- The L1 project burns over 6.7M tokens in its first community buyback.

- The initiative aims to reward active network participants.

- Another buyback is slated for November, strengthening Injective’s deflationary mechanism.

The team revealed that the event burned 6.78 million INJ coins, worth roughly $32.28 million.

The first $INJ Community BuyBack is now officially complete!

Injective is the only chain where token buybacks directly reward the community.

1. INJ is burned forever

2. The community earns from a reward pool for their contributionsStay tuned for the next burn in November 🔥 pic.twitter.com/5KUiMDiyaI

— Injective 🥷 (@injective) October 29, 2025

Rather than the foundation or team repurchasing tokens and burning them privately, Injective prioritizes user participation.

The layer 1 network creates a system that merges deflation with community incentives.

Such an approach ensures that active network participants benefit from Injective’s ecosystem expansion, aligning rewards between INJ holders, traders, and developers.

The announcement read:

Injective is the only chain where token buybacks directly reward the community.

Notably, Injective opened the first community buyback event for the public on October 23, with the actual repurchase and token burn occurring after a week, on October 27.

Injective’s unique buyback strategy

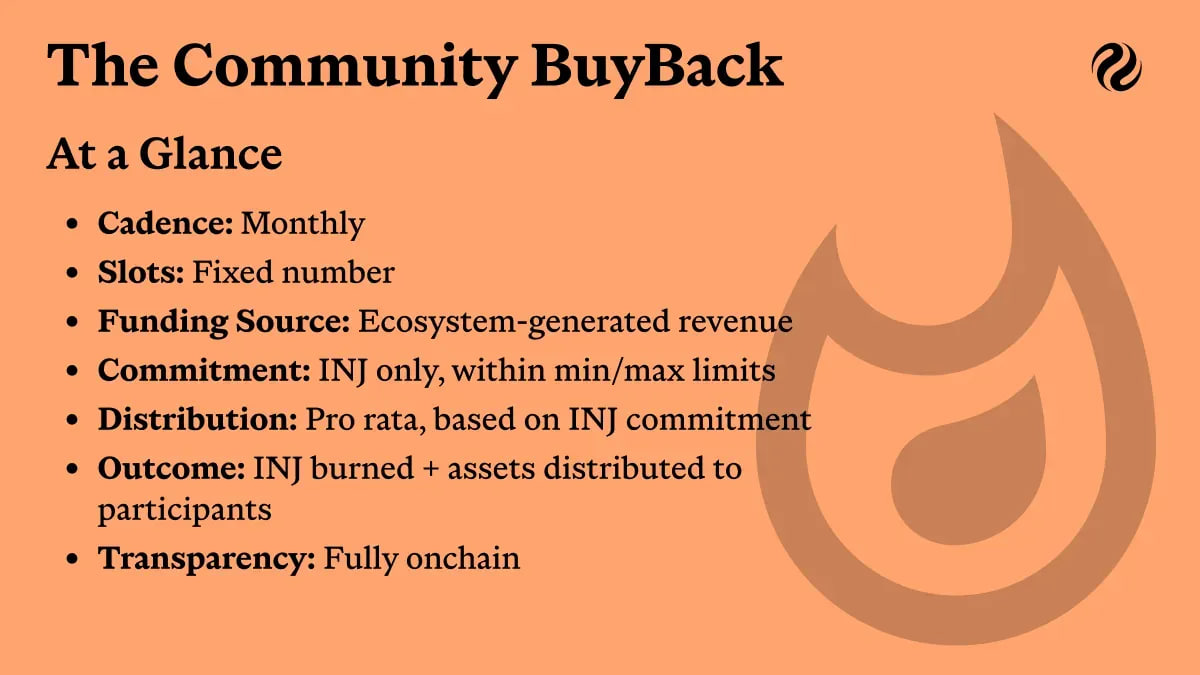

Injective’s community buyback mechanism adopts two powerful yet simple ways.

First and foremost, the platform permanently burns native tokens to reduce the overall supply.

Secondly, it distributes some of the value to reward users who contribute to the INJ’s ecosystem.

According to the official blog :

The Community BuyBack is a monthly on-chain event that allows anyone to take part in Injective’s deflationary mechanism. Participants commit INJ, and in return receive a pro rata share of the revenue generated across the Injective ecosystem. The INJ exchanged is then permanently burned, reducing the total supply of INJ.

Notably, the Community BuyBack basket comprises various tokens, including USDT and INJ, valued at 10,000 Injective tokens.

That design introduces a robust deflationary model, while incentivizing loyal users.

Injective maintains transparency, with all buyback information available on the dashboard.

Adopting a deflationary economy with a twist

Injective’s latest announcement is part of its broader mission to build a community-centered, sustainable token economy.

By burning native tokens every month, the project aims to reduce INJ inflation while encouraging long-term holding.

Most projects across the decentralized finance sector are embracing such mechanisms.

However, Injective has added a significant twist, involving its users in the process.

Besides strengthening trust, such an approach keeps INJ holders engaged in the ecosystem’s growth.

Also, holders will benefit from scarcity as every buyback reduces the circulating asset supply permanently.

The next burn will happen next month, in November.

INJ price outlook

The native token remained relatively muted over the past 24 hours, as bears moved the broader market.

INJ is trading at $8.66. It has consolidated between $9 and $8 over the previous week, gaining over 3% in that timeframe.

Its daily trading volume has increased by 17%, signaling renewed optimism, likely following the buyback announcement.

Nevertheless, broad market sentiments will influence the altcoin’s price trajectory in the coming sessions.