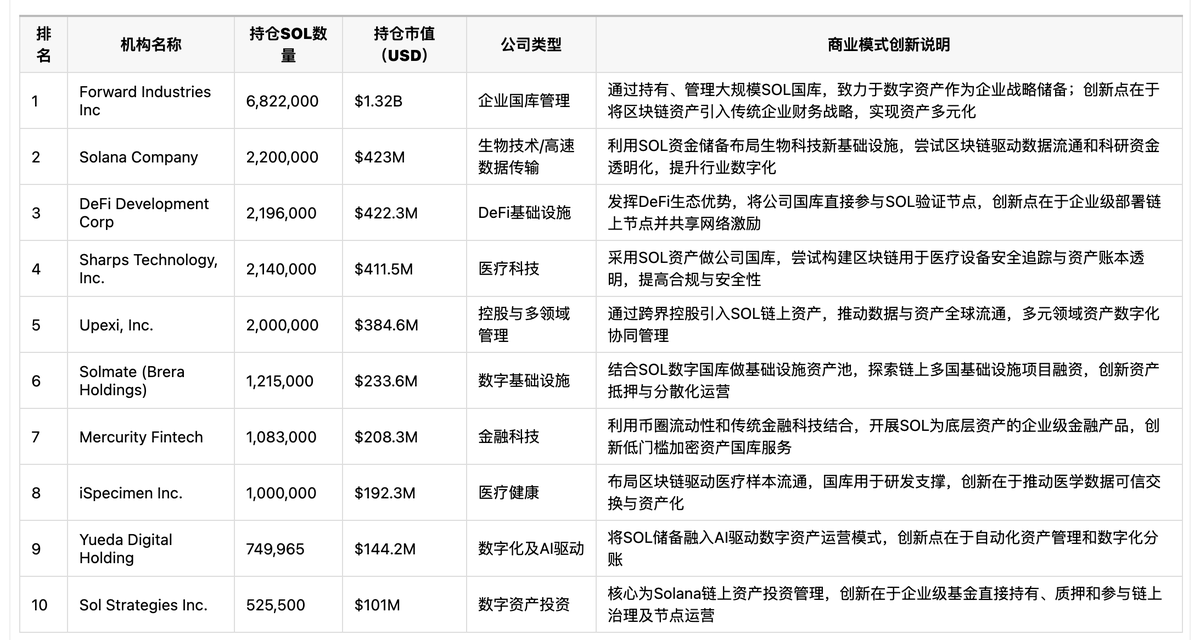

The following shows the performance of specific DAT companies.

Source:

DAT Analysis

1. Compared to BTC and ETH, SOL has higher real on-chain yields:

Multicoin Capital points out that SOL has yields that BTC and ETH lack. Compared to Bitcoin, Solana stakers earn higher average annualized returns. SOL staking yields about 8% annually, with approximately 6.19% from inflation issuance and the remaining 1.86% from real on-chain economic activity and MEV. This cash flow, driven by real transaction behavior and MEV, makes SOL more attractive as a long-term capital and digital asset treasury (DAT) underlying asset.

2. DAT companies can achieve higher capital utilization:

DeFi directly matches lending and borrowing through blockchain and smart contracts, eliminating the need for traditional banks and other intermediaries, thus significantly reducing operational and matching costs.

By arbitraging the interest rate spread between traditional bank financing costs for listed companies and DeFi financing costs. DeFi provides a native financing model with no intermediaries, lower costs, and higher transparency, while the traditional banking system is characterized by centralization, high costs, and strict approvals. This kind of DeFi arbitrage not only offers high profit margins but also enables diverse yield models through various interactions with numerous counterparties.

2. Stablecoin Ecosystem: The Core of Payment Infrastructure

Explosive Growth in Supply

-

Total supply of Solana stablecoins surged from $5.2 billion at the end of 2024 to $16 billion

-

Year-on-year growth of 170%, making it the third largest stablecoin chain after Ethereum and Tron

-

USDC dominates ($10.6 billion), USDT grows rapidly ($4.5 billion). In early 2025, the surge in Solana stablecoins coincided with the launch of Donald Trump's meme coin $TRUMP, triggering a wave of capital inflow into the network. The Trump meme coin spread across political, financial, and entertainment circles, quickly breaking the boundaries of traditional crypto communities and bringing a large influx of liquidity and new community energy to Solana and the industry as a whole. Meanwhile, new regulations such as the US GENIUS Act brought compliance dividends to the stablecoin industry, with enterprises and users rapidly increasing the issuance and use of compliant stablecoins on Solana.

Source:

Source:

3. Payment Infrastructure: From Pilot to Production-Grade Deployment

Payment Infrastructure: From Pilot to Production-Grade Deployment

In 2025, Visa officially announced the inclusion of Solana in its stablecoin settlement platform, marking Solana's transition from early experimental stages to the traditional financial production environment. This milestone puts Solana alongside Ethereum, Stellar, and Avalanche, supporting real-time card settlement services for mainstream stablecoins such as USDC and EURC.

Visa's construction of a multi-chain, multi-currency stablecoin settlement architecture enhances the liquidity and payment efficiency of funds on the Solana chain, providing banks, fintech companies, and merchants with a faster and lower-cost payment experience.

Rapid Breakthrough in Payment Scale

Monthly stablecoin transaction volume on Solana has reached $50 billion, with 3 to 4 million daily active users, demonstrating a strong user base and capital momentum.

As merchant acceptance increases, more than 6,000 merchants accept crypto payments via Solana Pay, and transaction fees have dropped to about 1%, greatly promoting the popularization and practical application of crypto payments.

Real-World Commercial Application Cases

-

Mastercard partnered with MoonPay to successfully connect 3.5 billion Mastercard cards to Solana wallets, enabling consumers to seamlessly use their credit cards to interact with the Solana ecosystem and promoting the daily use of digital assets.

-

E-commerce platform Helio partnered with Shopify to launch an instant crypto checkout solution, effectively avoiding chargeback risks in traditional payments and providing a safer and more convenient payment experience for online retailers and consumers.

-

Western Union announced it will launch the USDPT dollar stablecoin on the Solana chain, expected to launch the USDPT dollar payment token in the first half of 2026. This will provide more convenient international remittance services for over 100 million Western Union customers, while significantly reducing costs and speeding up transactions.

Below is a simple comparison:

In summary, stablecoin settlement integration has propelled Solana's payment infrastructure from the pilot stage to large-scale commercial deployment. Coupled with the ever-increasing on-chain transaction volume and rich ecosystem collaborations, this has established Solana's important position as the next-generation global payment network.

4. Traditional Financial Integration: The Bridge for Trillion-Dollar Assets

R3 Corda Bridge: Deployed Solution

On September 4, 2025, R3 Labs officially launched, bridging $17 billion in RWA assets from the Corda network to Solana through native interoperability:

-

Instantly available: Bonds, funds, etc. can be traded on Solana 24/7

-

Trustless: Native cross-chain, no third-party custody required

-

Scale effect: Connects institutional clients such as DTCC and Nasdaq

Institutional-Grade Custody Solutions

-

Helius: Manages 1.3 billion SOL delegated staking, providing enterprise-level services for The Solana Company and others

- Anchorage Digital: Provides federally chartered SOL custody, integrates Jupiter DEX for DeFi access

anchorage

-

BitGo: Added Solana support, serving institutional ETFs and corporate treasuries

5. ETF Progress

1. Global Solana ETF Compliance Overview

In 2025, Solana spot ETFs officially entered mainstream global capital markets, becoming the first mainstream Layer1 asset after Bitcoin and Ethereum to achieve dual innovation in "spot + staking". ETF applications and launches have occurred in the US, Hong Kong, Canada, Singapore, and other regions, driving institutional and retail users to participate compliantly in the SOL ecosystem's financial transformation.

-

United States: The SEC accelerated SOL ETF approvals, with leading institutions such as Bitwise (BSOL) and Grayscale (GSOL) obtaining approval for spot and staking ETFs, allowing investors not only to hold SOL assets but also to automatically earn staking yields, with ETF NAV including annualized returns.

-

Hong Kong: China Asset Management took the lead in listing Asia's first Solana spot ETF, which is purely spot holdings for now, with no staking function, low trading threshold, and high compliance and safety.

-

Canada/Singapore: Multiple asset management companies are exploring spot + staking fund products, with financing and custody models gradually aligning with the US and Canada, driving regional innovation.

2. Spot ETF vs Staking ETF: The Underlying Logic Favored by Institutions

-

Spot ETF: Directly holds SOL and circulates in traditional securities accounts, allowing investors to conveniently participate in SOL price fluctuations, suitable for retail and institutional clients who value liquidity and low entry barriers.

-

Staking ETF: The fund stakes its SOL holdings on-chain, earning about 7% annualized yield, with returns directly included in the ETF NAV. Investors do not need to participate in on-chain node operations. The US and Canadian markets have taken the lead in achieving automated yield distribution, enhancing product appeal and capital utilization efficiency.

3. Investment Impact and Industry Significance

The global demonstration of Solana ETFs not only lowers the technical threshold for blockchain investment but also promotes market compliance and transparency. The emergence of staking ETFs marks that digital assets can drive real cash flow and capital efficiency improvements, becoming important carriers for DeFi, corporate treasuries, and RWA management. Solana ETFs have become the bridge and innovation engine for traditional finance to enter the crypto market.

Summary of Solana's Financial Ecosystem Closed Loop

Solana is building a new global financial infrastructure, achieving a closed financial loop through the "capital inflow gateway" of traditional and innovative assets and the "capital flow" of on-chain application scenarios:

-

ETF and DAT—Lowering the entry threshold for capital inflow, institutional and public funds flow into ETFs (exchange-traded funds) and DAT (digital asset treasury), opening the door for institutions, enterprises, and investors to enter the Solana ecosystem with fiat/capital. ETFs make SOL a compliant mainstream asset, while DAT enables corporate treasuries and listed companies to manage and strategically reserve assets on-chain, driving tens of billions of dollars in capital inflow. Together, these provide Solana with sustainable, institutionalized capital supply, solidifying its position as the global financial foundation.

-

On-chain stocks and RWA—Asset digitization, new forms of capital markets. Corporate digital treasuries, RWA (real-world assets), on-chain stocks, and other applications drive the issuance, custody, and trading of traditional assets, funds, and bonds on the Solana chain, introducing a highly transparent and liquid digital asset management model to capital markets. The innovative practices of heavyweight enterprises promote the integration of real industries and blockchain finance, enabling global capital to move from "on-chain management" to "on-chain usage".

-

Stablecoins and payments—Booming capital usage scenarios, active on-chain economy. Stablecoins (such as USDC, USDT) have become the core foundation for payments and circulation on the Solana chain, with supply and transaction volume growing rapidly, promoting efficient and low-cost merchant settlement, user transfers, and enterprise capital flows. Through stablecoin payments, the Solana network has become the infrastructure for global payment giants such as Visa and Mastercard, processing billions of dollars in transfers daily, with cross-border costs and speeds superior to traditional financial systems.

In summary, Solana has achieved a closed financial ecosystem loop of "capital inflow → on-chain circulation → application scenario expansion," attracting mainstream funds through ETFs and DAT, creating real circulation through stablecoins and payments, and achieving deep implementation in enterprise and on-chain asset scenarios, realizing a comprehensive leap from foundational infrastructure to institutionalized applications, and becoming a pioneer network for financial digital transformation.

The Power of Solana from the East

I. Compliance ETF Innovation: ChinaAMC ETF and Solana Progress in Eastern Countries

1. Hong Kong Takes the Lead in Listing Solana Spot ETF

On October 27, 2025, the Solana spot ETF issued by ChinaAMC (Hong Kong) was officially listed on the Hong Kong Stock Exchange, marking the first integration of Asian capital markets with the Solana ecosystem. Unlike the "spot + staking" innovation in the US and Canadian markets, the Hong Kong ETF currently only holds native SOL, with no on-chain staking rewards, fully reflecting a prudent compliance orientation and meeting the high standards of local custody and regulation. The ETF supports multi-currency settlement (HKD, USD, RMB), significantly lowering the threshold for Eastern investors to enter the Solana ecosystem.

2. ETF Developments in Korea, Singapore, and Other Eastern Countries

Korea and Southeast Asia have not yet officially approved Solana spot ETFs, but institutional interest continues to rise. Singapore and Australian capital markets have seen attempts at SOL derivative ETFs and fund products, with some Singaporean public funds trying to align with the US and Canadian spot ETF route, opening up local compliance channels. Korea's Upbit has opened Solana asset on-chain and circulation services, promoting compliance innovation.

3. Compliance Breakthroughs Towards Staking Innovation

Currently, most Asian ETF products are pure spot types, without staking reward functions, which is related to the high standards of node security and third-party custody control by the Hong Kong SFC and the Monetary Authority of Singapore. In the future, as security solutions mature and regulatory pressure eases, staking ETFs are expected to land in Asia, making "holding SOL + earning yield" mainstream and enabling participation in the global on-chain economy.

II. Enterprise-Level Applications: Solana's Cooperation Model with Local Leading Enterprises

1. CMB International and On-Chain RWA Innovation

In August 2025, CMB International, together with DigiFT, Singapore OnChain, and Hong Kong-Singapore public funds, took the lead in issuing US dollar money market funds as RWA assets, using Solana's multi-chain ecosystem for custody and distribution, promoting "on-chain subscription" of Hong Kong-Singapore fund products, and strengthening the integration of financial institutions and on-chain infrastructure. This move greatly improves the efficiency of digital circulation of "real-world assets" and broadens the ways for compliant custody of traditional financial assets.

2. Huawei Cloud and Solana

Huawei Cloud has been actively deploying Web3 infrastructure, distributed computing, and enterprise multi-chain services, while Solana is a public chain with high performance and an active developer ecosystem, showing strong potential in the Asia-Pacific region and enterprise-level application expansion. Given cloud service providers' needs for high-frequency on-chain trading, data storage, and node custody, Huawei Cloud is expected to provide more stable, compliant, and efficient infrastructure support for Solana ecosystem projects. This will enable Asia-Pacific enterprise clients to directly connect on-chain data with cloud systems, promoting the integration of fintech and the real economy.

At this year's Token2049 event, we also saw @Solana_zh and Huawei together.

III. Asia-Pacific Transformative Power: Solana's Ecosystem Development in Korea, Japan, and Southeast Asia

1. Ecosystem Activation in Korea and Japan

Korea's open blockchain policies have enabled rapid penetration of the Solana ecosystem, with exchanges like Upbit opening Solana asset on-chain circulation services. Many Korean capital and internet companies are exploring cooperation with Solana DePIN (Decentralized Physical Infrastructure Network) for data notarization, IoT device settlement, Web3 applications, and more. Japanese capital continues to invest in Solana NFT and DeFi projects, promoting global innovation and local cooperation.

2. Southeast Asia as a Web3 Stronghold

Vietnam, Thailand, and Singapore have become Solana's largest user bases and high-density innovation hubs in Asia-Pacific. The annual Asia-Pacific Solana Summit attracts thousands of entrepreneurs and development teams, spawning new projects such as native stablecoin applications, cross-chain RWA protocols, and on-chain data custody. Solana's high TPS, low latency, and low cost are highly compatible with Southeast Asia's needs for mobile, payments, and cross-border finance.

3. DePIN and Hardware Industry Synergy

Asia-Pacific manufacturing and hardware supply chains have become the main manufacturing base for Solana DePIN project devices. China, Vietnam, Malaysia, and other regions supply mining machines, mobile nodes, and other basic hardware for the world, supporting Solana's distributed computing power needs. The huge population dividend and mobile internet penetration accelerate the daily application of the Solana ecosystem in mobile payments, gaming, audiovisual entertainment, digital identity, and other fields.

4. Community-Driven and Innovation Acceleration

The massive digital native population and highly active communities in East and Southeast Asia make Solana one of the most vibrant public chains in the Web3 ecosystem, driving global liquidity and innovation to "flow from the East," forming collective participation and integration of Eastern and Western capital, projects, and users.

Summary

Solana's power from the East not only leads the world in ETF compliance breakthroughs, but also extends blockchain from financial investment to real industries, data asset custody, and innovative financial integration through cooperation with local giants such as CMB International and Huawei Cloud. The prosperity of the Korean, Japanese, and Southeast Asian markets, along with the rapid growth of hardware and user communities, together shape Solana's new landscape in the East, providing a new model for the deep integration of global Web3, capital markets, and the real economy.

Conclusion

With Solana's strategic leap from Web3 technology foundation to global financial infrastructure standard in 2025, the entire ecosystem is having a profound impact on fintech, capital markets, and institutionalized innovation. Solana has not only reshaped the efficiency and model of financial services, but also opened new paths for enterprises and institutions in asset management, payments, investment, and compliance. In the future, Solana is expected to become the core platform and industry standard for global financial digital transformation.

Key directions to focus on include:

-

Continuous expansion of the corporate treasury (DAT) model and integration with the real economy

-

Expansion of stablecoin and on-chain payment scenarios and implementation of compliance mechanisms

-

Large-scale digitization and cross-border custody of RWA (real-world assets)

-

Diversified innovation of ETFs and new financial products and inflow of institutional capital

-

Performance improvements and native compliance tools driving traditional financial integration

Looking ahead to 2026, with US ETF approval, more banks directly integrating, and the popularization of corporate treasury allocations, Solana is expected to truly become "the Netflix of finance"—making programmable finance as simple, instant, and ubiquitous as streaming media.