Key Market Information Gap on October 14th—A Must-Read! | Alpha Morning News

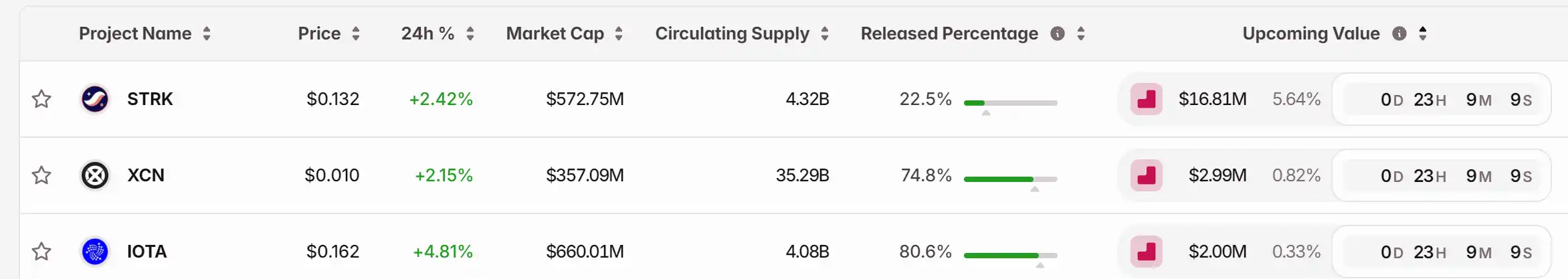

1. Top News: The crypto market remained "calm" overnight, with Ethereum surpassing $4,200, leading a rebound in some altcoins. 2. Token Unlocks: $STRK, $XCN, $IOTA.

Selected News

1. The crypto market remained "calm" overnight, with Ethereum breaking through $4,200 and leading a rebound in some altcoins.

2. BNB Chain and Four.Meme jointly launched a $45 million BNB "Rebirth Support" airdrop, with the amount distributed randomly.

3. Monad airdrop claiming will open today at 21:00.

4. Pyth Network has partnered with Kalshi to bring real-time prediction market data on-chain.

5. Zora released a video hinting at the upcoming launch of a livestreaming feature.

Articles & Threads

1. "How to Farm So Many Prediction Markets?"

As the parent company of the New York Stock Exchange, Intercontinental Exchange (ICE), announced on October 7 its plan to invest $2 billion in the prediction market platform Polymarket at a valuation of about $9 billion, just three days later, another prediction market giant, Kalshi, also announced the completion of a $300 million financing round, with a valuation reaching $5 billion. Meanwhile, Polymarket founder Shayne Coplan has previously reposted or liked posts about the platform possibly launching a token. This time, he listed a string of mainstream crypto asset symbols followed by the $POLY ticker on social media, which can be seen as an explicit hint at token issuance. This series of news has triggered FOMO sentiment among community members. As the news continues to ferment, the prediction market sector has once again become a hot topic of discussion.

2. "Black Swan Trader? Who Is the Mysterious Whale Garrett Jin?"

Discussions about the black swan crash event on October 11 are still ongoing, with the community continuously questioning the identity of the whale who precisely shorted with a position exceeding $1.1 billion in advance. On-chain detective analysis suggests that the address likely belongs to former BitForex CEO Garrett Jin. Around noon today, Garrett Jin posted three consecutive updates on his personal X account, responding to market rumors for the first time. He clarified that he has no connection with the Trump family or "Little Trump," emphasized that his previous operations were not insider trading, and stated that the funds used were not his personal assets but belonged to his clients.

Market Data

Daily overall market capital heat (reflected by funding rate) and token unlocks

Data sources: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin risks return to low $80K zone next as trader says dip 'makes sense'

Bitcoin ‘risk off’ signals fire despite traders’ view that sub-$100K BTC is a discount

Bitcoin’s end-of-year run to $100K heavily depends on Fed pivot outcomes

Ethereum’s major 2025 upgrade completed: a faster and cheaper mainnet has arrived

On December 4, Ethereum's second major upgrade of the year, Fusaka (corresponding to Epoch 411392), was officially activated on the Ethereum mainnet.