Ripple’s recent partnerships signal a new phase in institutional blockchain adoption. These latest deals have caught the attention of major banks, which are now stepping up their exposure to XRP. At the same time, Paydax (PDP) is emerging as a strategic ally in the global payments space. Together with Ripple (XRP), the next-generation DeFi bank is reshaping how traditional finance approaches digital liquidity, and the smart money is starting to take notice.

Ripple (XRP) And Paydax (PDP): Capturing The Attention Of Institutional Players

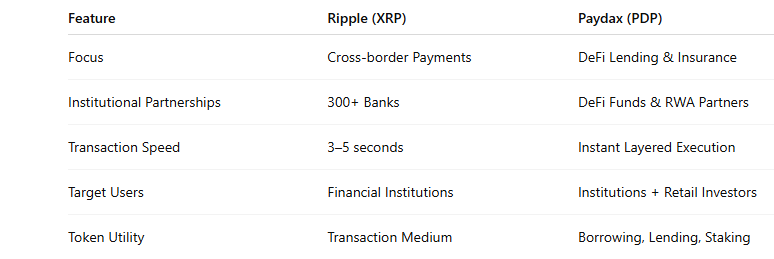

For several years, Ripple (XRP) has been at the forefront of bringing blockchain efficiency to global finance. The cross-border payment solutions giant offers faster settlements and transparent transactions, creating a bridge between traditional banking systems and digital assets through its token, XRP. Ripple’s focus has been on building a trusted network with regulatory clarity and real-world use cases that appeal to large financial institutions seeking scalable blockchain solutions.

Meanwhile, Paydax (PDP) is making waves by addressing some of the most persistent financial issues institutions and users face today: liquidity access, risk management, and capital efficiency. By enabling users to borrow, lend, and insure assets within a secure and borderless ecosystem, Paydax empowers individuals, eliminating the interference of intermediaries.

An eye-catching feature is Paydax’s approach to liquidity: instead of forcing users to sell assets to raise cash, Paydax allows them to unlock liquidity by borrowing against their assets. This approach preserves long-term investment positions while freeing up working capital, an important advantage for users and institutions that want to maintain exposure to digital or traditional assets without sacrificing operational flexibility.

Paydax (PDP): Benchmark Of Transparency And Security

In the world of digital finance, transparency and security are non-negotiable. Paydax (PDP) has built its platform around these foundational principles, positioning itself as a trusted gateway for individuals and institutions moving into decentralized finance (DeFi). The DeFi bank has taken some key measures, including:

-

Thorough Contract Audits: Every smart contract on the Paydax platform has been rigorously audited by three of the most respected auditing firms: Rapid Innovation, QuillAudits, and Hacken, with no irregularities detected.

-

Doxxed Team: The Paydax team has undergone a full KYC audit and has been doxxed. This helps to boost investor confidence as KYC-audited projects hardly get involved in rug pulls and scams.

-

Strategic Partnerships: Paydax partners with Brink’s, Sotheby’s, and Onfido to ensure users’ safety and the security of all collateralized physical items.

-

Live dApp: The Paydax dApp v1.0 is already live and functioning. This emphasizes the viable nature of the project, dismissing any notion that it could be merely theoretical.

The Strategic Edge: What Makes Paydax (PDP) Attractive to Investors

Paydax (PDP) is gaining investor attention for the same reason Ripple (XRP) became a cornerstone in institutional finance — it solves real financial problems. Designed for utility, not speculation, Paydax offers a suite of borrowing, lending, and insurance services that allow users to unlock liquidity without selling their assets and also yield up to 15.2% APY.

Furthermore, Paydax’s (PDP) appeal to reward investors has given it a unique selling point. Beyond the potential gains investors could yield, PDP holders will enjoy benefits such as:

-

Liquidation rewards

-

Lower loan fees + better terms

-

Tokens rewards

-

Governance rights on key decisions

-

Higher loan-to-value (LTV) ratios, etc.

Final Thoughts: Why Banks Are Doubling Down On Ripple (XRP) And Watching Paydax (PDP) Closely

As the digital finance landscape continues to evolve, banks and financial institutions are no longer just observing blockchain innovation; they’re becoming active participants. Ripple’s XRP has proven its strength in real-world utility, enabling faster settlements and unlocking new efficiencies for cross-border payments.

At the same time, emerging projects like Paydax (PDP) are catching attention for their innovative approach to seamless digital transactions and solving key financial issues. While XRP leads the charge in institutional adoption, Paydax offers a glimpse into the next generation of blockchain payment ecosystems designed for seamless borrowing, lending, and insuring of assets.