BTC Market Pulse: Week 43

Looking at last week's data, a combination of signals points to a market shifting into protection mode, with traders prioritizing capital preservation over directional bets.

Overview

Bitcoin endured a sharp drawdown last week, sliding from $115K to a low of $104K in just four days. This was a fast and decisive flush that shook out weaker hands and triggered a defensive rotation across the market. Price has since bounced, climbing back toward $111K, but the scars from the drop are still fresh. Sentiment remains cautious, and positioning reflects that.

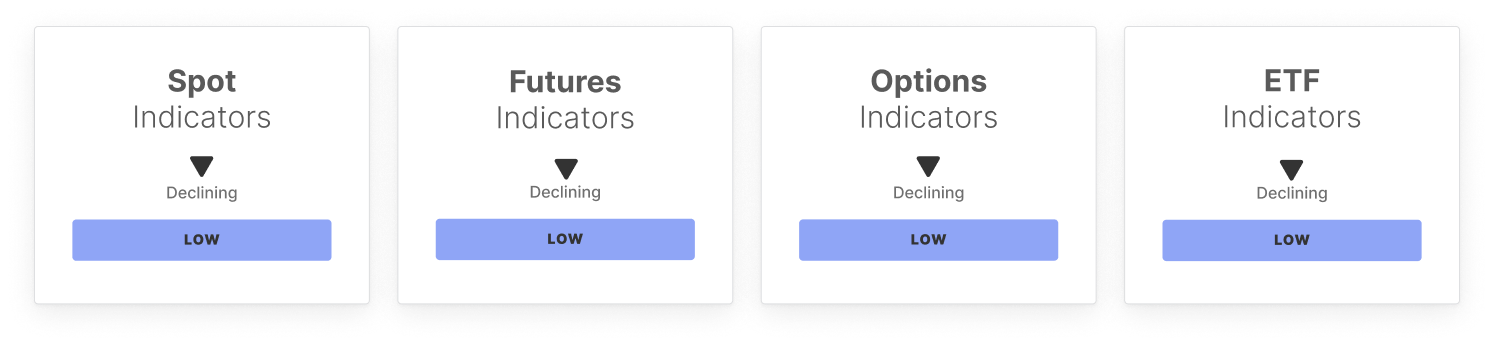

Momentum indicators have rolled over. The Relative Strength Index broke down before curling off oversold territory, while cumulative volume delta remains negative, showing ongoing sell-side pressure. Spot volumes contracted into the selloff, pointing to reduced conviction and a thinning bid.

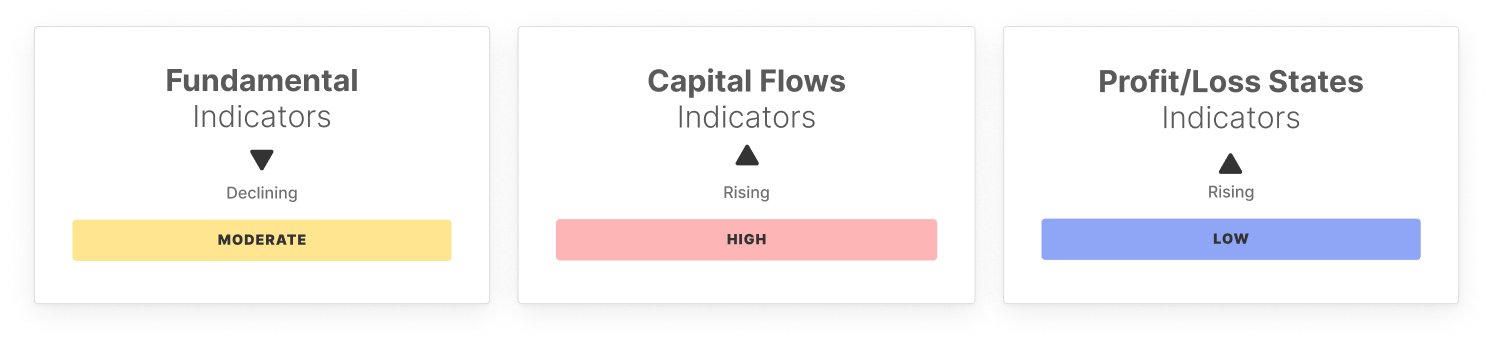

Futures markets followed suit. Open interest fell significantly, and funding rates eased back, signaling that traders have moved to de-risk. In the options space, the 25-Delta Skew spiked sharply as demand for downside protection surged. On chain, the short-term holder supply share continues to rise, suggesting that speculative capital is becoming more dominant. This combination of signals points to a market shifting into protection mode, with traders prioritizing capital preservation over directional bets.

Profitability metrics echoed the broader mood. The Net Unrealized Profit and Loss Ratio turned negative, showing that unrealized losses now dominate the market. The Realized Profit and Loss Ratio also broke below its lower bound, indicating growing stress and loss realization. Despite this, Realized Cap continues to trend upward. Capital is still flowing into Bitcoin, likely from longer-term participants with higher conviction.

In sum, market excess has been cleared out, protection has been bought, and positioning is much cleaner. The bounce off the low is encouraging, but the structure remains fragile. Until confidence rebuilds, expect a market defined more by caution than conviction.

Off-Chain Indicators

On-Chain Indicators

🔗 Access the full report in PDF

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.

Vitalik donated 256 ETH to two chat apps you've never heard of—what exactly is he betting on?

He made it clear: neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Prediction Market Supercycle