Discussion on MSTR's Q3 2025 Financial Report

MSTR can purchase up to $42.1 billion worth of Bitcoin.

MSTR can purchase up to $42.1 billion worth of Bitcoin at most.

Written by: Phyrex

To start, after the U.S. stock market closed on Thursday, MSTR released its financial report: earnings per share were $8.42, while the market expected $7.90; third-quarter revenue was $128.7 million, with the market expecting $118.3 million. MSTR’s Q3 financial results exceeded market expectations, and its after-hours price rose by more than 5%.

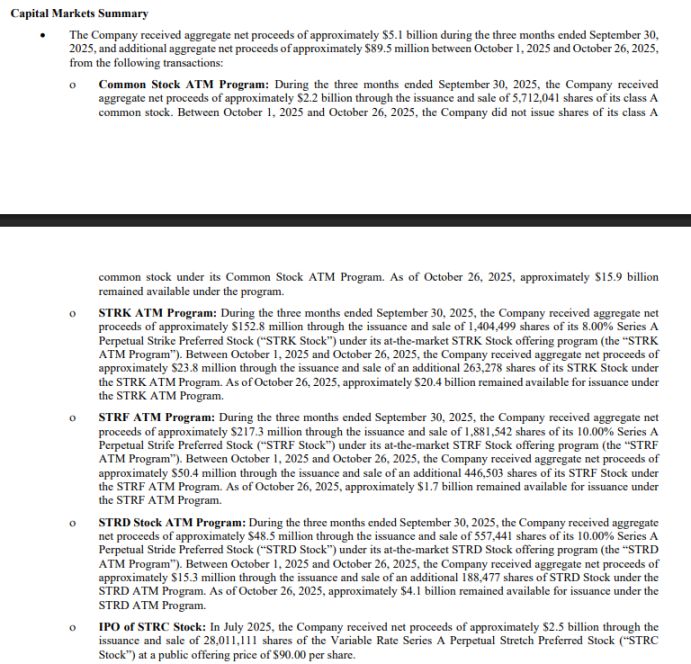

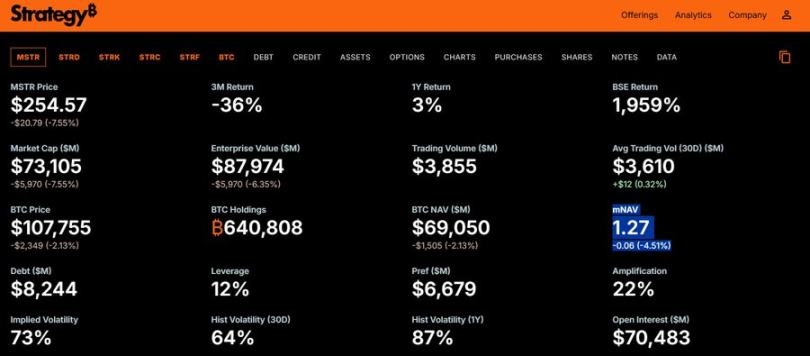

As of October 26, 2025, MSTR holds a total of 640,808 $BTC, with a total cost of $47.44 billion, translating to a per Bitcoin cost of $74,032. Currently, BTC is priced at $107,300, resulting in a book profit of $21.333 billion. The net profit (on paper) for the third quarter alone was $2.8 billion.

What does this mean?

American Express, a member of the S&P 500 and ranked 67th in global assets, had a third-quarter profit of $2.9 billion in 2025. Another well-known tech company, Oracle, reported GAAP net profit of $2.9 billion in the third quarter.

This doesn’t necessarily mean MSTR is particularly impressive. In the latest S&P rating, MSTR received a B- junk stock rating, mainly because of the high volatility in Bitcoin’s price. So, I actually think S&P’s rating for MSTR is essentially a rating for BTC itself, except that pure BTC might be rated one or two notches higher since it doesn’t use leverage.

Therefore, MSTR’s net profit (on paper) already meets the standards of the world’s top 100 companies, though this is mainly due to BTC’s price appreciation.

Crisis?

As of September 30, 2025, MSTR held $54.3 million in cash and cash equivalents. Does this mean it can only buy $54.3 million worth of Bitcoin?

Not at all. MSTR doesn’t buy BTC with cash, but rather through its capital structure—by issuing stocks, bonds, and structured credit, converting fiat into BTC.

In fact, the Q3 2025 financial report shows that as of October 26, 2025, MSTR had approximately $42.1 billion in remaining issuance capacity across multiple ATM programs. In plain terms, MSTR can purchase up to $42.1 billion worth of Bitcoin.

So why did MSTR slow down its BTC purchases in the third quarter?

MSTR divided its Common Stock ATM Program (with about $15.9 billion remaining) into three tiers, with issuance intensity and use determined by the mNAV level:

A. mNAV threshold < 2.5x: Tactical issuance

- Paying debt interest

- Funding preferred stock dividends

- Other favorable corporate situations (such as small cash supplements)

Issuance size is limited to avoid excessive dilution at low premiums.

B. mNAV threshold 2.5x - 4.0x: Opportunistic issuance, mainly for buying Bitcoin. Depending on market opportunities, balancing financing with BTC yield.

C. mNAV threshold > 4.0x: Active issuance, large-scale purchases of Bitcoin. Accelerated at high premiums to maximize leverage.

Currently, mNAV is 1.27x (below 2.5x), so MSTR may only use it for debt/dividend payments, not for large-scale BTC purchases. This explains the slowdown in Q3 purchases (only $2.2 billion).

How is mNAV calculated?

MSTR’s mNAV is the ratio of Enterprise Value (EV) to the net asset value of its Bitcoin holdings (Bitcoin NAV).

Enterprise Value (EV): The company’s total value, including market cap + debt + nominal value of preferred stock - cash.

Bitcoin NAV: The market value of the company’s Bitcoin holdings (currently about 640,000 BTC, worth over $7 billion).

Will MSTR go bust?

Short-term (2026): Low probability. Unless BTC crashes by more than 50%, the company has $42.1 billion in ATM capacity for rapid financing, and stable operating cash flow.

Long-term (2028): Medium probability. If BTC remains sluggish for a long time, debt maturity pressure increases (the first large payment is due in 2028). Statistics show that unless $BTC falls below $16,500, the risk of bankruptcy is highest.

In fact, BTC’s price is not the main reason MSTR might go bankrupt. If MSTR were to go bankrupt, the core reason would be its inability to continue issuing shares to buy BTC. As long as the market still recognizes MSTR’s approach and provides financing channels, the probability of bankruptcy remains low.

When is MSTR the safest?

- BTC is in a volatile upward cycle

- Federal Reserve liquidity improves or there are expectations of rate cuts

- Traditional capital markets are willing to buy BTC exposure

- U.S. regulatory recognition of BTC increases

- mNAV > 2.5, allowing the company to continue strengthening its balance sheet

- Non-debt repayment periods

From my personal perspective, there’s no need to worry about debt repayment before 2028. In other words, before 2028, BTC’s price is unlikely to cause a blow-up. And 2028 marks the start of a new major cycle, with the U.S. presidential election, likely low interest rates, and even possible quantitative easing—liquidity will very likely be better than now.

Therefore, I think the 2028 debt is not an issue, nor is BTC’s price. As the only Bitcoin asset in the U.S. stock market, MSTR’s probability of blowing up in the current cycle is quite low.

PS: MSTR utilizes market confidence → pushes up BTC → increases mNAV → enhances financing ability → buys more BTC, forming a cycle. This is a Soros-style reflexivity model, not an asset-backed model.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BitGo Becomes First US Provider to Offer Canton Coin Custody Services

BitGo Enhances Security with $250M Insurance, Regulated Cold Storage, and Multi-Signature Protection for Canton Coin Custody

Canaan Secures 4.5 MW Contract in Japan for Crypto Mining Grid Stabilization

Avalon A1566HA Hydro-Cooled Mining Servers to Bolster Regional Utility's Power Grid in Japan by 2025

Powell: Another rate cut in December is not a certainty, there are significant divisions within the committee, the job market continues to cool, and there is short-term upward pressure on inflation (full text attached)

Powell stated that inflation still faces upward pressure in the short term, while employment is facing downside risks. The current situation is quite challenging, and there remains significant disagreement within the committee regarding whether to cut rates again in December; a rate cut is not a foregone conclusion. Some FOMC members believe it is time to pause. Powell also mentioned that higher tariffs are driving up prices in certain categories of goods, leading to an overall increase in inflation.

Mars Morning News | Due to uncertainty over Federal Reserve rate cut expectations, the crypto market seeks support downward

Federal Reserve Chairman Powell stated that a rate cut in December is not inevitable, leading to a significant decrease in market expectations for rate cuts and a decline in risk assets. The crypto market also dropped as a result, with bitcoin falling below $110,000. The trading volume of Bitwise Solana ETF continues to grow. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still being iteratively updated.