Investors Pile In After Bitcoin’s Decline — Here’s What It Could Mean

Following the flash crash of last week, the Bitcoin price has once again sunk to similar depths, albeit in a more steady price correction. Notably, the leading cryptocurrency dipped below $105,000 on Friday as crypto liquidations rose to above $1.2 billion. However, underlying investor buying activity paints an encouraging picture of a potentially bullish rebound.

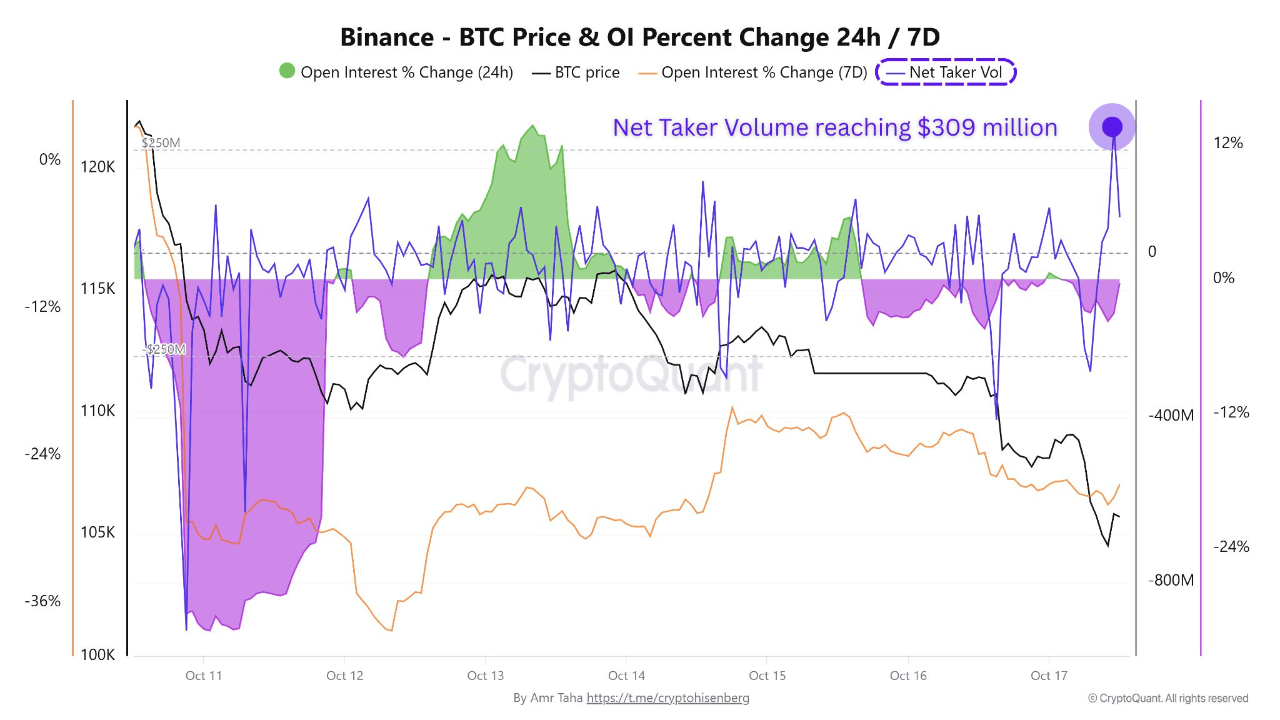

Bitcoin Net Taker Volume Hits $309 Million Despite Price Fall

In a QuickTake post on X, popular analyst Amr Taha shares an exchange activity update on the Bitcoin market amidst a significant price correction. The pundit reports a major uptick in buying pressure, which suggests investors may be quietly accumulating despite the present price weakness.

Notably, on-chain data shows that the Bitcoin crash to below $105,000 coincided with a spike in the net taker volume on Binance to around $309 million, marking its first positive zone since October 10. In trading terms, buy-taker volume represents orders that actively hit the ask, i.e., traders willing to buy immediately at market price rather than waiting for a better entry.

The move indicates that, despite short-term volatility, there remains a deep undercurrent of bullish conviction among Bitcoin holders and traders. This high accumulation activity during a price demand usually precedes local bottom formations, as aggressive buyers absorb selling pressure, setting the stage for a parabolic price rebound.

Furthermore, while the taker volume surged, Amr Taha reports that the open interest (OI), which measures the total number of outstanding futures and perpetual contracts, failed to rise in tandem. This divergence suggests that trading activity is concentrated in the spot market rather than in leveraged derivatives, reinforcing the fact that investors are actively participating in the present market state.

In summary, the renowned crypto analyst views this exchange activity development as a potential bullish undercurrent. Taha explains that spot accumulation around key liquidity levels, such as the $105K zone, often serves as a foundation for future price recoveries once selling pressure subsides.

Bitcoin Rebound Verified By Gold Price Surge

In other news, a market analyst with the username Crypto Jebb echoes Bitcoin’s chances of a major price rebound. However, the expert anticipates the premier cryptocurrency may still see a further decline before eventually finding a bottom around $92,000.

In line with a growing notion, Jebb hinges his bullish thesis on a potential rotation of capital from the gold market to Bitcoin once the former hits a new market peak. Notably, gold is currently maintaining an impressive bullish momentum, having become the first asset to surpass a $30 trillion market capitalization value.

Jebb predicts an eventual capital rotation when the gold market starts to correct, with potential inflows expected to push Bitcoin to around the $150,000 price mark in January. At press time, Bitcoin trades at $107,053, representing a 0.74% decline in the past day following a modest recovery effort.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.