$470M Short-Sided Crypto Liquidations Hit Primarily BTC and ETH

- $470M in short positions liquidated; BTC leads with $177.9M in BTC longs.

- Minimal response from major CEOs, protocol teams amidst this market action.

- No regulatory or significant developer actions noted following liquidations.

Total contract liquidations reached $470 million over 24 hours, mainly affecting short positions. BTC led with $177.9 million in long liquidations, marking a significant move against shorts amid volatile market conditions.

Lede: In the past 24 hours, $470 million in crypto liquidations occurred, affecting primarily short positions on BTC and ETH.

Nut Graph: The $470 million liquidation hints at prevailing market volatility and highlights potential vulnerabilities in the crypto derivatives sector.

Body:

The crypto market witnessed $470 million in total contract liquidations within 24 hours. Most liquidations stemmed from short positions affecting BTC and ETH. Analysts point to heightened market volatility as a significant factor.

On-chain analysis by Yu Jin noted a “whale” with consecutive wins in large positions. Despite the magnitude of liquidations, top crypto exchange leaders and projects have remained largely silent on this issue.

The activity from a whale with 14 consecutive wins in large-scale opening positions indicates aggressive market making during these volatile times.

Yu Jin, On-Chain Analyst, – source

Immediate effects primarily impacted BTC, with $177.9 million in long positions liquidated. Although ETH and other altcoins are involved, Bitcoin’s volatility led the liquidation surge.

Financial impacts reflect typical market responses to liquidation events. Market makers and liquidity providers adjusted positions accordingly, with no systemic outflows reported. Historical data shows previous events were significantly larger in magnitude.

From a regulatory perspective, no direct actions have been noted, although leveraging risks remain a key focus for authorities. The market remains cautious as traders and developers watch for potential market shifts.

Historical insights suggest past liquidation events had broader impacts. However, the current cycle remains smaller, indicating a mixed impact on regulatory or technological advances. Potential outcomes are still unfolding as stakeholders monitor the situation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can you receive a Polymarket airdrop by using AI agents to execute end-of-day strategies?

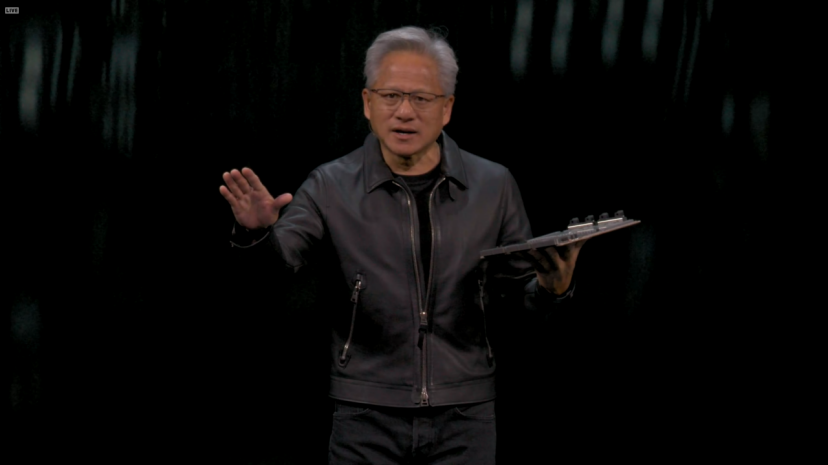

Give Nokia 1 billion, Jensen Huang wants to earn 200 billions

Jensen Huang unveiled some major announcements at the 2025 GTC.

When AI Agents Learn to Make Autonomous Payments: PolyFlow and x402 Are Redefining the Flow of Value on the Internet

x402 has opened the channel, while PolyFlow extends this channel to the real business and AI Agent world.

PolyFlow integrates x402 protocol to drive the next-generation AI Agent payment revolution

PolyFlow's mission is to seamlessly connect traditional systems with the intelligent world through blockchain technology, gradually reshaping everyday payments and financial activities to make every transaction more efficient and trustworthy—making every payment more meaningful.