99% of people don’t understand: There are actually two types of crypto worlds

From perpetual contract tokens to privacy tokens, it is now the turn of AI tokens.

From perpetual contract token rotations to privacy tokens, and now to AI tokens.

Written by: Yash

Translated by: AididiaoJP, Foresight News

I used to think the crypto world was a complete system, but recently my perspective has shifted. I’ve started to view the crypto world from a builder’s standpoint, seeing it as two main domains:

- Narrative-driven crypto world

- Utility-driven crypto world

I will explain how to accurately understand them and how to build projects and make money from them.

Utility-driven Crypto World

These are usually “the best businesses”:

- Wallets (@Phantom, @MetaMask)

- Stablecoins (USDT, USDC)

- Exchanges (@HyperliquidX, @Raydium, @JupiterExchange)

- Launch platforms (@pumpdotfun)

- Bots and trading terminals (@AxiomExchange)

- Decentralized Finance (@aave, @kamino, @LidoFinance)

These projects have real-world application scenarios and can generate huge revenues.

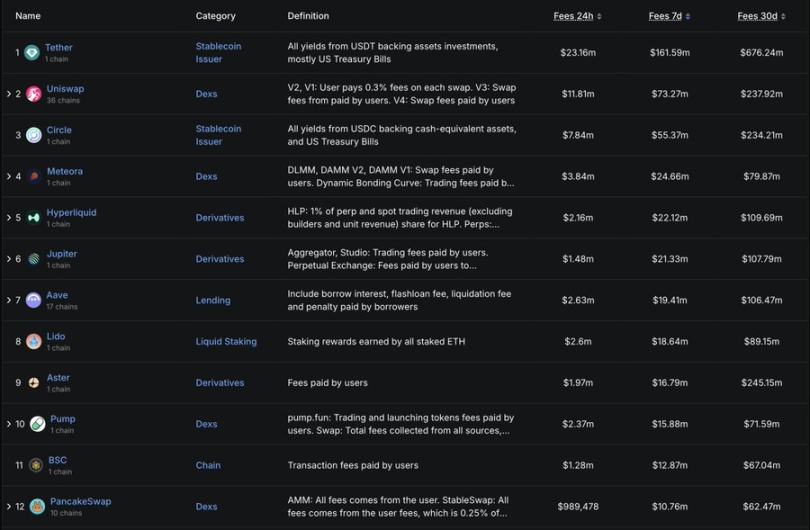

Projects with the highest fees generated in the crypto world

Narrative-driven crypto world:

Usually, there is a good story and vision (worth over $100 billions), strong enough to change the world:

- Bitcoin (the digital gold narrative)

- AI x Crypto (most GPU infrastructure and agent frameworks)

- Decentralized science or intellectual property related (Story Protocol)

- Newer L1/L2s (e.g., stablecoin L1 or perpetual contract L2)

- Privacy (@Zcash)

- Restaking and any infrastructure

- x402

They generate almost no revenue, but because the story attracts institutions and retail investors, the token price rises.

Currently, the narrative-driven and utility-driven crypto worlds are not mutually exclusive.

Think about this:

There are indeed people using Zcash (5,000-10,000 transactions per day), but it currently has a very strong privacy narrative, so it gets more attention. And it’s very likely that this attention will also drive its utility.

Similarly, @CoinbaseDev’s x402 has almost no usage, but it’s a hot topic recently and will certainly drive more awareness and usage through speculation.

Zcash daily transaction count (Source: bitinfocharts.com)

Both are equally important because they reinforce each other:

Narrative-driven crypto world drives → speculation, speculation drives → adoption of the utility-driven crypto world

In the utility-driven crypto world, your product (users) is king, while in the narrative-driven crypto world, your community is king.

The Builder’s Dilemma

Every builder faces this dilemma: whether to build for the narrative-driven crypto world or the utility-driven crypto world.

A rule of thumb is:

If you are good at the attention game and have enough influence to create a movement, you should build for the narrative-driven crypto world.

For example, if you are good at tokenomics games (and centralized exchange listings / small circles), you should focus on building grand narratives and visions.

Of course, if there is enough momentum, it will also become useful enough. For example, blockchains like Solana—capital indeed attracts talent and makes these chains useful.

If you want to have a narrative worth over $1.1 billions, you must start from first principles and think about what unique things can be achieved using the crypto tech stack.

Is this vision persuasive enough, and if successful, can it have a market worth over $100 billions? Is it exciting enough to spark hype among retail investors?

For example, Plasma has a trillion-dollar stablecoin market narrative, thus held a token generation event at a $14 billion valuation, even though there is no actual usage yet.

If you are good at building products, you should build for the utility-driven crypto world. You can try to solve a niche problem (e.g., Axiom serves Memecoin traders, or a DeFi protocol).

The utility-driven crypto world is about building; traders or crypto-native users will directly need what’s available on terminals/exchanges.

It’s not necessarily just to fuel speculation—the same product can also have non-speculative use cases. For example, stablecoins used for payments.

Narrative is also important here. For example, for Polymarket, its narrative is prediction markets. Because narrative does attract users, you can see narrative as marketing.

Of course, you can eventually do both, but it’s best to focus on one at the start, and identifying your own strengths is quite difficult. You must find your own strengths.

For Traders

You must always bet on the narrative.

You bet on the narrative you think will be the most forward-looking in the coming weeks, months, or years.

Everyone trading tokens is playing the “attention arbitrage” game—buying what’s getting attention, selling what’s already had its moment. For example, from perpetual contract token rotations to privacy tokens, and now to AI tokens.

For a specific narrative, you must bet on the teams you think can gain attention and become the alpha and beta targets. If they succeed, your bet will take off.

Summary:

Both utility-driven and narrative-driven crypto worlds are important aspects of the crypto space.

As a builder, always start by choosing one, and become very strong in either narrative or utility. Once you’ve done one well, you can expand to the other—that’s the ultimate goal.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BlackRock’s Stance Leaves Altcoin Enthusiasts on Edge

In Brief BlackRock's Bitcoin spot ETF boosted confidence, defying expectations of Bitcoin's end. Altcoin ETFs could eliminate current institutional investor limitations, spurring market growth. Lack of BlackRock's altcoin ETF may limit long-term support, risking market disillusionment.

Oversold but Not Over: TRUMP, UNI, and PI are Primed for Recovery

Zcash (ZEC) Tests $300, Bulls Target $320 as Volume and Adoption Surge

Opendoor (OPEN) Breaks Falling Wedge on 4H Chart, Bulls Eye 144% Upside