Crypto 2025, why is it so difficult?

Everyone is nostalgic for the "golden age" that has already passed.

Everyone is nostalgic for the "golden age" that has already passed.

Written by: Route 2 FI

Translated by: Chopper, Foresight News

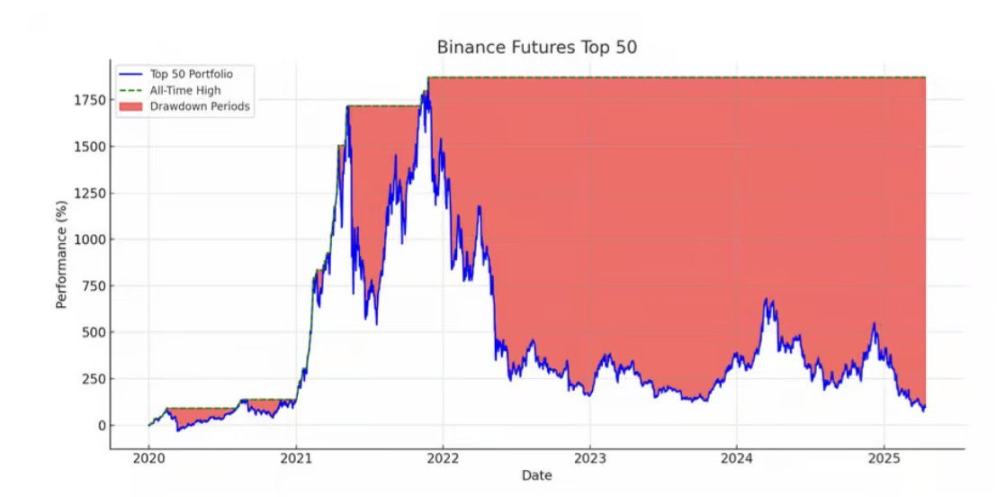

If you’re still wondering why most people in the crypto community are extremely frustrated, just look at these numbers: Many of the current top 50 altcoins by market cap are now priced lower than they were after the FTX collapse in 2022.

Data source: @VentureCoinist

To make matters worse, the prices of major coins like SOL, ETH, and BTC have also fallen back to levels seen in December 2024.

During this cycle, many crypto community users have not made significant profits and are gradually becoming anxious to break even. The current market sentiment is gloomy, and if you believe in the 4-year cycle theory, you’ll notice we’re already in the later stage of the cycle. In fact, we’ve already passed the “18-month mark,” which has historically been the top of the bitcoin cycle.

Right now, cryptocurrency is undergoing visible changes. Over the past four years, most token launches have adopted a low circulating supply and high fully diluted valuation (FDV) model. The most typical case was in July this year, when Polychain Fund sold $240 million worth of TIA tokens. But should we really blame them? On closer thought, they were just fulfilling their investment duties. Almost anyone holding unlocked tokens would likely make the same choice.

Remember the golden age when tokens would skyrocket just by being listed on a centralized exchange? Those days are gone. Now, almost everyone is full of frustration: traders are adapting to new strategies, memecoin players are battling each other, project teams complain that users don’t use their protocols, retail investors grumble about a saturated market, and venture capitalists reminisce about the easy money of the old days.

Traditional financial institutions have entered the space, but have no interest in altcoins. In short, here’s the state of the crypto market in 2025:

- There are too many tokens;

- A large amount of non-essential technology exists;

- Many projects have not found product-market fit;

- Token economic models are failing;

- Airdropped tokens are immediately swapped for stablecoins by users;

- Trading has become much more difficult, and any asset worth trading with sufficient liquidity faces fierce competition.

That’s right, almost no one has confidence in any project these days.

After "Black Friday," about half of crypto traders lost everything, and many of them may never return to the market. Admittedly, every profitable trade corresponds to someone else’s loss, but in this event, funds also flowed to the exchanges, meaning that aggressive traders, professional traders, and retail investors all became poorer.

Altcoins have entered a new stage, and the core issue is: too many new tokens are issued at high valuations, which—even for quality, stable projects—causes liquidity to be siphoned off, ultimately weakening the overall market.

In recent years, token issuance has followed a trend: high FDV, large-scale airdrops, low circulating supply, and later, massive token unlocks from venture capital funds entering the market.

We used to think that as long as the conditions were right, all tokens would go up. But is that really the case? Now, there are far more tokens claiming to have utility than in 2021. Every week, 3-5 new "quality" tokens are launched, the total market cap rises, and everyone seems happy. But ask yourself: who is going to buy these tokens? Unless institutions or retail investors enter en masse, the market will only fall into endless zero-sum games.

Now, every week, "quality" new projects are launched at ultra-high FDVs, meaning a massive supply of tokens is flooding the market. Unless new buyers come in, these tokens are bound to fall in price (at least in the long run).

It’s already October 2025, and capital inflows into altcoins are not only more selective, but also insufficient to offset the impact of large token unlocks.

Let’s end on an optimistic note. Whether you think the market will hit new highs or has entered a bear market, you should start accumulating unique skills to hedge against risk. Unique skills are those that only you possess, or that you do better than others. Everyone has a field they’re naturally good at—if you focus on it, you can turn it into an advantage. For example, I’m good at writing, so I prioritize writing long-form threads instead of making YouTube videos or starting a podcast.

Your unique skill might be in another area: trading, building networks, sales, etc. My core point is: if you hone a skill, you’ll find a place in this industry. Compared to traditional finance, the crypto industry has a much lower employment threshold and many options: content creation, centralized exchange trading, project research, memecoin trading, NFT, airdrops, YouTube, Telegram operations, podcasts, and more.

If you want to connect with top talent in the industry, staying visible on Twitter is the best way: write about topics you’re curious about, fields you want to learn more about, occasionally post something lighthearted, and interact with people you admire. Tweet every day, even if it’s just “gm.” Proactively DM others and offer advice, expecting nothing in return. This way, you can build friendships and maybe even collaborate in the future. The key is to “be helpful, stay friendly, and be active in the community every day.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.