October Crypto Crash Shows Stark Contrast to 2021 Selloffs, Analyst Finds

Investor resilience after the recent crash suggests the bull run is intact. Exchange balances are at all-time lows, and smaller Bitcoin holders are showing strong accumulation, analysts report.

Investor behavior following last Friday’s crypto flash crash reveals a significant divergence from the panic-driven sell-offs seen in previous cycles, particularly in 2021.

Analysts suggest the current downturn is not the end of the bull run but rather a sign of retail investor conviction regaining strength.

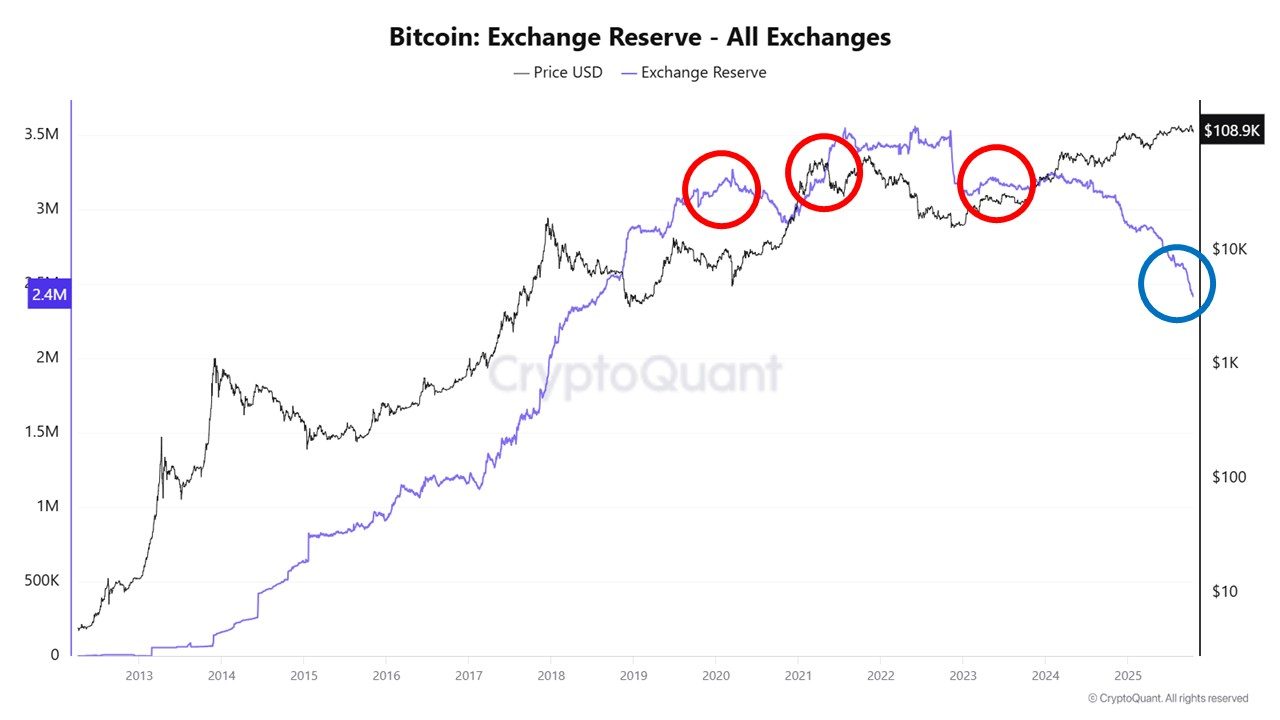

Exchange Balances Hit Record Lows

An analyst at the on-chain data platform CryptoQuant posted an analysis on Friday detailing the shift.

“Bitcoin has once again faced a sharp drawdown, yet today’s market structure is fundamentally different from 2020 or 2021,” the analyst stated.

The most notable difference is crypto balances on centralized exchanges (CEXs). During the sharp drops of 2020 and 2021, CEX crypto balances surged as panic set in, indicating an accumulation of tokens ready to be sold.

In contrast, the analyst reports that exchange balances remain near all-time lows following the latest crash. This low inventory of sellable coins on exchanges suggests limited potential for a sustained, deep price decline.

The analyst also deems the likelihood of a long-term bearish trend as low.

Bitcoin: Exchange Reserve – All Exchanges. Source:

CryptoQuant

Bitcoin: Exchange Reserve – All Exchanges. Source:

CryptoQuant

Long-term holder behavior also tells a different story. In 2020 and 2021, the Long-Term Holder SOPR (LTH-SOPR) plunged below 1 for several months, signaling capitulation and realized losses. The ratio remains near neutral this time.

This stability suggests long-term investors are engaging in prudent profit-taking rather than fear-based selling. These established holders are maintaining their positions amidst volatility, thereby enhancing the network’s resilience.

Analyzing major drawdowns over the past five years, the Cryptoquant analyst noted that a V-shaped recovery typically follows a leverage washout, often driven by whale accumulation.

For example, during the 30% drop in May 2021 following news related to Tesla and Chinese regulation, whales sold approximately 50,000 BTC but re-purchased 34,000 BTC near the bottom.

Similarly, the 15% correction in August 2023 caused by the US debt rating downgrade saw a brief dip in SOPR, followed quickly by a rebound. Each event resolved excess leverage and ushered in a new accumulation phase.

Smaller Holders Step Up

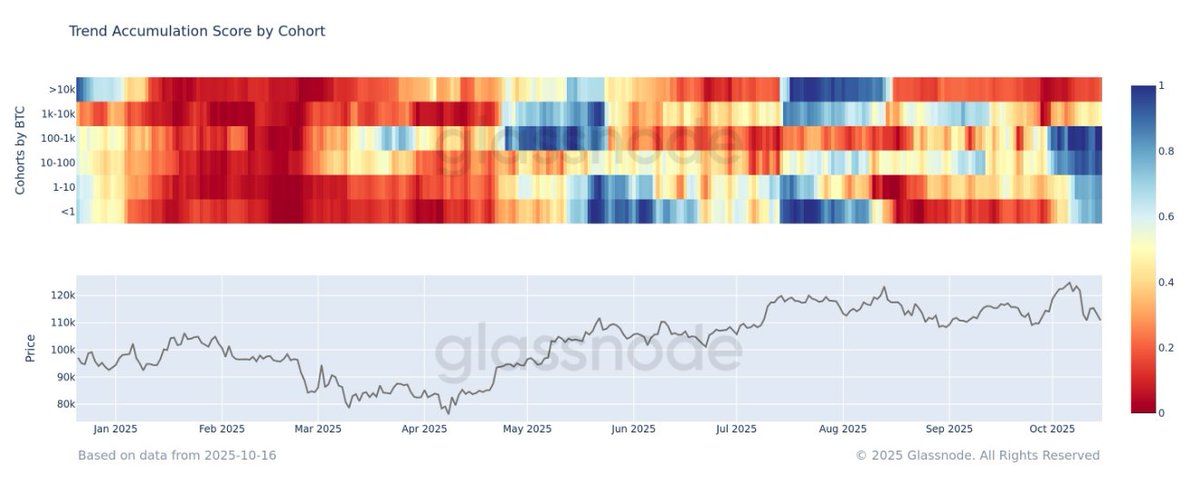

This sentiment is further reinforced by Glassnode’s “Bitcoin Trend Accumulation Score by Cohort” data.

This metric tracks whether different investor groups (whales, retail, intermediate holders) are accumulating (buying and holding) or distributing (selling). A strong blue color indicates strong buying, while red signifies strong selling.

Bitcoin Trend Accumulation Score by Cohort” data. Source:

Glassnode

Bitcoin Trend Accumulation Score by Cohort” data. Source:

Glassnode

Glassnode noted, “Smaller $BTC holders are stepping up.” Strong accumulation is now evident among the cohorts holding between 1 and 1,000 BTC.

Meanwhile, whale investors holding over 1,000 BTC, who were previously leading the strong selling, appear to be slowing their distribution.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.