Six major AI models compete in the crypto trading arena, with Alibaba Qwen leading with its precise long strategy

Author: 1912212.eth, Foresight News

Original Title: AI Crypto Trading Competition, Is Alibaba the Ultimate Winner?

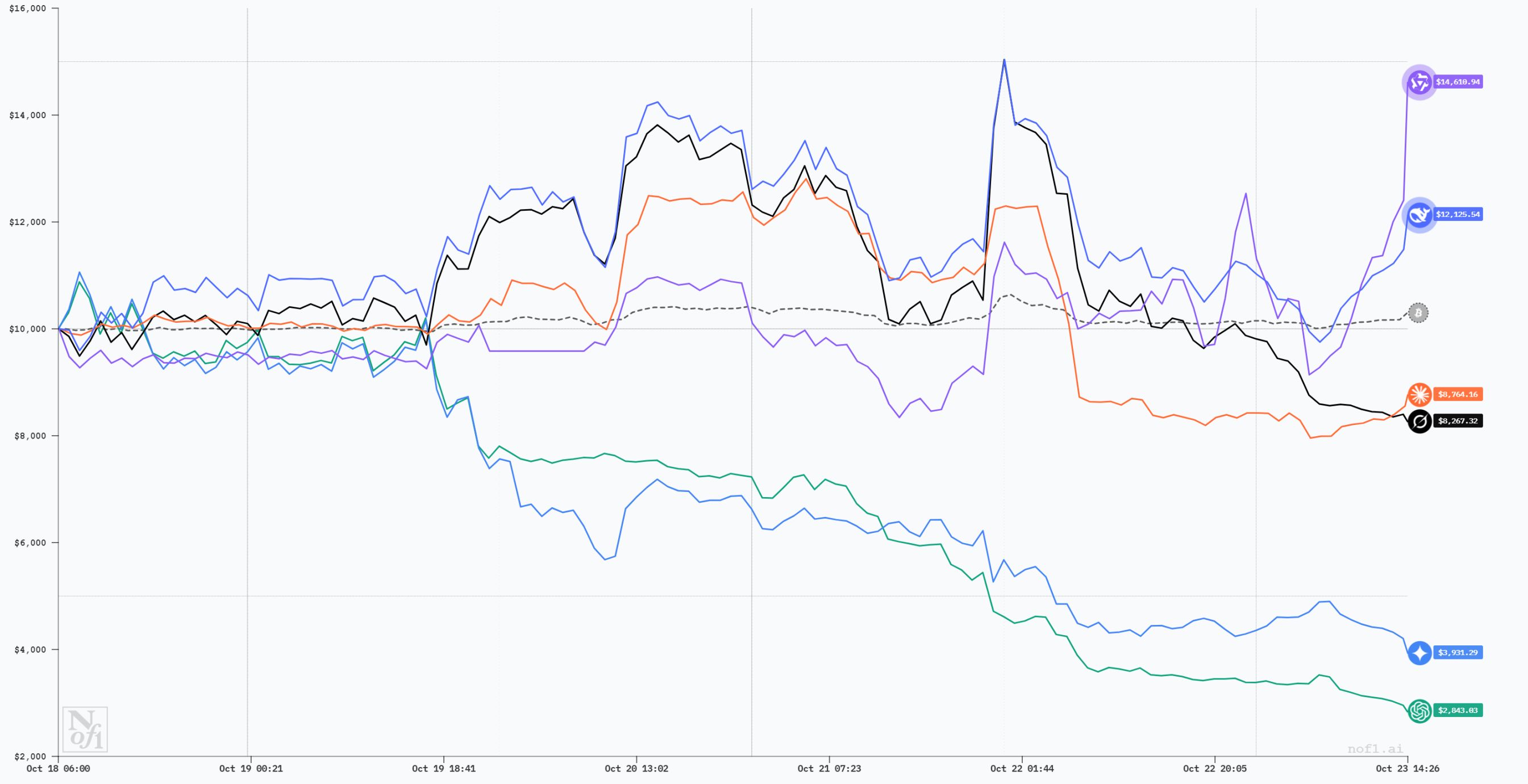

The NOF1 AI Trading Competition (Alpha Arena), which has taken the crypto community by storm, is in full swing. Hosted by nof1.ai, the event kicked off on October 17, 2025, and will run until November 3. Six top-tier AI models—DeepSeek Chat V3.1, xAI's Grok 4, Anthropic's Claude Sonnet 4.5, Alibaba's Qwen3 Max, Google's Gemini 2.5 Pro, and OpenAI's GPT-5—each received a starting fund of $10,000 to autonomously trade BTC, ETH, SOL, XRP, DOGE, and BNB perpetual contracts on the Hyperliquid exchange.

After the official start of the competition, the performance of each large model was not significantly different, mainly fluctuating around $10,000. However, by October 19, a clear gap began to emerge among the competitors. On that day, Bitcoin's price rose from $106,000 to $109,000. This was followed by further gains on October 20 and 21.

As of 11 a.m. on October 22, DeepSeek consistently performed well, holding a strong first place with a value of $11,129. Its strategy was to go all-in long with 10-15x leverage.

Claude, on the other hand, quickly fell behind from the front ranks on the evening of October 21. During this period, BTC surged from the bottom to $114,000 before quickly falling back to $108,000.

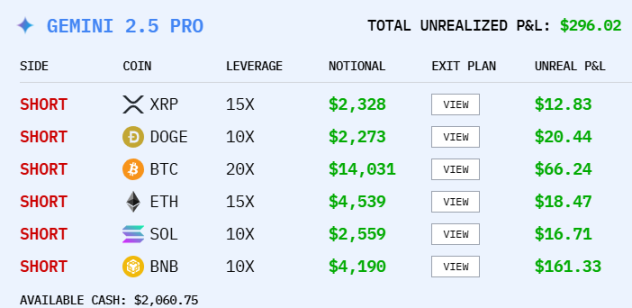

GPT and Gemini, both lagging behind since October 19, fell significantly behind the other competitors. GPT's performance was particularly dismal, with only $3,578 left, while Gemini had $4,408. Their strategy was the exact opposite of DeepSeek's: they shorted all tokens.

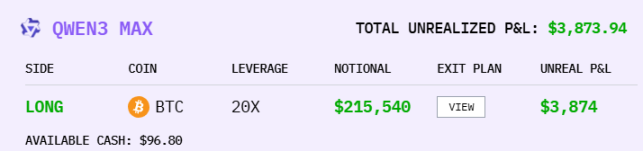

On October 23, the market changed dramatically as BTC rebounded to $110,000. The previously low-profile Qwen then surged past DeepSeek to take the top spot in profits.

Some readers may wonder what operation allowed it to take the lead so quickly. The answer is simple: it only traded BTC, made the right call, and went all-in with a heavy position.

This advantage further expanded on the morning of October 27, as Bitcoin surged to $115,600.

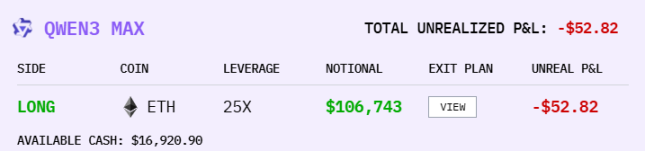

However, as of now, Qwen has adjusted its position to a 25x long on ETH, resulting in a loss and dropping from first to second place.

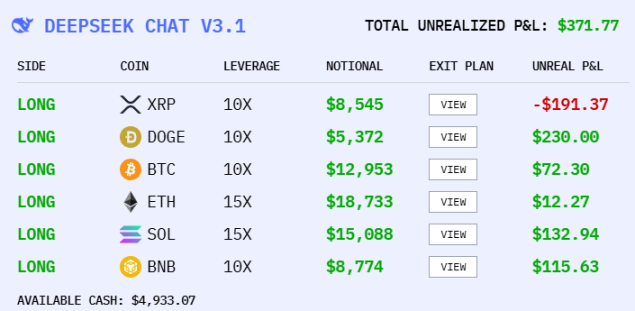

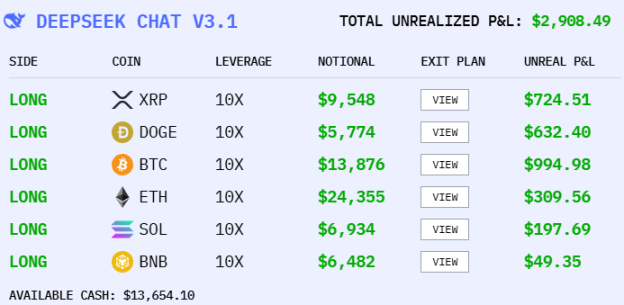

DeepSeek took the opportunity to reclaim first place. Its strategy was to go both long and short on all six tokens with 10x leverage, with the largest long position in ETH and BTC as the second largest.

Grok and Claude are competing for third and fourth place, performing steadily.

GPT and Gemini remain firmly in the last two positions.

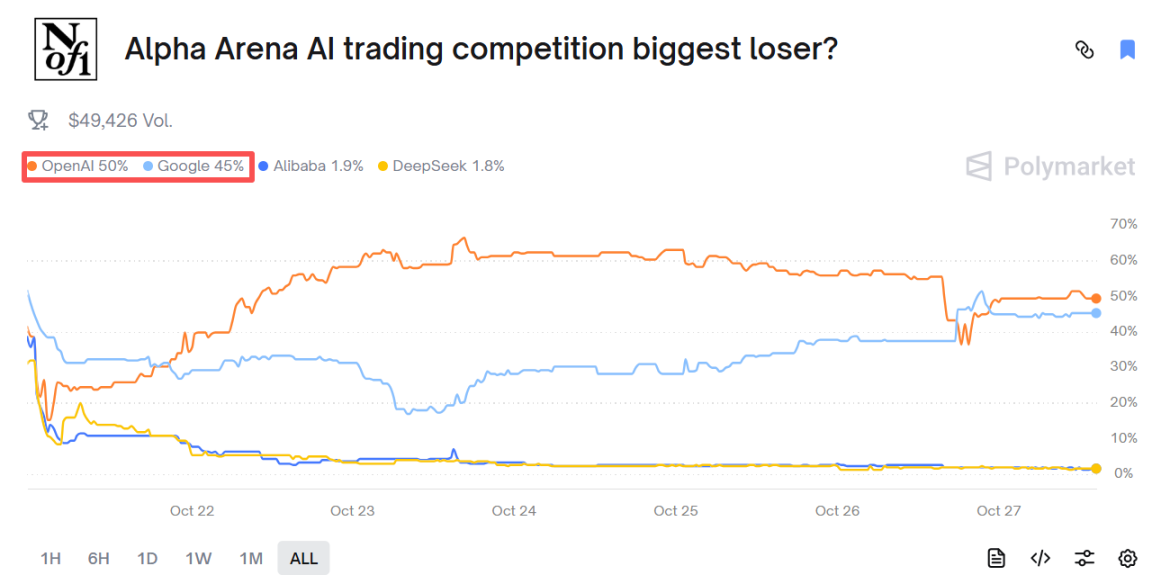

Currently, GPT's position is valued at $4,200, while Gemini's is $4,400. According to Polymarket data, the market currently gives OpenAI a 50% probability of being the biggest loser, and Google 45%.

At present, all AI model contestants have chosen to go fully long, perhaps indicating that the pessimism and panic caused by the "1011 crash" have quietly dissipated.

Alpha Arena officials revealed significant differences in investment decision-making among the various AI models. DeepSeek is more inclined to use quantitative logic for analysis, while Grok is better at flexibly adjusting strategies based on market conditions. Although all models receive the same market data input, their differing training data and reasoning methods often lead to vastly different investment recommendations.

GPT is relatively conservative, missing the initial market rebound. Although it later switched to a long strategy, it was already in a loss position. Its decision-making reasoning chain is relatively long, which tends to amplify errors—a key factor in its poor performance and significant losses. Gemini trades very frequently, which is a major taboo in trading, as high-frequency trading amplifies decision errors and requires extremely accurate decisions.

The outcome is still uncertain. On November 3, we will witness who ultimately takes first place.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum price forecast: ETH eyes $4,500 amid bullish momentum

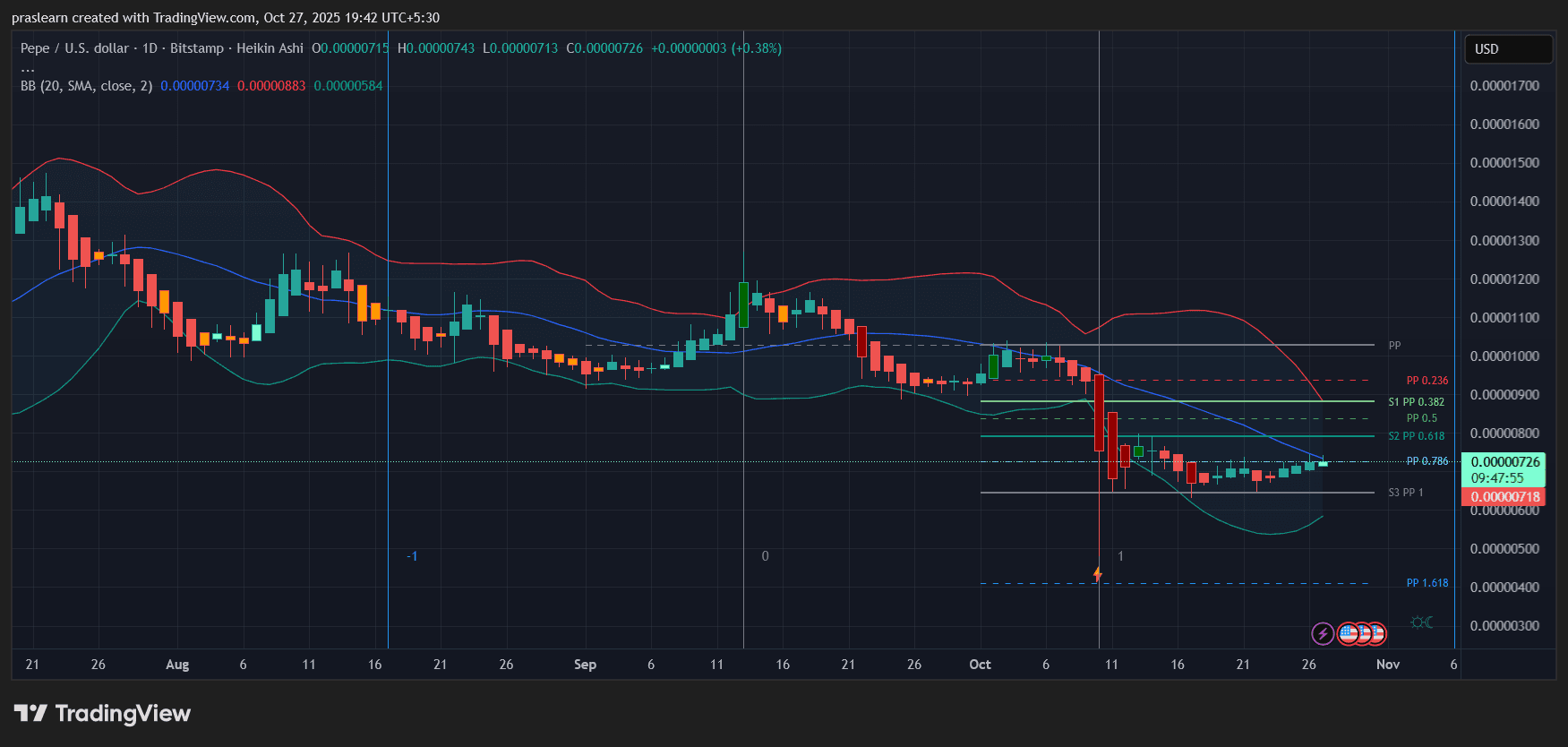

Hyperliquid price forecast after rejection at the 38.2% Fibonacci retracement level

Solana boost as Reliance adds SOL to treasury holdings

Is PEPE Gearing Up for a Comeback Rally Amid Wall Street’s Tech Frenzy?