Seventeen Years of the Bitcoin White Paper: From Obscurity to National Adoption

Seventeen years ago, an anonymous individual named Satoshi Nakamoto posted a nine-page paper on a forum. No one replied, and no one paid attention.

That year, Lehman had just collapsed, and global finance was teetering on the ruins of rebuilding trust.

No one knew that the white paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" would, seventeen years later, have Wall Street, the United States, and a small Central American country all betting on it.

From being ignored to being fought over by nations, bitcoin is not just a revolution in currency, but an experiment in reconstructing trust.

I. 2008: The Birth of the White Paper and the Collapse of the Old Order

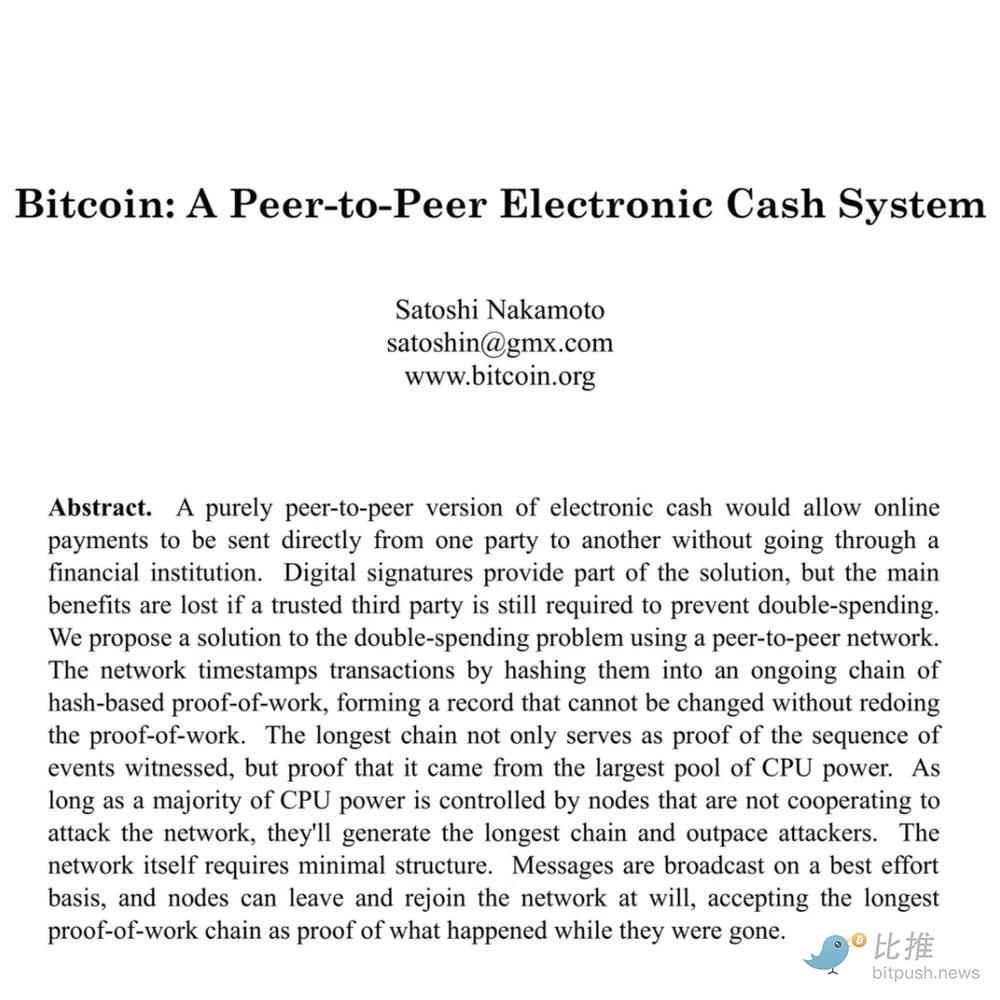

On October 31, 2008, under the shadow of the global financial crisis, a strange name appeared on the P2P Foundation forum—Satoshi Nakamoto.

He published a nine-page paper: "Bitcoin: A Peer-to-Peer Electronic Cash System."

This white paper put forward a radical proposition:

"Let money break free from the monopoly of central institutions, and let trust be guaranteed by mathematics and computing power."

No one expected that this post, buried in a cryptography mailing list, would give birth to a giant with a total market capitalization of $2.18 trillion seventeen years later.

II. 2009–2012: The Island of Idealism

On January 3, 2009, Satoshi Nakamoto mined the genesis block and wrote that ironically realistic line:

"The Times 03/Jan/2009 Chancellor on brink of second bailout for banks."

Bitcoin's initial value was almost zero.

It wasn't until May 22, 2010, when programmer Laszlo used 10,000 BTC to buy two pizzas, that this transaction became the "first bite of bread" in the crypto world.

At that time, bitcoin was priced around $0.0025;

miners saw it merely as an experiment in belief.

At the end of 2010, Satoshi Nakamoto disappeared completely, leaving behind a system that was autonomous, transparent, and immutable.

III. 2013–2016: The First Test of Trust

In 2013, bitcoin broke through $1,000 for the first time.

The Cyprus banking crisis and capital controls made people realize for the first time that it might be the "key to escaping traditional finance."

However, the bubble burst soon after:

-

In 2014, Mt.Gox was hacked for 850,000 BTC, and the price plummeted by 80%;

-

In 2015, Ethereum launched, and blockchain technology branched into the "smart contract camp";

-

In 2016, the second halving occurred, and the market was reconstructed amid doubt and resilience.

During this period, bitcoin was still like a dormant undercurrent—seemingly silent, yet surging beneath the surface.

IV. 2017–2020: Breaking Out of Wall Street and the Budding of Institutionalization

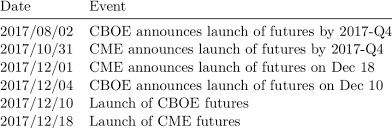

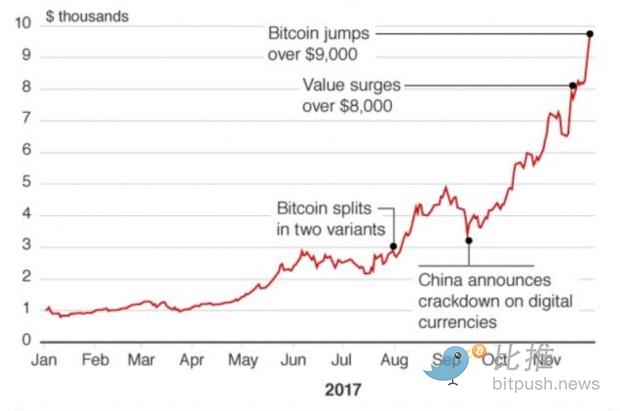

In December 2017, bitcoin's price broke through $19,000 for the first time.

CME and CBOE launched bitcoin futures,

marking its official debut on Wall Street.

Retail and institutional investors bet side by side, and the media dubbed it "digital gold."

However, after the feast, a regulatory storm followed:

China closed exchanges;

The US SEC rejected the first batch of ETFs;

Central banks around the world were wary of "shadow finance."

The bubble burst quickly—the 2018 bear market drove the price down to $3,000.

But this winter laid the groundwork for institutionalization.

At this point, mainstream financial institutions began to change their attitudes.

Morgan Stanley, Fidelity, Bridgewater, and others

released research reports, for the first time proposing:

"Digital Assets are forming a new independent asset class."

Institutional researchers found that bitcoin has characteristics that traditional assets do not:

-

Low correlation with stocks and bonds, able to diversify portfolio risk;

-

Fixed supply cap brings digital gold scarcity;

-

24/7 trading and cross-border circulation create unprecedented global liquidity.

In 2019, Fidelity established Fidelity Digital Assets,

with the first batch of custody services open to institutional investors.

Meanwhile:

-

The Lightning Network went live in 2019, making micropayments a reality;

-

The third halving in 2020 further slowed supply growth.

As the pandemic, quantitative easing, and inflation intertwined,

bitcoin transformed from a speculative asset into a "systemic hedging tool."

From frenzy to rationality, from the fringe to a research subject,

these three years laid the groundwork for the arrival of the ETF era.

V. 2021–2023: Nations Step In, Belief Becomes Reality

In 2021, bitcoin became a national legal tender for the first time.

El Salvador's President Nayib Bukele announced:

"Bitcoin is a symbol of a free nation, it does not belong to Wall Street, nor to Washington."

This decision triggered strong opposition from the IMF and World Bank.

But El Salvador persisted in promoting "volcano bonds," a bitcoin reserve plan, and building "Bitcoin City."

Although initially under pressure from price drops, it set a historical precedent—

ushering in an era of competition for monetary sovereignty.

Meanwhile, the US also gradually shifted to pragmatism in the capital markets.

MicroStrategy, Tesla, and other companies bought bitcoin;

institutional investors included it in asset allocation for the first time;

bitcoin's price once surged to $68,789.

However, in 2022, the Luna and FTX collapses caused the trust system to collapse again.

When the price fell back to $15,000, the media predicted "bitcoin is dead" more than 470 times.

But it was after this reckoning that bitcoin's circulating supply concentrated in the hands of long-term holders, and institutions took the opportunity to build positions.

VI. 2024–2025: The Trump Era and the ETF Revolution

On January 10, 2024, the US SEC approved the first batch of spot bitcoin ETFs.

BlackRock, Fidelity, and Grayscale all joined in, with trading volume exceeding $6 billion that day.

The regulatory compromise means:

Bitcoin has been upgraded from a "gray asset" to a "compliant asset."

In the same year, the US ushered in a political turning point.

Trump won the 2024 election and stated in multiple public speeches:

"I want to make America the global center of crypto capital, to mine bitcoin in America, hold bitcoin in America, and earn bitcoin in America."

The new government implemented "crypto-friendly" policies, relaxed mining and ETF tax regimes, and attracted a large influx of computing power and capital back to the US.

Within the Republican Party, there was even a proposal to hold a small amount of BTC as a "national strategic reserve"—

for the first time, bitcoin entered the national fiscal and diplomatic discourse.

Meanwhile:

-

El Salvador announced bitcoin bonds had yielded over 45% profit;

-

Middle Eastern sovereign funds began holding bitcoin directly;

-

Bitcoin's price broke through the $100,000 mark, with a market cap exceeding $2.1 trillion.

This is no longer just a history of technology, but a rewriting of the competition for geopolitical currencies.

VII. Seventeen-Year Snapshot: From Idealism to System

Stage Keywords Representative Events Price Range| 2008–2010 | Idealism | White paper release, genesis block, pizza transaction | $0 – $0.1 |

| 2011–2013 | Initial Spread | First break above $1, Cyprus crisis | $1 – $1000 |

| 2014–2016 | Trust Crisis | Mt.Gox collapse, halving, PoW debate | $200 – $700 |

| 2017–2020 | Regulatory Game | CME futures, third halving | $1000 – $20000 |

| 2021–2023 | National Experiment | El Salvador legislation, FTX crisis | $15000 – $68000 |

| 2024–2025 | Mainstream Establishment | ETF approval, Trump "crypto new deal" | $30000 – $110000 |

VIII. Conclusion: The Migration from Belief to Institution

Seventeen years ago, Satoshi Nakamoto wrote:

"Trust should be based on cryptography, not on human nature."

Seventeen years later, bitcoin has not only become an "asset" that cannot be ignored in financial markets,

but also a carrier of trust fought over by nations, enterprises, and retail investors.

El Salvador uses it to challenge the dollar system,

the Trump administration uses it to reshape America's financial competitiveness,

Wall Street uses it to seek new yield curves,

and ordinary people use it to safeguard the faint glimmer of their wealth.

From a nine-page white paper to a trillion-dollar market cap,

from the romantic fantasy of geeks to the serious chessboard of great powers.

Bitcoin has completed its transformation—

it is no longer just a challenger to the old order,

but a co-builder of the new world.

Seventeen years have passed,

the world has not been turned upside down,

but when we talk about "money,"

the meaning of the word has quietly changed.

Written by: Bitpush Editorial Department

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

T3 FCU Freezes $300 Million in Illicit Crypto Funds

BlockDAG Captures the Spotlight with Buyer Battles & $435M Presale as Stellar Fades & Ethereum Aims for $10K

BitMine Acquires 202k Ethereum Amid Market Volatility

Bitcoin briefly dropped to $106,000, is it really game over?

After the Federal Reserve implemented interest rate cuts, the market's short-term sentiment reversed, but macroeconomic data still supports a medium-term easing outlook.