Ethereum in Retreat Mode as Institutions Dump Record Holdings

Ethereum remains under pressure after record ETF outflows erased $428 million in capital. With sentiment turning bearish, ETH risks extending its dip unless new demand reignites momentum.

Ethereum’s market sentiment continues to struggle following last Friday’s market crash, despite gradual signs of broader market improvement.

As institutional investors reduce participation, spot market participants have also trimmed their holdings. This could result in continued consolidation or a definitive breakdown of the critical $4,000 resistance level around which the coin currently trades.

Ethereum Market Hits Pause Amid Record ETF Redemptions

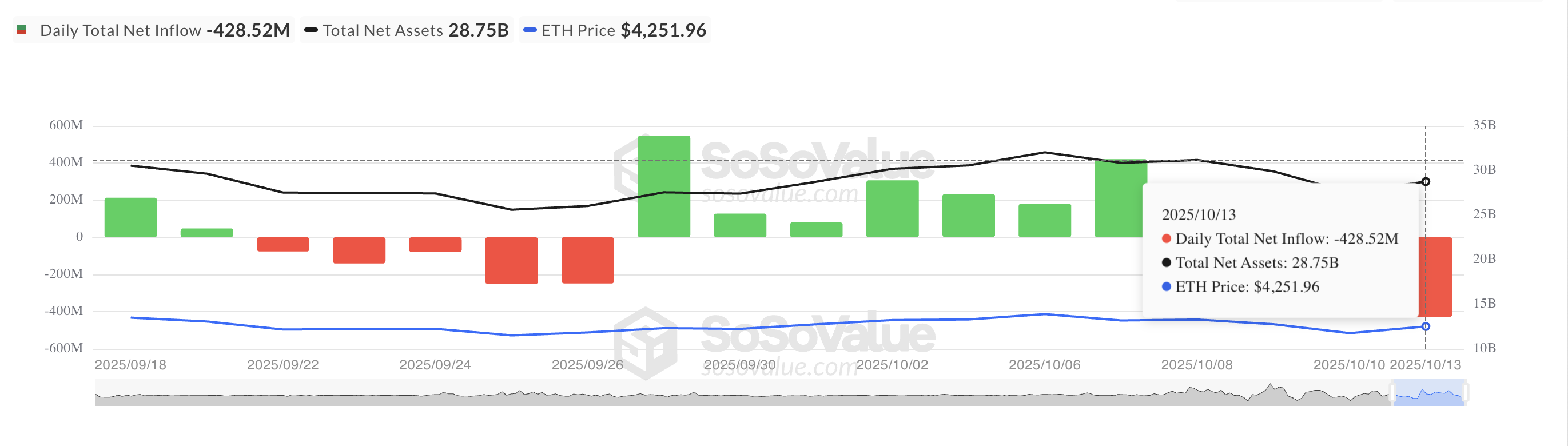

ETH-backed exchange-traded funds (ETFs) have recorded significant outflows since last Friday’s market-wide liquidation event. According to data from SosoValue, these funds registered $428.52 million in outflows on Monday.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

Total Ethereum Spot ETF Netflow. Source:

SosoValue

Total Ethereum Spot ETF Netflow. Source:

SosoValue

BlackRock’s iShares Ethereum Trust (ETHA) led ETF outflows with $310.13 million in redemptions, followed by Grayscale’s Ethereum Trust (ETHE) at $20.99 million and Fidelity’s Ethereum Fund (FETH) at $19.12 million.

Bitwise’s Ethereum ETF (ETHW) and VanEck’s Ethereum ETF (ETHV) recorded smaller declines of $12.18 million and $9.34 million, respectively, on the same day.

According to the data provider, Monday’s outflows marked the largest single-day capital exit from these funds since August 4, highlighting the decline in institutional interest following the liquidation event.

This trend may further dampen market sentiment around the altcoin and add more downward pressure on its price, limiting the coin’s ability to recover in the short term.

Bearish Signals Mount for Ethereum Amid Technical Weakness

Readings from the ETH/USD daily chart show the altcoin trading below its Super Trend indicator, which now acts as dynamic resistance at $4,561. For context, ETH is currently trading well below this level, at $3,986.

ETH Super Trend Indicator. Source:

TradingView

ETH Super Trend Indicator. Source:

TradingView

The Super Trend indicator helps traders identify the market’s direction by placing a line above or below the price chart based on the asset’s volatility.

When an asset’s price trades above the Super Trend line, it signals a bullish trend, indicating that the market is in an uptrend and buying pressure is dominant.

Conversely, as with ETH, when an asset trades below this line, it signals that the market is under bearish control. Traders usually interpret a position below the Super Trend as a warning that downward momentum could continue, making it harder for ETH to regain strength in the near term.

Bears Target Lower Levels While Buyers Wait

If bullish sentiment remains elusive, ETH could extend its decline below the critical $4,000 price level, potentially dropping to $3,626. If this level weakens, it could give way to a deeper decline toward $3,215.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

However, a rebound in new demand for the leading altcoin could invalidate this bearish outlook. In that scenario, the coin’s price could climb to $4,211.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.