XRP’s Bullish Setup: Selling Drops 82%, Breakout Needs Just 5% Push

XRP price has rebounded over 5% in 24 hours as sell pressure drops by 82%. With long-term holders slowing their exits and short-term traders increasing their positions, all it may need now is a 5% push above $2.59 to confirm a breakout toward $2.81 and $3.10.

XRP price is up 5% in the past 24 hours, trading near $2.46, extending its short-term recovery. However, the token remains down 18% over the past 30 days, showing that a complete rebound is still in progress.

Recent on-chain trends suggest that one group is easing selling pressure, while another key group is increasing the XRP exposure — a sign of confidence returning. But everything still depends on one key XRP price level.

Holders Cashing Out Less as Short-Term Investors Step In

The Hodler Net Position Change, which measures the amount of XRP accumulated or sold by long-term holders, shows a notable improvement in investor behavior. Between October 16 and 17, long-term holders sold heavily, pushing the metric down to –18.57 million XRP.

However, by October 19, the net outflow eased significantly to –3.28 million XRP, marking a drop in selling pressure of over 82%. And the XRP price has been moving up a bit more aggressively since.

Long-Term XRP Investors Selling Fewer Coins:

Long-Term XRP Investors Selling Fewer Coins:

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

This suggests that long-term investors are no longer offloading as aggressively, possibly preparing for a price recovery.

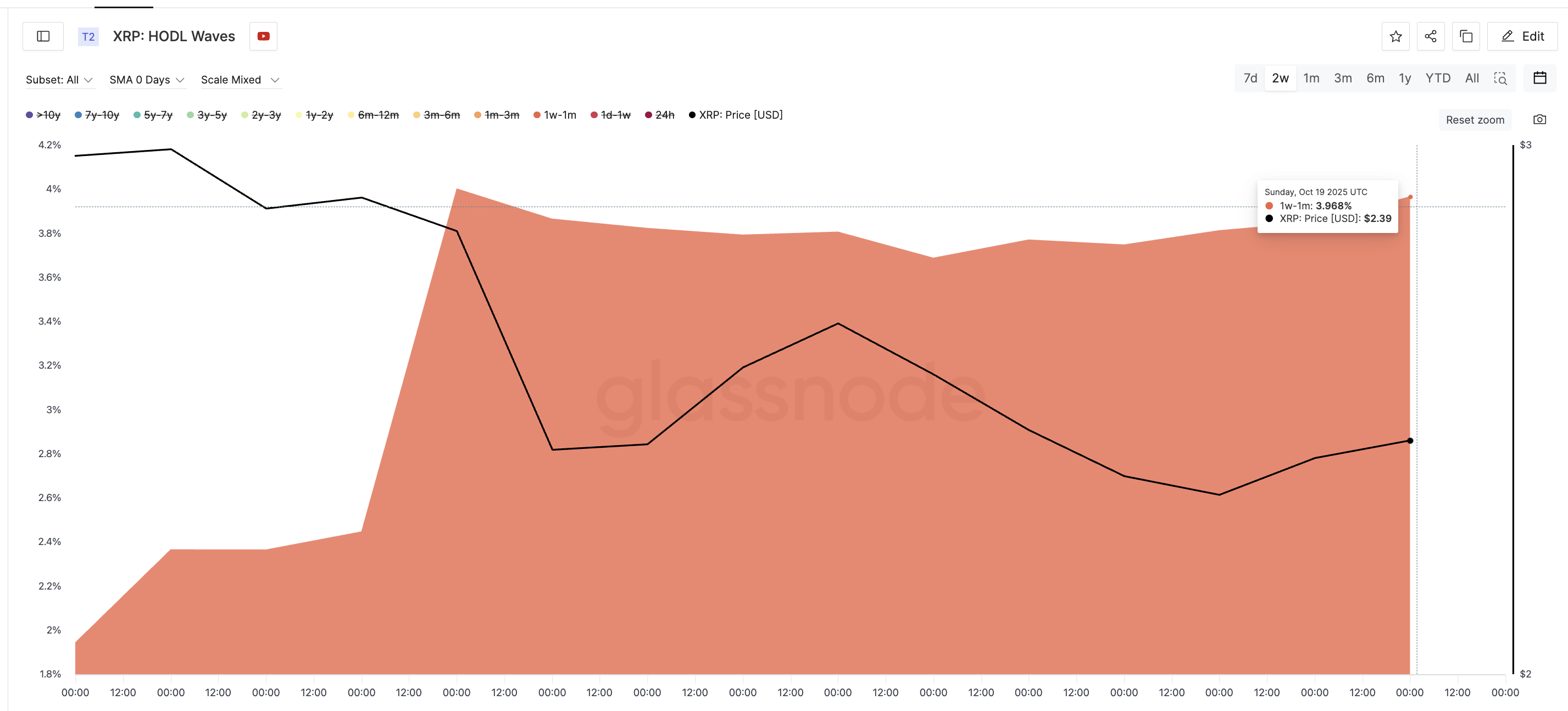

At the same time, the 1-week to 1-month cohort, typically short-term traders, has increased its share of total XRP supply from 1.94% on October 5 to 3.97% on October 19. This HODL waves metric shows that this short-term group is now holding (even accumulating) rather than exiting.

HODL Waves show how much of a coin’s supply is held by investors for different time periods.

Short-Term XRP Cohort Continues To Buy:

Short-Term XRP Cohort Continues To Buy:

The combination of easing long-term selling and renewed short-term accumulation paints a constructive outlook for XRP price.

XRP Price Needs a 5.4% Move and Retail Support to Break Higher

On the technical side, the XRP price has finally moved past a key resistance at $2.43. It is a level that capped recovery attempts earlier this month. The next hurdle sits at $2.59 (another key capping resistance), about 5.4% above the current price.

A daily candle close above $2.59 would signal a potential breakout and open the path toward $2.81 and $3.10, both key Fibonacci levels.

XRP Price Analysis:

XRP Price Analysis:

However, the Money Flow Index (MFI), which tracks buying pressure, has been trending down since October 6. This shows weak retail participation despite price gains. For the bullish setup to fully play out, buying activity from smaller traders needs to rise.

If the XRP price fails to sustain above $2.43, a breakdown below $2.27 could invalidate the bullish outlook. And that would expose the token to further declines toward $2.08 and $1.76.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

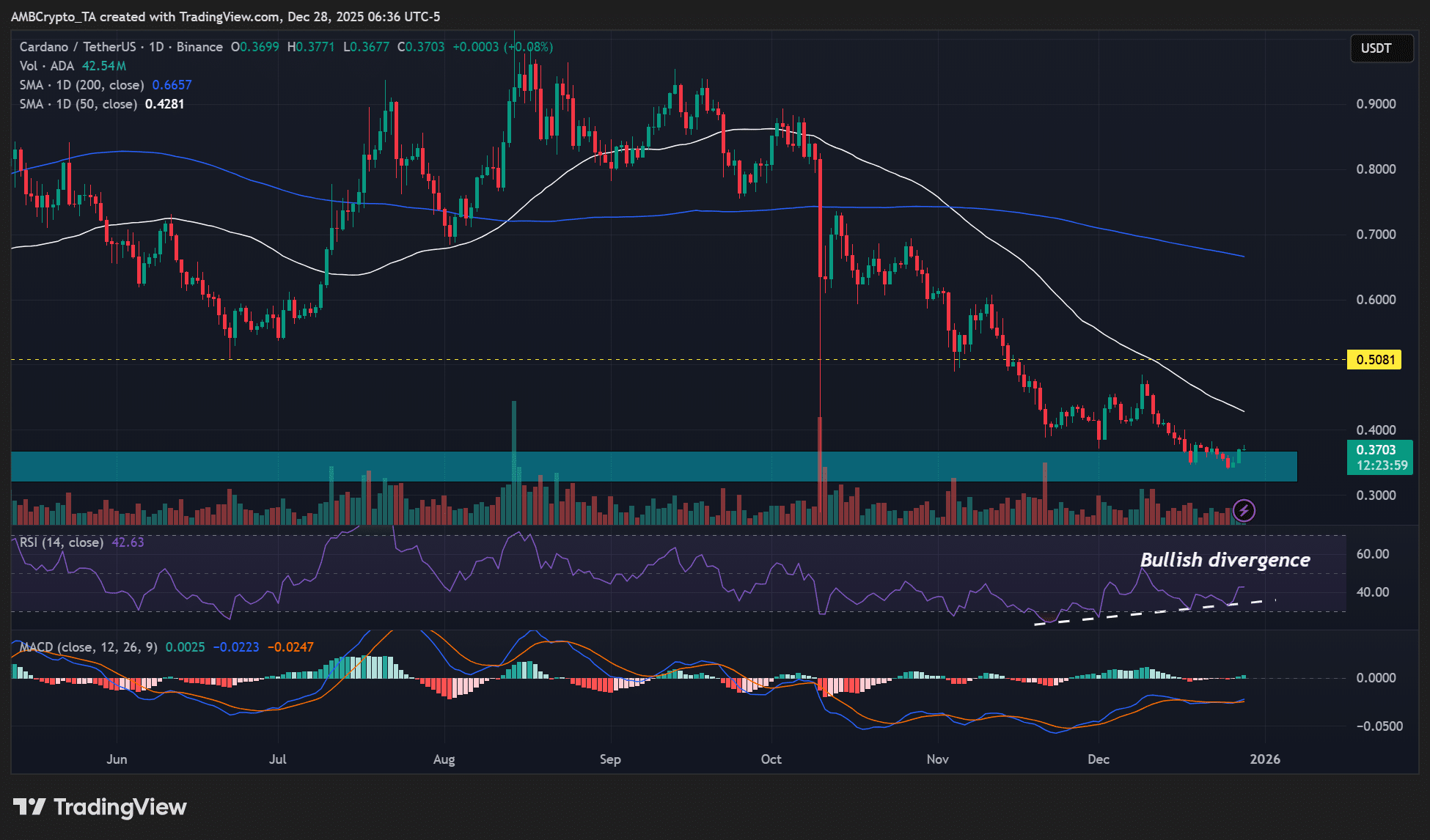

Cardano’s 10% hike – Will ADA’s price recovery extend into 2026?

Why Bitcoin traders stay cautious despite global liquidity boom

Is Web3 gaming dead? How can compliance revive true asset ownership?

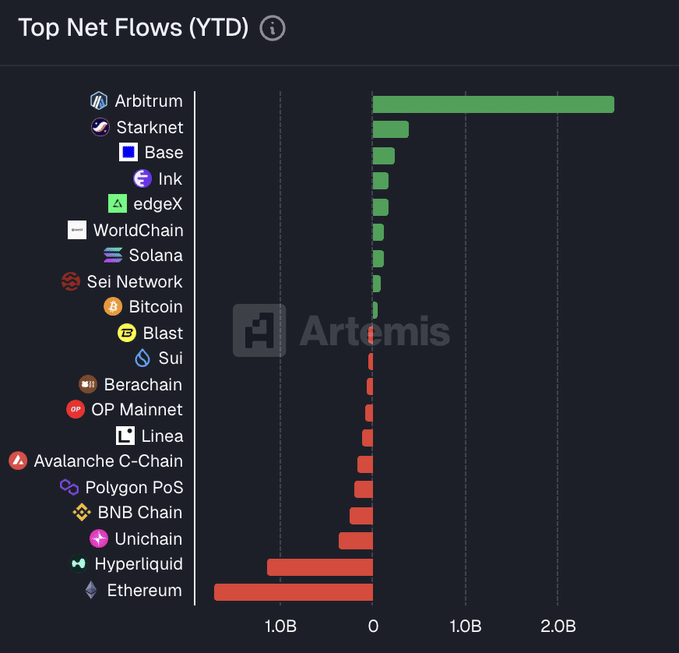

Arbitrum leads 2025 inflows, but ARB hesitates – What comes next in 2026?