Can Bitcoin reclaim $120k? Analysts warn of macro pressures

Analysts at Bitfinex see Bitcoin targeting $117K–$120K, but recovery hinges on fresh capital entering the spot market.

- Analysts at Bitfinex report a 2.5x imbalance between sellers and buyers in crypto markets

- U.S.–China trade tensions erased $1 trillion from the crypto market

- For Bitcoin to recover, fresh capital needs to enter, despite murky fundamentals

After weathering one of the most violent liquidation events in crypto history, Bitcoin could be making a comeback. On Monday, Oct. 13, Bitfinex released a report detailing the crash and outlining a potential recovery. However, the outlook largely depends on spot demand and macro clarity.

BTC rebounded from the largest liquidation event in history by notional value. Sparked by U.S.-China trade tensions, the crash wiped out almost $1 trillion from the crypto market cap in hours, from $4.26 trillion to $3.30 trillion.

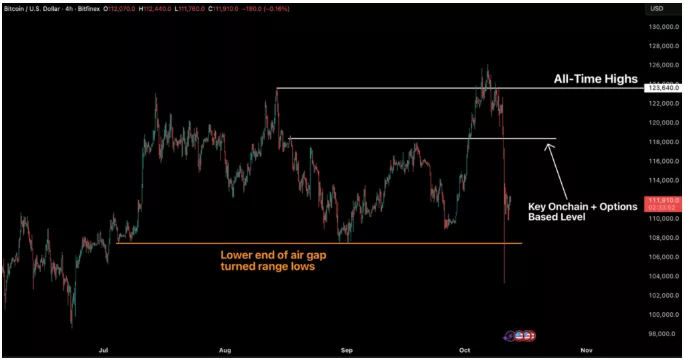

Bitcoin price chart, showing the major price drop that led to the liquidation event | Source: Bitfinex Alpha

Bitcoin price chart, showing the major price drop that led to the liquidation event | Source: Bitfinex Alpha

While Bitcoin (BTC) fell 18.1%, altcoins declined as much as 80%, with some temporarily becoming illiquid. The report notes that a 2.5x imbalance toward sellers created the conditions for the flash crash, contributing to $19 billion in futures liquidations in a single day. Although BTC bounced, further recovery remains uncertain.

Chart depicting Bitcoin liquidations, which reached more than $19 billion in a single day | Source: Bitfinex Alpha

Chart depicting Bitcoin liquidations, which reached more than $19 billion in a single day | Source: Bitfinex Alpha

Will Bitcoin recover to $120,000?

According to Bitfinex analysts, the recovery will largely depend on BTC holding key support at $110,000. That would put it in position to retest the $117,000 to $120,000 range. However, additional gains will depend on spot demand and the macro backdrop.

For a full recovery, Bitcoin needs fresh capital inflows to drive spot demand. This will largely depend on macro conditions, which are currently clouded by the lack of economic data due to the U.S. government shutdown.

“For now, the absence of data may be masking underlying fragility. If the shutdown persists, delayed reports on inflation and employment could amplify volatility once they are released. But the market message is clear: liquidity, credit confidence, and the expectation of further easing from the Fed are keeping the economy afloat, even as the lights in Washington remain dim,” wrote analysts at Bitfinex.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.