How to Cope with the BTC Cycle under the Heavy Pressure of the "Cyclical Curse"? (10.13~10.19)

The improvement in the US-China tariff war and BTC has once again fallen to the bull-bear dividing line, with cyclical patterns indicating clear signs of a "peak."

Written by 0xBrooker

The progress of the US-China tariff conflict remains the biggest variable affecting major global financial markets. Although there was some easing between the two sides this week, whether there will be real progress seems to depend on the upcoming negotiations between the delegations. The key mid-term node is whether the leaders of both sides can meet as scheduled during the APEC in South Korea.

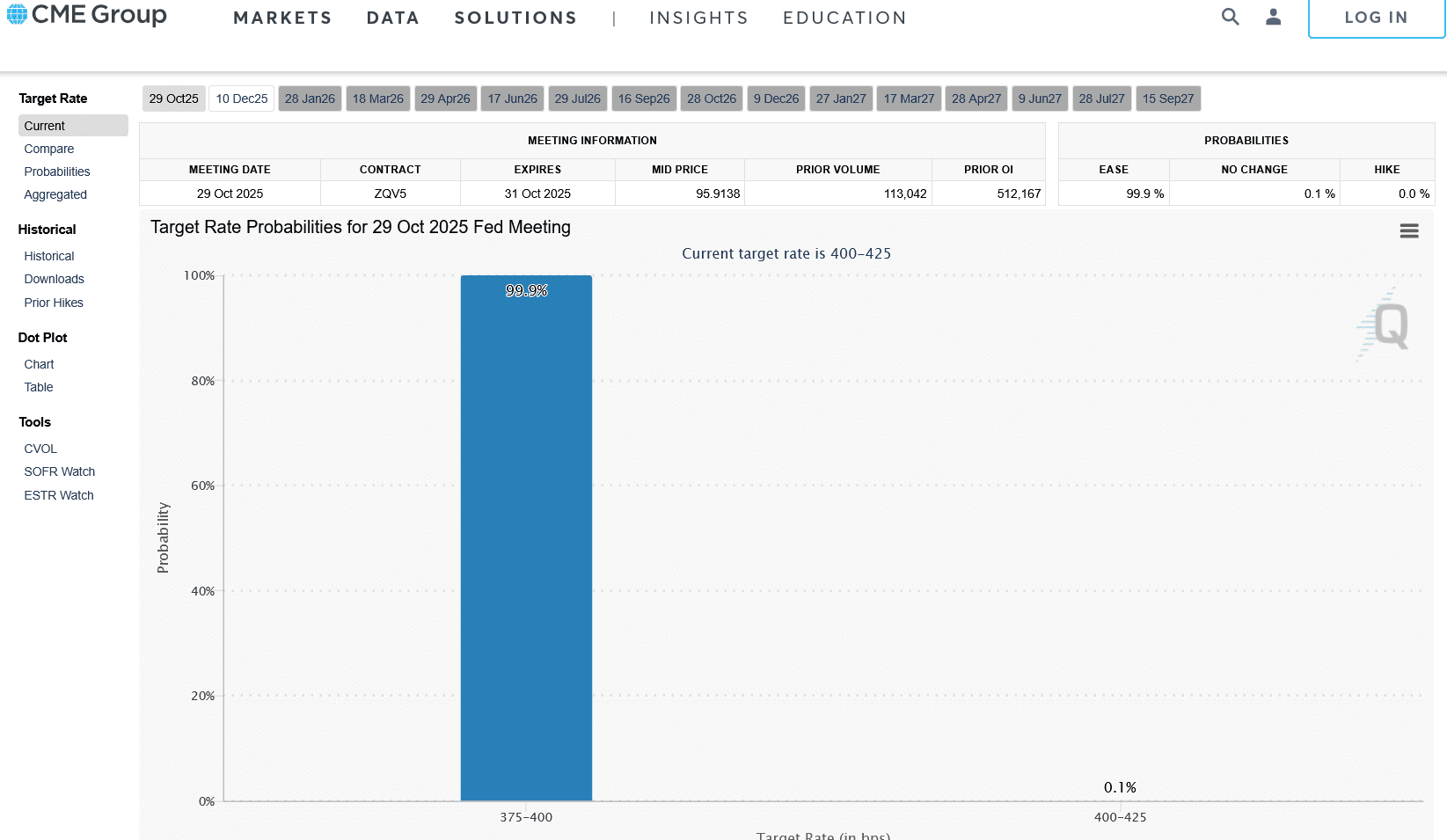

The Federal Reserve continues its dovish stance, coupled with the sluggish US job market, making the market's expectation of two 50 basis point rate cuts this year very strong. This provides underlying support for risk assets.

In addition to the US-China tariff conflict and the Fed's dovishness, BTC is still trapped by internal structural issues within its own market. On one hand, over $20 billion in nominal value of long positions in the futures market have been liquidated, making it difficult to gather strength in the short term; on the other hand, affected by the cyclical curse, long-term holders continue to sell, making it hard for the market to stabilize and rebound due to insufficient capital.

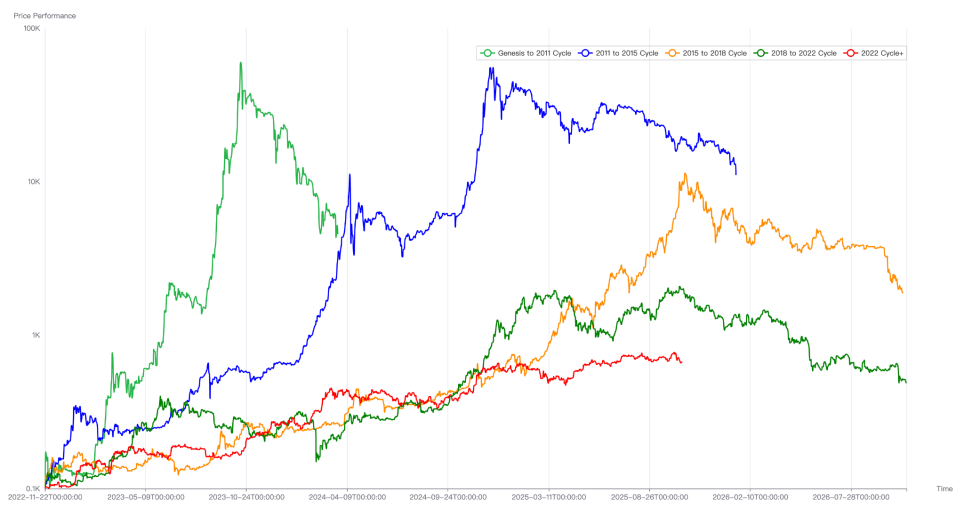

Comparison of BTC's Historical Cycle Trends

Another key point to watch is that starting next week, US tech and AI stocks will enter the Q3 earnings season. Whether their performance meets expectations will also have a significant impact on financial markets.

Policy, Macro Finance, and Economic Data

The main factor affecting the US stock market recently has been various statements regarding the US-China trade war. After both sides took major countermeasures last week, this week both released some moderate statements to ease market sentiment. Especially on the US side, President Trump and the Treasury Secretary have made conciliatory remarks on various occasions—high tariffs are unsustainable; US-China relations remain good; the US does not want to decouple from China economically, and believes China feels the same. In contrast, China's response has been more calm—attributing "global panic" to US actions and statements towards China; emphasizing that export controls are due to national security and industrial policy needs.

According to media reports, the two delegations are about to start another round of contact and negotiations. South Korea has confirmed that the US President will visit South Korea during the APEC at the end of the month. Of course, whether the leaders of the US and China can meet as scheduled during this period still depends on whether the upcoming new round of negotiations between the delegations can make progress.

With the easing of the tariff war, the US stock market, which is in a data blackout period, has temporarily stabilized, with the Nasdaq up 2.14% for the week. The US Dollar Index, which was approaching the 100 mark, fell 0.3% to close at 98.547. However, risk appetite has not truly improved, as capital inflows pushed the yield on the 10-year US Treasury down 2.53% for the week, closing at 4.015%. Gold saw a FOMO-style rally, surging 5.76% this week.

Due to the US government shutdown, the release of several economic and employment data has been delayed. Federal Reserve Chairman Powell emphasized at the Philadelphia meeting that "the risk of weakening employment is more worthy of attention" and mentioned the possibility of conditionally ending balance sheet reduction. The overall tone is cautious and dovish, leaving room for further rate cuts. FedWatch has already fully priced in 50 basis points of rate cuts for October and December this year.

In terms of US stock sectors, large banks' earnings all exceeded expectations, but two regional banks were reported to have more than $50 million in bad debts, causing temporary panic in the market. Starting next week, the AI and tech stocks that determine market direction will enter the Q3 earnings release period. If results exceed expectations, they may provide some support to the volatile market, but if they fall short, the market is likely to adjust downward.

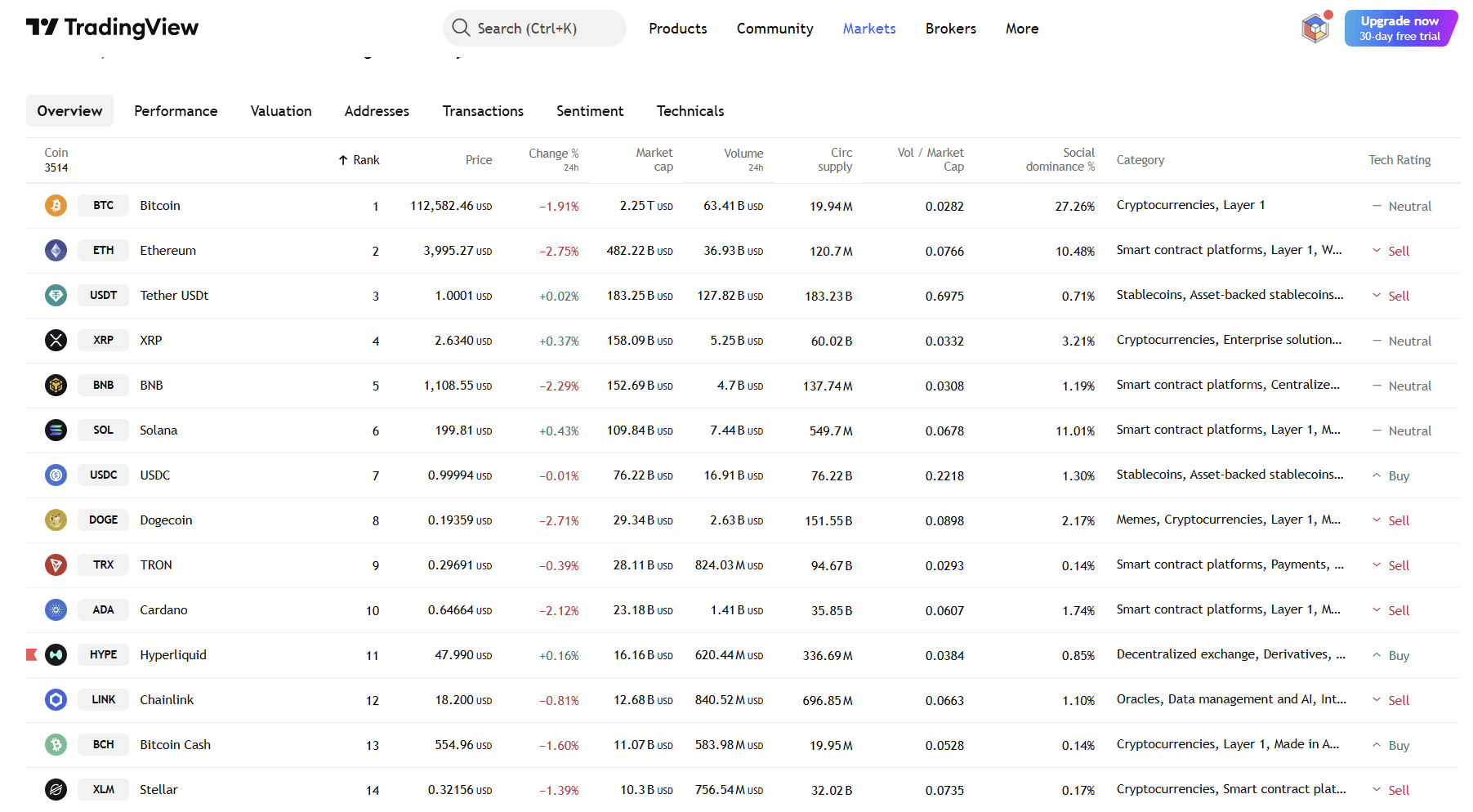

Crypto Market

In last week's report, we mentioned that BTC and the crypto market are currently under the dual influence of the US-China tariff war and the cyclical curse. The resonance of these two factors has prevented BTC from recovering last week's losses along with the Nasdaq, and instead, it continued to decline, dropping another 5.55% this week after a 6.84% drop last week.

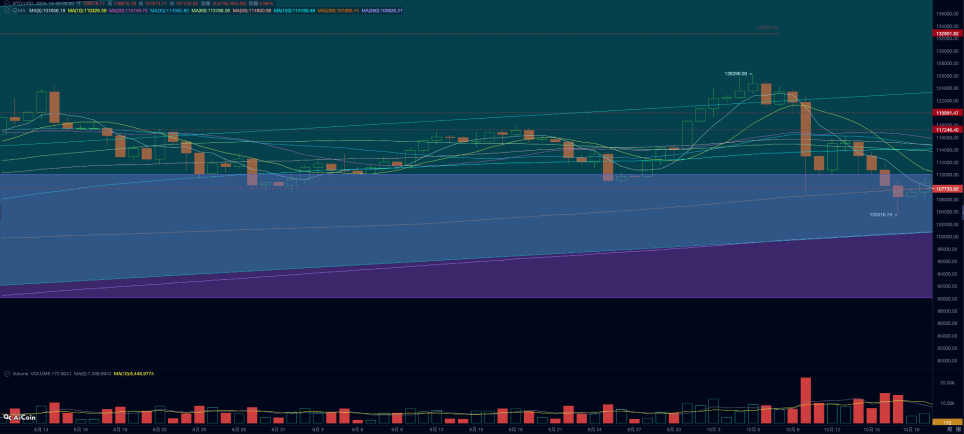

BTC Daily Chart

Technically, BTC's price has fallen into the "Trump bottom" range ($90,000~$110,000). Since Trump was elected in 2024, this range has formed a suppression/support zone for BTC's movement for nearly a year. In addition, BTC has also briefly fallen below the 200-day moving average of $107,500, which technically puts BTC on the bull-bear dividing line.

Although during this bull market, BTC's price has fallen below the 200-day moving average several times, will this time be different? According to BTC's cyclical law, BTC has already entered the topping period in terms of timing. It can be observed that the group most affected by the cyclical law—long-term holders—are accelerating their selling, making it difficult for the market, with weakening capital inflows, to bear the pressure.

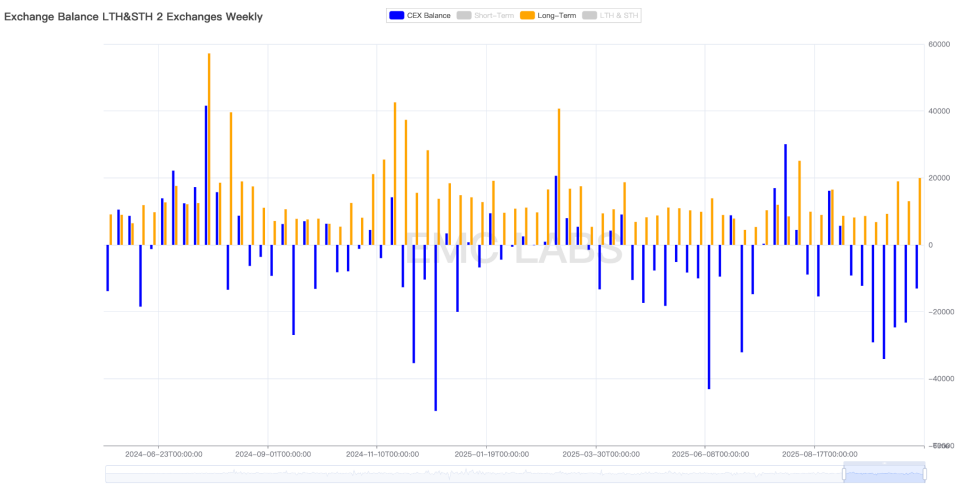

According to eMerge Engine statistics, the scale of selling by long- and short-term holders this week was 149,496 coins, lower than last week, among which long-term holders sold 19,978 coins, significantly higher than last week.

Weekly Statistics of Long-term Holder Selling and Centralized Exchange Inventory Changes

Long-term holders are traditional BTC cycle believers, and their selling has a profound impact on the market, being the most important force shaping previous cycle tops. Their continued selling may be dominated by the cyclical "curse." To break the old cycle and form a new one, greater structural forces are needed (such as DATs companies and BTC Spot ETF channel funds).

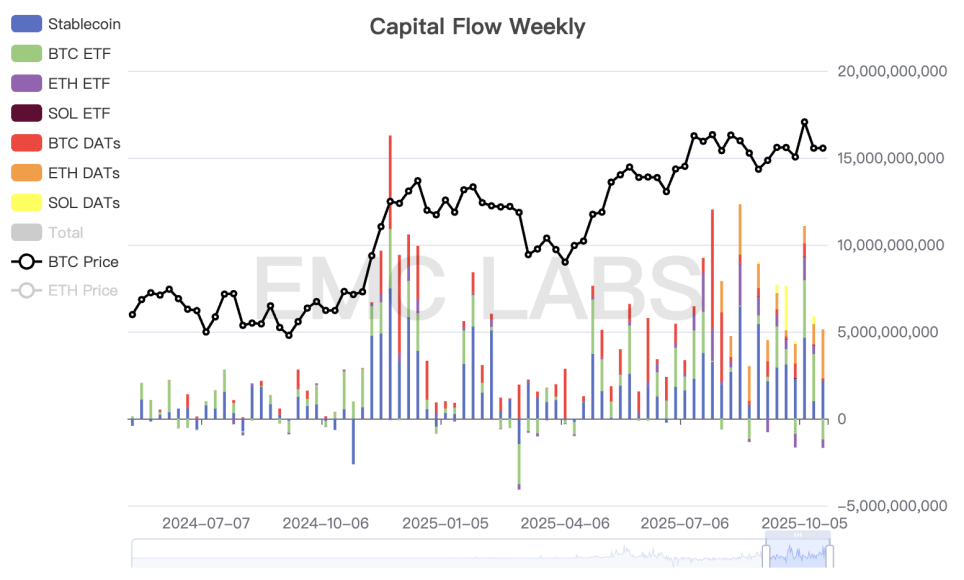

In terms of capital inflows, the scale declined again this week on top of last week's decrease, with BTC Spot ETF outflows approaching $1.2 billion. The short-term withdrawal of ETF channel funds caused by the US-China tariff conflict is another main reason, besides long-term holder selling, for the rapid and sustained decline in BTC's price.

Weekly Crypto Market Capital Flow Statistics

In addition, after a sharp decline last week, the scale of open positions in the futures market continued to fall this week, with funding rates once dropping into negative territory. This shows that after a large-scale squeeze, it is difficult for bullish forces in the futures market to regroup in the short term.

From the perspectives of technical analysis, long-term holder selling, capital inflows and outflows, and futures market structure, BTC's current price is under tremendous pressure. Unless there is a significant improvement in the US-China tariff war that reverses market sentiment, it will be difficult for both short- and mid-term trends to reverse. Coupled with the cyclical curse, we believe long-term investors should base their trading strategies on the end of the cycle. As mentioned in the September monthly report, the end of the old cycle and the start of a new one is a probabilistic event—not impossible, but currently difficult to regard as a high-probability event.

Cycle Metrics

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0, indicating a transition period.

EMC Labs was founded in April 2023 by crypto asset investors and data scientists. It focuses on blockchain industry research and crypto secondary market investment, with industry foresight, insight, and data mining as its core competencies. It is committed to participating in the booming blockchain industry through research and investment, promoting blockchain and crypto assets to bring benefits to humanity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Shiba Inu (SHIB) Price Explode After the Fed Rate Cut?

Crypto News Today: Fed Calm, Nvidia Milestone, and Political Firestorms Wrap Up Uptober

Breaking: Grayscale Launches Solana Trust ETF

Mars Finance Exclusive Interview | Shooting Game King Mart1X: How Will $20 Million in Financing Innovate Web3 Gaming?

Matr1x is an innovative Web3 gaming platform that integrates gaming, artificial intelligence, e-sports, and blockchain technology, aiming to reshape the global gaming and digital content industries. The team has extensive experience in game development and has secured over 20 million USD in funding. Matr1x has launched several Web3 games and e-sports platforms, demonstrating its innovation in tokenomics and ecosystem development. Through models such as "Watch to Earn," Matr1x is committed to promoting high-quality development of Web3 games and has established a significant presence in the market.