Ethereum and Polygon Welcome Launch of Stablecoin Backed by Japanese Yen

JPYC Introduces Japan's First Stablecoin, Underpinned by Bank Deposits and Government Bonds, on Ethereum and Polygon Networks

Key Points

- JPYC, a Tokyo-based fintech firm, has launched a Japanese Yen-backed stablecoin.

- The JPYC stablecoin is fully backed 1:1 by bank deposits and government bonds.

Tokyo-based fintech firm, JPYC, has unveiled a stablecoin backed by the Japanese Yen. This comes in response to the increasing global demand for digital assets. The JPYC stablecoin is completely backed by bank deposits and government bonds, maintaining a 1:1 parity with the Japanese yen.

JPYC Stablecoin Launches on Ethereum, Polygon

The worldwide stablecoin market, largely dominated by USD-pegged stablecoins, has exceeded $300 billion. This has led other global markets to explore potential opportunities with Euro-backed or Yen-backed digital assets.

During a press conference in Tokyo, JPYC President Noriyoshi Okabe described the launch as a significant milestone in the history of Japanese currency. He also disclosed that seven companies have shown interest in incorporating the new stablecoin into their operations.

JPYC has also introduced JPYC EX, a dedicated platform for issuing and redeeming the token. This platform operates under Japan’s Act on Prevention of Transfer of Criminal Proceeds, ensuring strict identity verification and transaction monitoring.

Users can deposit Japanese yen via bank transfer to receive JPYC tokens in a registered wallet and redeem them back into yen through a linked withdrawal account via JPYC EX.

JPYC’s future plans include reaching an issuance balance of 10 trillion yen within the next three years. The goal is to position its stablecoin as a cornerstone for a new digital financial infrastructure in Japan.

Japan’s Emerging Stablecoin Market

JPYC might soon face competition in Japan’s budding stablecoin market. Monex Group, another Tokyo-based financial services firm, announced plans in August to launch its own yen-pegged stablecoin.

Japan’s three largest banks, Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corp, and Mizuho Bank, are reportedly collaborating to issue a yen-backed stablecoin through MUFG’s Progmat issuance platform.

Simultaneously, Japan’s Financial Services Agency (FSA) is reportedly considering a regulatory review that could permit banks to hold and invest in cryptocurrencies such as Bitcoin (BTC) , indicating a broader shift toward digital asset adoption in the country.

According to recent data from blockchain analytics firm Glassnode, the Stablecoin Supply Ratio (SSR) Oscillator remains near cycle lows, reflecting abundant stablecoin liquidity relative to Bitcoin.

Glassnode noted that historically, such conditions tend to precede stronger buying activity as market confidence improves. This suggests that the crypto market may be positioned for renewed upside momentum once sentiment turns bullish.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The "100% win rate whale" adds another 41 million!

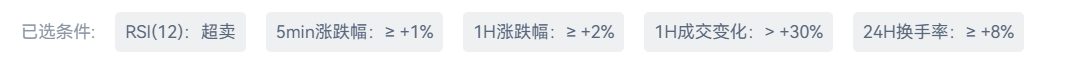

Unlock Precision Gold Mining: Practical Guide to AiCoin Conditional Token Selection Function

AiCoin Daily Report (October 28)

Six Years, Millions, 12 Lessons: A Crypto Survival Guide