$15 billion worth of BTC changes hands: The U.S. Department of Justice takes down Cambodia's Prince Group, becoming the world's largest BTC whale

On October 14, the U.S. Department of Justice announced criminal charges against Chen Zhi, founder of Cambodia's Prince Group, and successfully seized 127,271 BTC under his control, with a market value of approximately $15 billion. This event marks not only the largest judicial seizure of virtual assets in history, but also a public demonstration of state power directly exercising control over on-chain assets.

Produced by | Odaily

A lawsuit filed in the U.S. District Court for the Eastern District of New York has caused a huge stir in the crypto world.

On October 14, the U.S. Department of Justice announced criminal charges against Chen Zhi, founder of Cambodia's Prince Group, and applied for the forfeiture of 127,271 BTC under his control, with a market value of about $15 billions, making it the largest judicial seizure of bitcoin in the world.

"The most significant virtual asset seizure in history." The Department of Justice used highly cautionary language in its announcement. Furthermore, officials specifically emphasized that this batch of BTC was not stored on an exchange, but had long been held by Chen Zhi himself through non-custodial private wallets. This seems to shake the core belief of the crypto community: "Not your keys, not your coins."

In fact, even without cracking encryption algorithms, the U.S. government can still complete the "judicial transfer" of assets through legal procedures. Through on-chain tracking and international cooperation, law enforcement agencies locked down bitcoin scattered across multiple addresses, all controlled by Chen Zhi. The court then issued a seizure order, legally transferring these assets to addresses controlled by the U.S. government, entering judicial custody and awaiting a final civil forfeiture ruling.

Meanwhile, the U.S. Treasury's Office of Foreign Assets Control has designated the "Prince Group" as a transnational criminal organization and imposed sanctions on 146 related individuals and entities; the U.S. Financial Crimes Enforcement Network, under the Patriot Act, has designated Huione Group as a "primary money laundering concern," prohibiting it from accessing the U.S. dollar clearing system. The UK has also simultaneously imposed asset freezes and travel bans on Chen Zhi and his family members.

In the context of the crypto market, this moment is highly symbolic. It is not only law enforcement against a criminal group, but also a public demonstration of a state agency directly exercising control over on-chain assets. 127,271 BTC—a number sufficient to change market sentiment and regulatory direction—has been written into bitcoin regulatory history as a key milestone.

From Fujian Businessman to Scam Empire: Chen Zhi's Capital Layout and Industrialized Crime

The indictment from the U.S. Department of Justice reveals another side of Chen Zhi and his Prince Group.

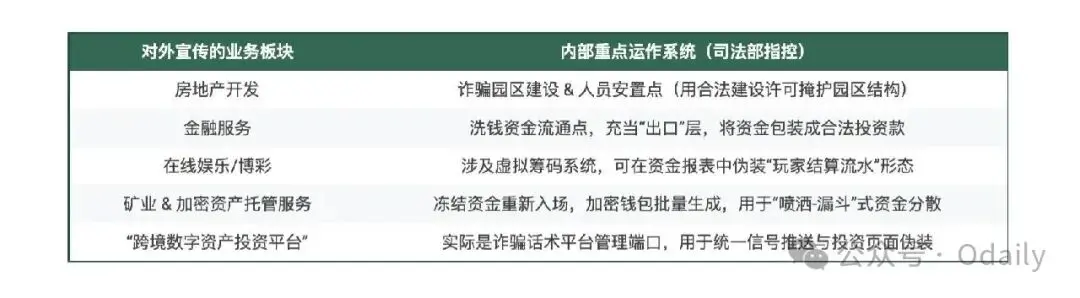

According to Southeast Asian media reports, Chen Zhi was once a "new tycoon" in Cambodia, and his Prince Group was promoted as a multinational conglomerate with businesses spanning real estate, finance, and other sectors. However, the DOJ alleges a "dual-layer operating logic" behind the scenes: outwardly a legitimate business empire, but internally a fund control and clearing system serving scam proceeds.

Chen Zhi is originally from Fujian, and made his fortune in Cambodia early on through gambling and real estate. After obtaining Cambodian citizenship in 2014, he quickly acquired multiple development permits and financial licenses through political and business connections. He did not stop at local business, but built a complex cross-border asset structure by setting up companies in the British Virgin Islands, Singapore holding structures, and is suspected of holding UK identity, thus creating barriers between different legal jurisdictions. In April 2024, the King of Cambodia even issued a royal decree appointing Chen Zhi as an advisor to Senate President Hun Sen, demonstrating his deep political and business roots locally.

On April 19, 2024, King Norodom Sihamoni of Cambodia issued a royal decree appointing Duke Chen Zhi, Chairman of Prince Group, as an advisor to Senate President Prince Hun Sen.

According to the indictment, the telecom scam system established by Chen Zhi in Cambodia operated on an "industrialized" scale. DOJ documents repeatedly mention the concepts of "parks" and "phone farms," with highly systematized operational models:

- Physical Bases: So-called "parks" are registered under the guise of outsourcing services, but in reality operate under closed management.

- Human Control: Foreign workers are lured in by "high-paying jobs," but often have their personal freedom restricted upon arrival.

- Standardized Operations: Each operator manages hundreds of "relationship lines," using unified scripts for social engineering and investment inducement, with processes similar to customer relationship management.

- Technical Camouflage: "Phone farms" use large numbers of SIM cards and IP proxies to create virtual identities and locations, masking their true origins.

This is not a traditional ragtag scam gang, but a well-divided "on-chain scam factory." All scam funds ultimately flow into the financial transit layer of Prince Group. Reports indicate that Chen Zhi's criminal proceeds were used for extremely lavish consumption, including the purchase of luxury watches, yachts, private jets, and even Picasso paintings auctioned in New York.

Prince Group's two-tier business structure overview

Tracing the Funds: From Hacker Heist to Scam Money Laundering

The origin of the 127,271 BTC in this case is particularly complex. According to reports from on-chain analysis firms such as Elliptic and Arkham Intelligence, this batch of bitcoin closely overlaps with the 2020 theft of a large mining company called "LuBian."

Records show that in December 2020, LuBian's core wallet experienced abnormal transfers, with about 127,426 BTC stolen. There is even an on-chain record of LuBian sending a small transaction with a message to the hacker's address: "Please return our funds, we'll pay a reward." Afterward, these massive funds remained dormant for a long time, only becoming active in mid-2024, with their movement paths overlapping with wallet clusters controlled by Prince Group.(Latest update: On October 15,LuBian-related wallets, after three years of dormancy, transferred all 9,757 BTC, worth $1.1 billions(https://www.odaily.news/zh-CN/newsflash/452472))

This means the investigation uncovered not just a simple "scam-money laundering" chain, but a more complex path: "Hacker heist of mining farm → long-term dormancy → funds absorbed by criminal organization → attempts to launder through mining and OTC trading". This finding elevates the case to a new level of complexity: it involves both hacking and mining security vulnerabilities, and reveals how gray-market exchange networks absorb and hide huge sums with suspicious origins.

How Was the Bitcoin Seized?

For the cryptocurrency industry, the far-reaching impact of this case is not just the downfall of a scam kingpin, but that judicial and intelligence agencies have fully demonstrated a complete process for handling on-chain assets: On-chain tracking → Financial blockade → Judicial takeover. This is a seamless integration of "on-chain tracing capabilities" and "traditional judicial power" in a real-world scenario.

Step One: On-Chain Tracking—Locking Down the "Funds Container"

The anonymity of bitcoin is often misunderstood. In fact, its blockchain is a public ledger, and every transaction leaves a trace. Chen Zhi's group tried to launder money using the classic "spray-funnel" model: dispersing funds from the main wallet like a watering can into a large number of intermediary addresses, then after a short stay, reconverging them into a few core addresses like streams flowing into a river.

This operation may seem complex, but from an on-chain analysis perspective, frequent "scatter-gather" behavior actually forms unique graph patterns. Investigative agencies (such as TRM Labs, Chainalysis) use clustering algorithms to accurately map "funds return maps," ultimately confirming that these seemingly scattered addresses all point to the same controlling entity—Prince Group.

Step Two: Financial Sanctions—Cutting Off the "Cash-Out Channel"

After locking down the on-chain assets, U.S. authorities initiated dual financial sanctions:

- Treasury (OFAC) sanctions: Chen Zhi and related entities were added to the list, and any U.S.-jurisdiction institution is prohibited from transacting with them.

- FinCEN Section 311: Key entities are designated as "primary money laundering concerns," completely cutting off their access to the U.S. dollar clearing system.

At this point, although these bitcoins can still be controlled by private keys on-chain, their most important value attribute—the ability to be exchanged for U.S. dollars—has been frozen.

Step Three: Judicial Takeover—Completing the "Ownership Transfer"

The final forfeiture does not rely on brute-forcing private keys, but on legal procedures directly taking over "signing authority." Law enforcement, based on search warrants, obtains mnemonic phrases, hardware wallets, or transaction permissions, and then, just like the original asset owner, initiates a legitimate transfer transaction, moving the bitcoin into a government-controlled custody address.

At the moment this transaction is confirmed by the blockchain network, "legal ownership" and "on-chain control" are unified. The ownership of these 127,271 BTC, in both technical and legal senses, has officially transferred from Chen Zhi to the U.S. government. This combination clearly demonstrates: in the face of state power, "on-chain assets are unseizable" is not absolute.

After Forfeiture, Where Will the Bitcoin Go?

When 127,271 BTC were transferred from the scam empire's wallet to a "U.S. Government Controlled Wallet," a more strategic question emerged: the ultimate destination of this massive asset will reveal how the U.S. government positions bitcoin—is it "stolen goods" to be liquidated quickly, or a "strategic asset" to be held?

Historically, the U.S. government has handled seized digital assets in several ways. In the Silk Road case, bitcoin was transferred to private institutional investors via public auction after judicial proceedings—Tim Draper was one of the auction buyers. BTC from the Colonial Pipeline ransomware ransom was temporarily held in government accounts by the DOJ for use as case evidence and Treasury records after recovery. As for FTX, its assets are still in judicial custody, and officials have not formally confirmed that the seized assets will be classified as government property; most of the assets should, in theory, be used to compensate users in creditor liquidation, rather than being added directly to the national treasury.

Unlike the above cases where seized bitcoin was disposed of via public auction (such as the Silk Road case), this case faces a key variable: In March 2025, the White House has signed an executive order establishing a "strategic bitcoin reserve" mechanism. This means that the BTC in the Chen Zhi case is likely to be held directly as a national reserve asset, rather than simply auctioned off.

Thus, the U.S. is building an unprecedented "on-chain asset regulatory loop": locking targets through on-chain tracking—cutting off fiat exits via sanctions—completing legal ownership deprivation through judicial procedures—finally transferring assets into government control. The core of this process is not to restrict market circulation, but to redefine the legal ownership of "key control."

Once judicial procedures confirm the assets as criminal proceeds, their nature shifts from "personally controlled cryptocurrency" to "digital asset certificates under national jurisdiction."

With the transfer of 127,271 BTC, the U.S. has become the sovereign entity holding the most bitcoin in the world. This is not only an unprecedented forfeiture action, but also heralds the beginning of an era of systematic state control over on-chain assets.

Original link

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell: Employment is weakening, inflation remains high, and no one is talking about rate hikes now

Powell pointed out that the U.S. labor market is cooling, with hiring and layoffs slowing down and the unemployment rate rising to 4.4%. Core PCE inflation remains above the 2% target, but service inflation is slowing. The Federal Reserve has cut interest rates by 25 basis points and started purchasing short-term Treasury bonds, emphasizing that the policy path needs to balance risks between employment and inflation. Future policies will be adjusted based on data. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its generated content are still in the process of iterative improvement.

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.