Research Report|In-Depth Analysis and Market Cap of Yield Basis(YB)

Bitget2025/10/15 07:23

By:Bitget

I. Project Overview

I. Project Overview

Yield Basis is a DeFi protocol initiated by Curve Finance founder Michael Egorov, designed to provide sustainable on-chain yields for Bitcoin and Ethereum holders. Its core innovation lies in leveraging

constant 2x leverage with an auto-rebalancing mechanism, combined with BTC/ETH liquidity and crvUSD credit, effectively mitigating impermanent loss (IL) typical of AMM models.

The protocol is built on the Curve framework, using a hybrid invariant (combining Cryptoswap and Stableswap) driven AMM and crvUSD credit injection into leveraged pools, allowing users to maintain a 1:1 BTC exposure while earning continuous yields from trading fees and leveraged compounding.

Yield Basis emphasizes

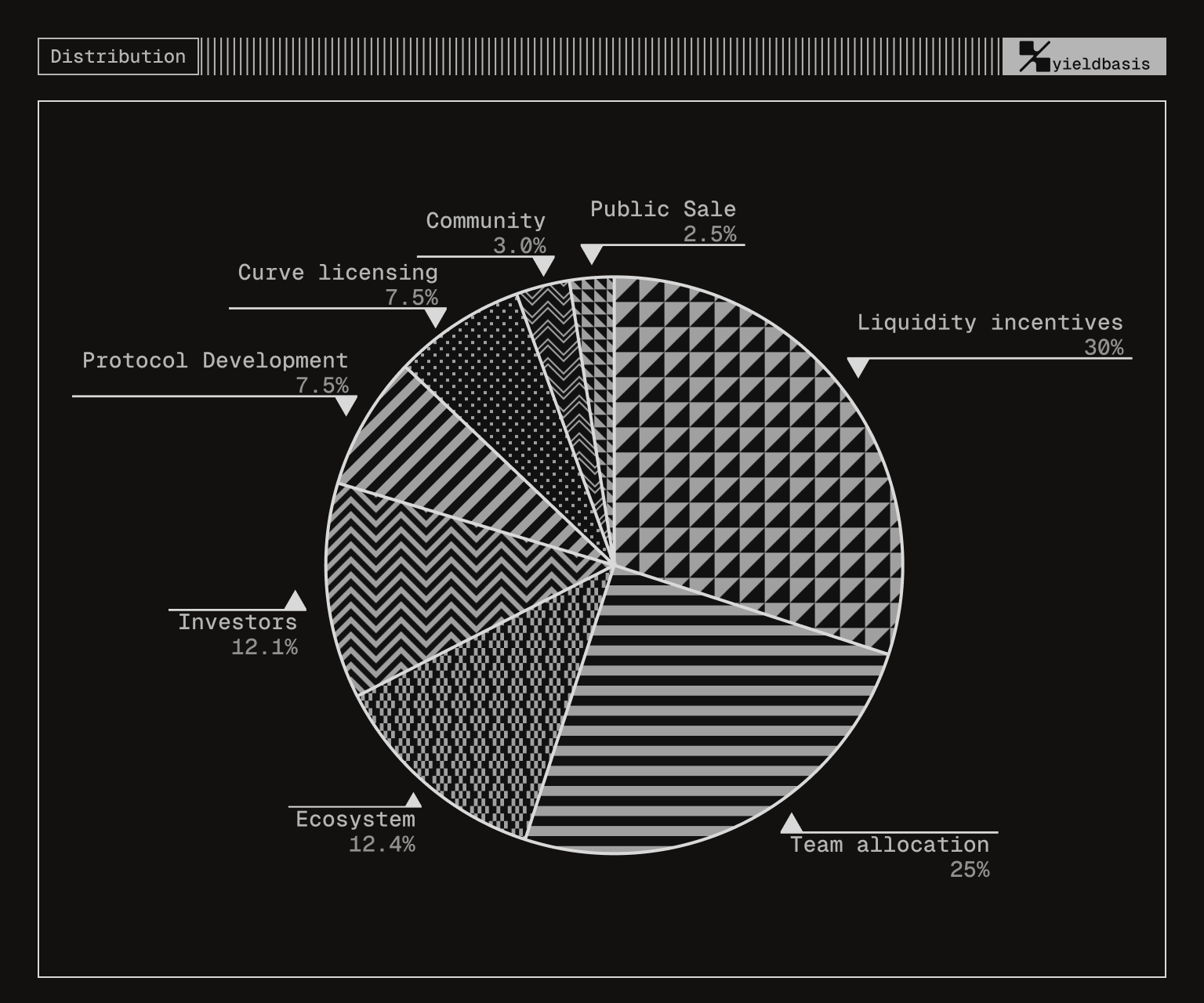

multi-chain scalability, aiming to become the foundational BTC DeFi yield layer. The YB token has a total supply of 1 billion, with a

community-first distribution model, including large-scale airdrops and liquidity incentives, empowering governance and staking. The mainnet is planned to launch in

October 2025, targeting a

fully diluted valuation (FDV) of $200 million, backed by a

$60 million crvUSD credit line from Curve DAO, and supports presale, spot, and perpetual trading on major platforms.

II. Project Highlights

Innovative Impermanent Loss (IL) Mitigation: Yield Basis offers BTC/ETH holders a native 2x leveraged AMM structure to address long-standing IL issues in DeFi liquidity pools. The protocol automatically borrows crvUSD to construct leveraged AMM positions and employs real-time rebalancing to lock BTC exposure, providing verifiable and sustainable yields for LPs even during large market swings.

Curve Core Technology & Sustainable Yield Distribution: Built on Curve’s stable AMM framework, combining Cryptoswap and Stableswap invariants, Yield Basis enables leveraged amplification with low slippage and high capital efficiency. Revenue primarily comes from trading fees and leverage compounding, avoiding excessive token inflation incentives. Token holders can stake and participate in governance via a ve model to earn dividends, strengthening long-term ecosystem value.

Experienced Team & Strong Funding Background: The founding team has deep expertise in AMMs, stablecoins, and on-chain lending. The project has raised $5 million in funding and completed YB presales on Kraken Launch and Legion platforms, attracting tens of thousands of community participants. Curve DAO’s crvUSD credit line further reinforces protocol credibility and liquidity.

BTC Yield Layer Paradigm for Institutional DeFi: Positioned as a BTC yield layer, Yield Basis focuses on Bitcoin circulating supply, creating new on-chain yield opportunities without AMM IL. The protocol supports multi-asset expansion, integrating RWA and on-chain liquidity, targeting institutional users and positioning itself as a Web3 DeFi infrastructure layer, complementing Curve’s stablecoin ecosystem.

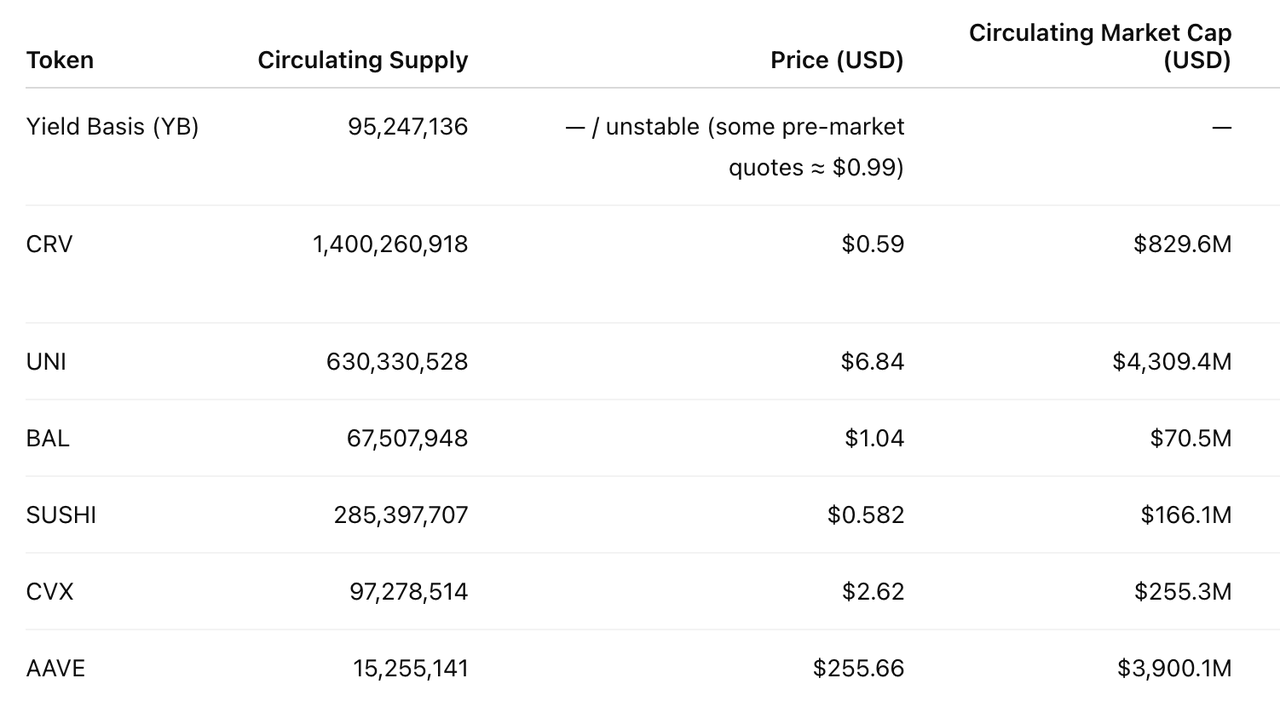

III. Market Cap Expectations

Leveraging AMM architecture with BTC/ETH liquidity aggregation, Yield Basis demonstrates a clear market adoption path. Successful fundraising and oversubscribed presales indicate strong market recognition. In the increasingly active BTC DeFi sector, Yield Basis is expected to become a representative sustainable yield protocol.

IV. Tokenomics

Total Supply: 1,000,000,000 YB

Allocation & Vesting:

Token

Use Cases:

Governance: YB holders control protocol decisions (pool parameters, fee allocation), with ve-model voting.

Incentives: Tokens reward liquidity provision, staking, and yield generation for BTC/ETH assets.

Liquidity: Core asset in trading pairs and available on CEX/DEX.

Leveraged Yield: Integration with crvUSD lending enables 2x leverage for higher yields and capital efficiency.

V. Team & Funding Information

Team Background: Founder Michael Egorov brings extensive DeFi experience, particularly in AMMs, stablecoins, and liquidity innovation. The team focuses on BTC/ETH liquidity and yield, leveraging crvUSD for loss-protected liquidity mining.

Funding: Total raised:

$13.55M

Seed (March 2025): $6.05M at $50M valuation; investors include SevenX, Delphi Ventures, Amber Group, AntAlpha, Aquarius, Bitscale, Mirana, Chorus One, plus angels from AAVE, Bitfury, Brevan Howard, etc.

Public Sale: Kraken + Legion Launchpad: $5M, price $0.2/YB, valuation $200M. Binance Wallet: $2.5M, price $0.1/YB, valuation $100M.

Token

Circulation: Initial circulating supply ~9.52% (95.24M YB), distributed across ecosystem, team, private investors, liquidity provision, and community governance, with governance and community comprising 68.5%.

VI. Potential Risks

Fundamental Risks:

Leverage Risk: 2x leveraged AMM may amplify losses during extreme market moves or liquidity shortages. Short-term user behavior or attacks could pressure protection mechanisms.

Sustainability of Yield: Revenue mainly from trading fees and incentives; a decline in market activity or accelerated token release could cause early users to exit, pressuring YB price and ecosystem engagement.

Dependency on Market Liquidity: Yield model depends on continuous liquidity and market demand; delayed mainnet adoption may reduce capital efficiency and yield.

Sell Pressure Risk:

Short-term: Public sale, TGE ecosystem tokens, immediately unlocked community tokens.

Mid-term: Liquidity incentives, team linear vesting.

Long-term: Generally manageable, as investor and ecosystem token releases are gradual.

Additionally, the founder’s profile may generate FOMO before and after launch, potentially inflating FDV. Investors should consider market conditions for reasonable valuation and entry timing.

VII. Official Links

Website:

https://yieldbasis.com/

Twitter:

https://x.com/yieldbasis

Disclaimer: This report was generated by AI and human-verified for accuracy. It is not intended as investment advice.

0

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Do Kwon Wants Lighter Sentence After Admitting Guilt

Cointribune•2025/11/29 13:18

Bitwise Expert Sees Best Risk-Reward Since COVID

Cointribune•2025/11/29 13:18

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

Coinpedia•2025/11/29 12:57

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

Coinpedia•2025/11/29 12:57

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,974.34

-0.17%

Ethereum

ETH

$3,001.37

-0.94%

Tether USDt

USDT

$1

+0.02%

XRP

XRP

$2.22

+1.02%

BNB

BNB

$880.63

-0.53%

Solana

SOL

$137.81

-0.45%

USDC

USDC

$0.9998

-0.02%

TRON

TRX

$0.2817

+0.36%

Dogecoin

DOGE

$0.1489

-1.30%

Cardano

ADA

$0.4191

-1.05%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now