Is XRP About to Rally on US–China Trade Peace Talks?

The upcoming meeting between President Donald Trump and China’s Xi Jinping in South Korea has the market buzzing again. The two leaders are expected to reach a trade framework that could ease months of tariff threats and supply chain strain. While the broader stock market is reacting with optimism, crypto traders are eyeing one question: could XRP price be next in line for a breakout?

How the Trade Talks Could Influence XRP Price Prediction?

When geopolitical tensions cool, risk assets like crypto often catch a bid. A potential US–China trade thaw could boost market confidence, weaken the dollar slightly, and push capital into digital assets. XRP, in particular, benefits from such macro optimism because it sits at the intersection of finance and cross-border liquidity—a theme closely tied to trade and payments.

If the talks result in a rollback of tariffs or China resuming large-scale US imports (like soybeans and tech components), we could see risk appetite return to both equities and crypto. This would give XRP price a tailwind, at least in the short term.

Treasury Secretary Scott Bessent added fuel to market optimism with his remarks over the weekend. Speaking on major news programs like Meet the Press and Face the Nation, he said both sides had already agreed on a “framework” for the leaders to finalize—a sign that the talks are moving beyond rhetoric.

Bessent emphasized that the deal would be “fantastic for U.S. citizens, for U.S. farmers, and for our country in general,” noting that additional tariffs are likely off the table. He also hinted at China easing its export controls on rare earth minerals and resuming soybean purchases, both of which could cool inflation and stabilize supply chains—key factors that tend to support risk assets like XRP.

What the XRP Price Chart Is Saying Right Now

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

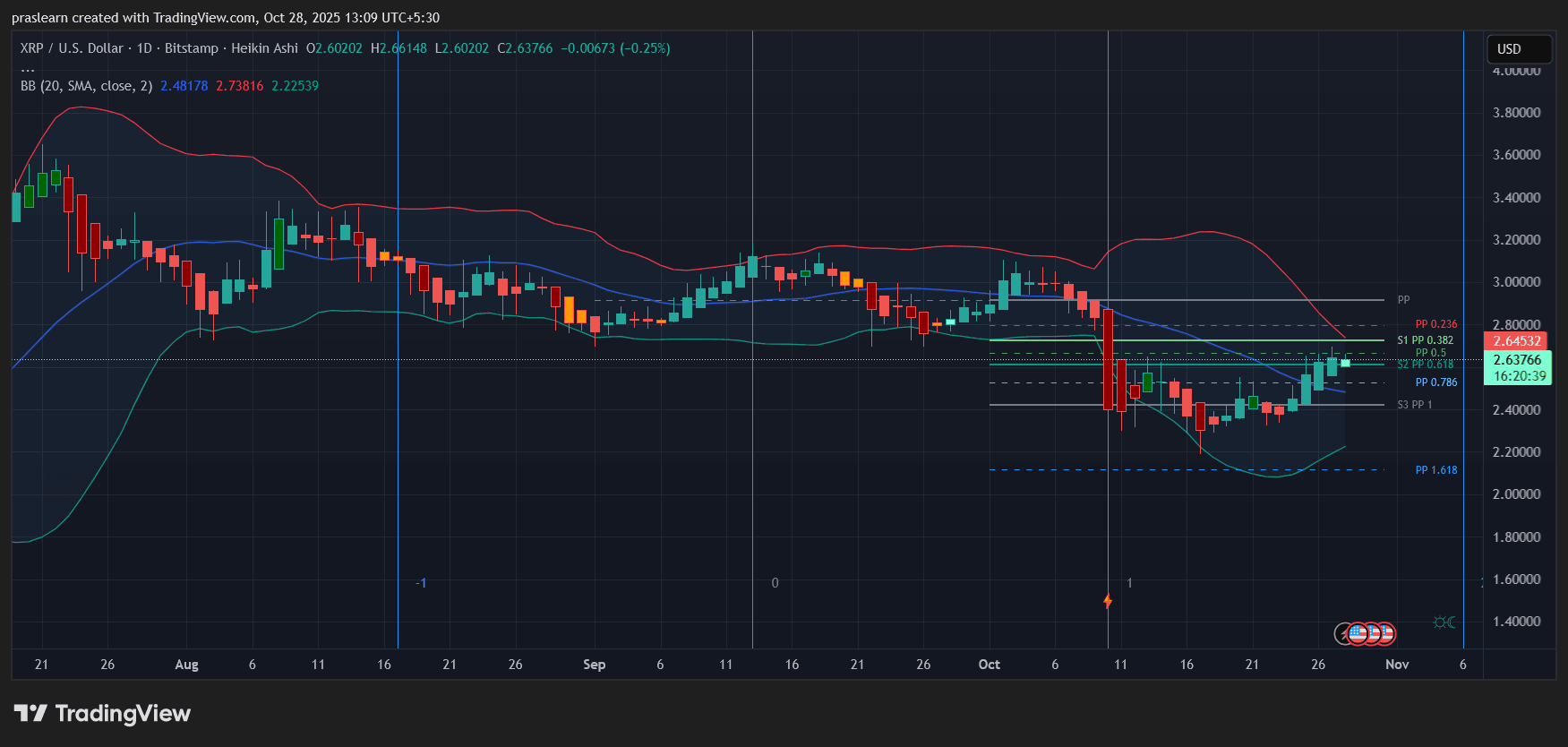

The daily Heikin Ashi chart shows XRP price currently trading near 2.63 USD, testing the midline of the Bollinger Bands after bouncing from around 2.25 USD earlier this month. The pattern reflects a classic rebound after a sharp capitulation phase in mid-October.

Here’s what stands out technically:

- Bollinger Band Compression: The bands are narrowing, signaling a potential volatility expansion soon. XRP price is hugging the mid-band and pushing toward the upper one—often a precursor to an upside breakout if volume supports it.

- Fibonacci Retracements: The price is flirting with the 0.382 to 0.5 retracement zone (around 2.64–2.70 USD). A clear breakout above 2.75 USD could trigger a move toward 2.90–3.00 USD, where previous resistance and pivot levels cluster.

- Support Zone: Strong support sits near 2.25–2.30 USD, marked by prior lows and the lower Bollinger band. A breakdown below 2.20 USD would invalidate the current bullish recovery.

- Momentum Shift: Recent green candles on Heikin Ashi suggest waning bearish pressure. However, XRP needs a close above 2.70 USD to confirm a trend reversal.

Is This Rally Sustainable or Just a Relief Bounce?

Let’s be clear: XRP price is still fighting its way out of a medium-term downtrend. While the recent bounce looks promising, it sits in a broader structure of lower highs since August. Unless XRP can flip the 2.75–2.80 USD zone into support, the risk of a fakeout remains high.

That said, the combination of improving macro sentiment and chart recovery hints at potential momentum building up. The market’s next reaction will depend heavily on the tone of the Trump–Xi meeting. A cooperative outcome could accelerate capital rotation into altcoins like XRP.

What to Watch Next

- Breakout Confirmation: A decisive move above 2.75 USD with strong volume could open the door toward 3.00 USD.

- Failing the Retest: If XRP price gets rejected here and falls below 2.40 USD, expect renewed selling pressure.

- Macro Catalyst: Watch Thursday’s headlines from the Trump–Xi meeting. Positive language around trade and exports could fuel the next leg of the rally.

XRP Price Prediction: Can XRP Cross 3 USD in the Coming Days?

If the trade talks deliver a real truce—especially involving export rollbacks and renewed agricultural imports—the sentiment boost could spill into crypto markets quickly. $XRP could ride that wave to test the 2.95–3.00 USD resistance range within days. However, if negotiations stall or rhetoric turns hostile again, XRP price may retreat back toward 2.30 USD before finding new buyers.

XRP’s setup is cautiously bullish ahead of the US–China talks. The technicals show strength returning, and the macro backdrop could ignite a risk-on wave. But without a confirmed breakout above 2.75 USD, this remains a speculative rally rather than a trend reversal. Watch Thursday closely—XRP’s next big move will likely be decided by geopolitics as much as charts.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Metaplanet Unveils BTC Focused Capital and Repurchase Strategy

Mt. Gox Delays Bitcoin Repayments to 2026

Crypto Market Crash Wipes Out $79 Billion in 12 Hours

S&P Downgrades Strategy’s Financial Strength Amid Bitcoin Risks