「10.11」 Cryptocurrency Epic Settlement, how are the DAT companies' stocks doing?

For those companies facing dual exposure to both the crypto market and the stock market, has the worst moment already passed?

Original Article Title: "After the Crypto Crash, How Are DAT Companies' Stocks Holding Up?"

Original Article Link: David, Deep Tide TechFlow

On the 10th, President Trump announced a 100% tariff on Chinese goods on Truth Social in the afternoon. This news instantly ignited panic in the global financial markets.

Within the next 24 hours, the cryptocurrency market experienced the largest liquidation event in history, with over $19 billion in leveraged positions being forcibly closed. Bitcoin plummeted from $117,000 to below $102,000, marking a more than 12% intraday drop.

The US stock market also faced hardship. By the close of October 10th, the S&P 500 index fell by 2.71%, the Dow Jones Industrial Average dropped by 878 points, and the Nasdaq Composite Index declined by 3.58%, all registering their largest single-day drops since April.

However, the real epicenter of the crisis was the DAT (Digital Asset Treasury) companies that held cryptocurrency as part of their treasury reserves.

MicroStrategy, as the largest corporate Bitcoin holder, saw its stock price similarly hit; other cryptocurrency reserve companies experienced even more significant plunges. According to after-hours trading data, investors continued to sell off.

For these companies exposed to both the crypto and stock markets' dual risks, has the worst moment passed?

Why Did DAT Companies See Harsher Drops?

First and foremost, DAT companies faced a direct impact on their balance sheets. Taking MicroStrategy as an example, the company holds approximately 639,835 bitcoins, and a 12% drop in Bitcoin price means an instant evaporation of nearly $10 billion in asset value.

This type of loss must be recognized as an "unrealized loss" on the balance sheet. While it's not a realized loss as long as they don't sell, the numbers on the financial statements are real.

As an investor, what you see is a company's core assets rapidly depreciating. There is also a multiplier effect on market confidence.

By early 2025, MicroStrategy's stock carried a premium to net asset value (NAV) that reached as high as 2x, but by the end of September, it had compressed to around 1.44x; currently, it's hovering around 1.2x.

Some other companies' mNAV is almost returning to 1, and some have already fallen below 1. These numbers reflect a harsh reality: the market's confidence in the DAT model is being shaken in this extreme market condition.

During a bull market, investors are willing to give these companies a premium, as the narrative can be seen as being at the forefront of crypto innovation. However, when the market turns, the same story becomes an unnecessary risk exposure.

Cryptocurrencies other than Bitcoin have suffered significant technical damage in this leverage-induced major crash, with some even plummeting to zero instantly; even large-cap altcoins have experienced massive drops due to insufficient liquidity.

The stocks of companies holding these assets have become the preferred short-selling targets in the face of deteriorating market sentiment.

During market panic, investors need to offload quickly. While the Bitcoin market trades 24/7, large sell-offs can significantly impact the price. In contrast, selling stocks like MSTR or COIN on the Nasdaq is much easier.

Selling billions of dollars' worth of gold would not disrupt the market, but selling $70 billion of Bitcoin could lead to a price collapse and trigger massive liquidation; this liquidity difference has made DAT companies' stocks a channel for rapid fund withdrawal.

What's worse, many institutional investors have strict risk control red lines. When volatility exceeds a certain threshold, they must reduce their positions, whether they want to or not. And DAT companies are precisely one of the most volatile targets.

Using an inappropriate analogy, if a regular tech company is sitting on one boat, then a DAT company is like tying two boats together, one sailing in the stock market's waves and the other struggling in the crypto market's storm.

When both sides encounter bad weather simultaneously, the impact they endure is not additive, but multiplicative.

Who's the Hardest Hit and Most Resilient?

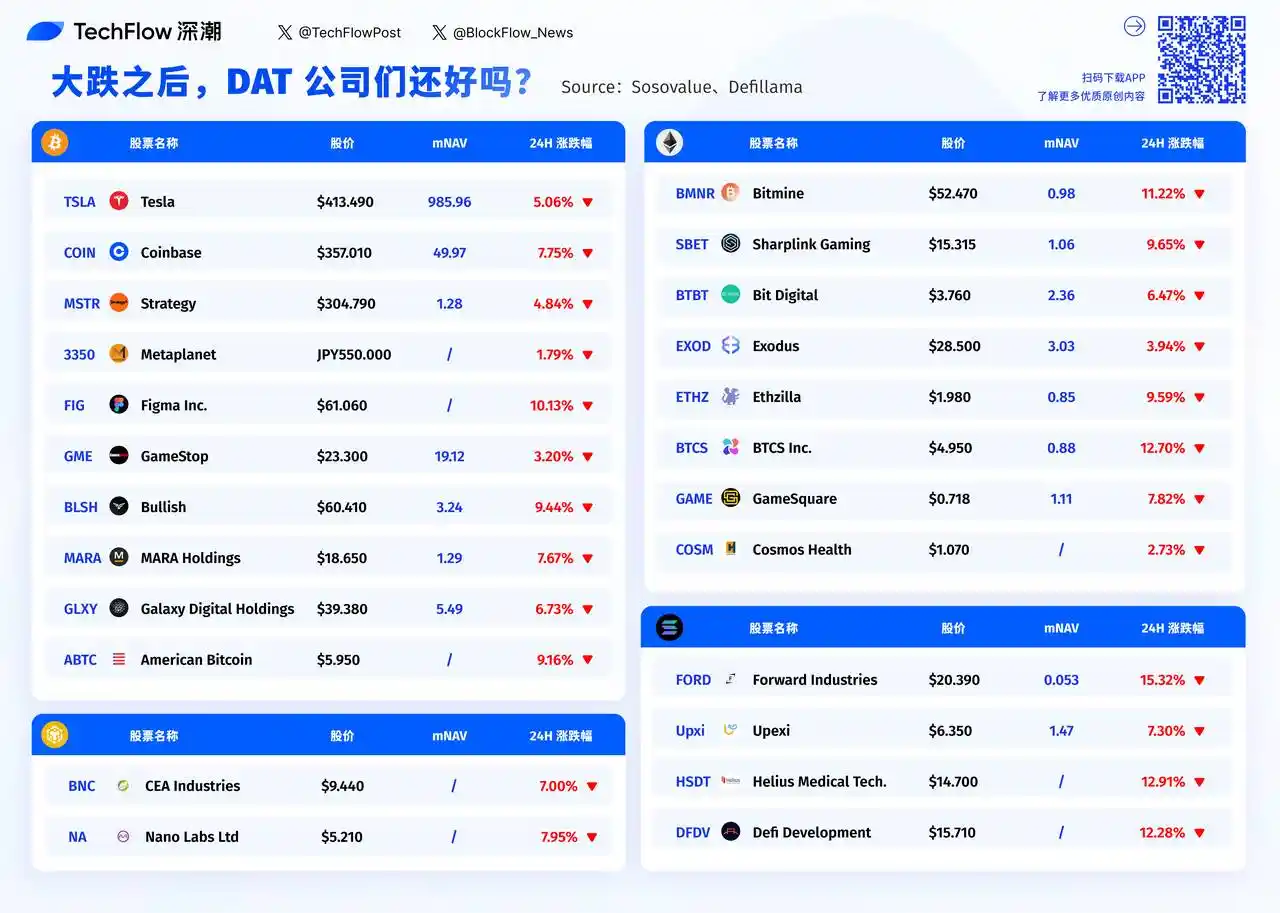

Looking at the previous day's DAT company losers list, you can clearly see a pattern: the smaller the company, the harder the fall.

Forward Industries fell by 15.32%, with an mNAV of only 0.053. BTCS Inc. fell by 12.70%, and Helius Medical Tech fell by 12.91%.

These small companies with market caps of less than $100 million can hardly find buyers in a panic. In contrast, although MicroStrategy is the largest Bitcoin holder, its decline was only 4.84%.

The logic behind this is quite simple: liquidity.

When panic sets in, the bid-ask spread of small-cap stocks widens significantly, and a slightly larger sell order can crash the price.

In this list, Tesla stands out as an anomaly. It dropped by 5.06%, which was one of the smallest declines, but in terms of data, its mNAV is as high as 985.96. This number means that the market values Tesla at nearly 1000 times its holding value.

Because Tesla is fundamentally not a DAT company, holding coins is just a side activity. Investors buy Tesla based on optimism about its electric vehicle business, and the fluctuation of Bitcoin has minimal impact on its valuation; the same reasoning applies to Coinbase as well. Despite its 7.75% drop, as an exchange, it has tangible fee revenue.

In contrast, for those purely DAT companies, the situation is entirely different.

MicroStrategy has an mNAV of only 1.28 times, almost trading at its holding value. Galaxy Digital has an mNAV of 5.49 times, and MARA Holdings is at 1.29 times. The market values these companies mostly based on their cryptocurrency asset value with a small premium. When the cryptocurrency market crashes, they have no other business to cushion the impact.

When a company's market value is almost equal to the value of its held cryptocurrency assets (mNAV close to 1), it means the market perceives that this company has no additional value beyond holding coins.

Bitmine has an mNAV of 0.98, and American Bitcoin has not disclosed it but is also likely very low. These companies have effectively become Bitcoin ETFs disguised as publicly traded companies.

The question is, now that there are actual Bitcoin ETFs available for purchase, why would investors still indirectly hold through these companies?

This may explain why, during a panic, companies with low mNAV see larger declines. They bear both cryptocurrency risk and stock market risk while not providing any additional value.

In a few hours, the U.S. stock market will open. After a weekend of calm, will market sentiment improve? Will those small DAT companies with declines exceeding 10% continue to be sold off, or will there be buying interest at lower prices?

From a data perspective, companies with an mNAV below 1 may present oversold opportunities, but they could also be a value trap. After all, when a business model itself is in question, cheapness is not necessarily a reason to buy in.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.

Prize pool of 60,000 USDT, “TRON ECO Holiday Odyssey” annual ecological exploration event is about to begin

TRON ECO is launching a major ecosystem collaboration event during Christmas and New Year, offering multiple luxurious benefits across the entire ecosystem experience!