The fund shorting MicroStrategy is now targeting an Ethereum treasury company

From a 14% premium to a 31% discount, see how Kerrisdale exposed the "premium private placement" lie.

From a 14% premium to a 31% discount: How Kerrisdale exposes the “premium private placement” myth.

Written by: Eric, Foresight News

At 21:47 on October 8, East 8th District time (08:47 local time in New York, USA), short-selling firm Kerrisdale Capital publicly announced on X that it had shorted the stock BMNR of Ethereum treasury company BitMine. Kerrisdale stated in its post that it is not bearish on Ethereum itself, but believes the premium of BitMine’s stock price over its net asset value, brought by the treasury company model, is about to disappear. Kerrisdale’s bet is on the price returning to parity or even a discount.

This short on BMNR is not Kerrisdale Capital’s first attack on crypto concept stocks. In mid-2024, it shorted bitcoin mining company Riot and the DAT company pioneer Strategy (then known as MicroStrategy), and the share prices of the targeted companies dropped significantly after Kerrisdale’s short-selling news was released. This time, after Kerrisdale announced its short on BMNR, the stock price did not immediately drop significantly, and last night’s sharp decline was more in line with the overall market. However, in terms of price alone, BMNR’s closing price on October 10 (US local time) was $52.47, more than 10% lower than the closing price of $60 on the 8th.

A close reading of the short report shows that Kerrisdale’s six reasons for shorting BitMine stock are all on point. Compared to its previous shorting of Riot and Strategy, where it hedged by going long bitcoin, this time Kerrisdale’s naked short on BMNR reflects its extreme lack of confidence in BitMine.

The “Flywheel” Has Become a “Death Spiral”

Kerrisdale’s bearish view on BitMine is mainly based on six aspects:

- Severe dilution of Ethereum per share: BMNR issued over 240 million shares via ATM (at-the-market) in just three months, raising over $10 billions, with an average daily financing of about $170 millions, severely diluting the Ethereum content per share;

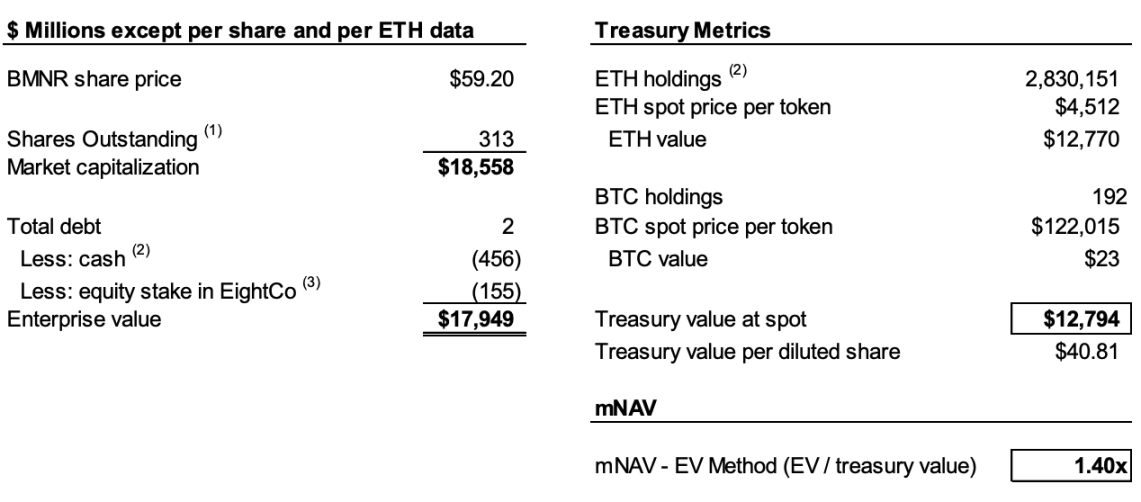

- Continuous decline of mNAV: The premium of BMNR’s market value over its net crypto asset value (mNAV) has dropped from 2.0x in August to 1.4x, with the trend continuing to worsen;

- Using financial maneuvers to cover up cash-out activities: The recent $365 millions “premium” financing is actually a deep discount, with attached warrants greatly diluting the value of common shares;

- Opaque disclosures: Since August 25, the company has stopped disclosing per-share NAV and total share capital, making it impossible for investors to judge whether the Ethereum “content” per share is increasing;

- Intensifying competition: There are already 154 companies in the US planning to raise nearly $100 billions for crypto treasury strategies, and the launch of ETFs will further weaken the scarcity of DATs;

- Strategy model failure: As the DAT pioneer, Strategy (formerly MicroStrategy) has seen its mNAV premium drop from 2.5x to 1.4x, shaking market confidence in this model.

To understand the logic behind the short, we first need to explain the core logic of DAT company operations. As Kerrisdale states in its report, the core logic is: issue shares at a price higher than the book value of tokens → raise funds → buy more coins → increase the number of coins per share → maintain the premium → issue more shares, forming a self-reinforcing cycle.

For example, if Company A has $1 billion worth of bitcoin on its books and a total of 100 million shares, Company A issues new shares at a price higher than $10 per share because investors expect that after fundraising, the company will continue to buy bitcoin, increasing the “content” of bitcoin per share and thus raising the stock price. Therefore, investors are willing to buy new shares at a premium. After fundraising, Company A continues to buy bitcoin, increasing the bitcoin content per share and pushing up the stock price. Company A can continue this operation to keep raising its stock price.

However, two necessary conditions must be met to maintain this cycle: first, there must be a premium in mNAV at the initial stage or at least an expectation that a premium will arise later; second, the premium and premium rate must be maintained. If the premium rate is zero or even negative, investors might as well buy the corresponding crypto assets directly.

Thus, we can combine points 1, 2, and 4 to explain the bearish reasons. According to the report, Kerrisdale estimates that as of October 6, BitMine had issued over 240 million shares, with a total share capital of 311.7 million shares. Although from July to August, BitMine increased the content from 2.7 ETH/thousand shares to 7 ETH/thousand shares through the flywheel, Kerrisdale estimates that from August 25 to October 6, the company’s Ethereum holdings increased by 65%, but the Ethereum content per share increased by only 17%.

In other words, Kerrisdale believes the dilution means the growth rate of content will continue to lag behind the growth rate of Ethereum holdings. Coupled with the mNAV dropping from 2x in August to 1.4x, the decline in content growth and premium may lead to a vicious cycle, causing both numbers to keep falling and eventually reach parity or even a discount.

If the data still contains some speculation, BitMine’s decision to stop disclosing per-share NAV and total share capital from August 25 further solidified Kerrisdale’s judgment. As stated on X: “If per-share earnings had improved, they should be touting it loudly.”

“Premium Private Placement” Is Actually “Discounted Cash-Out”

On September 22, BitMine announced it had signed a securities purchase agreement with an institutional investor, directly issuing 5,217,715 common shares at $70 per share, and granting warrants to subscribe for up to 10,435,430 common shares (exercise price $87.50 per share). Before deducting placement agent fees and other estimated offering expenses, the company expects total gross proceeds of approximately $365.24 millions from this offering.

This type of news, which usually pushes the stock price up, is seen by Kerrisdale as BitMine’s discounted cash-out through financial maneuvers.

The report states that the $70 offering price represents a 14% premium to the closing price of $61.29 that day, but each share comes with two warrants (exercise price $87.5, term 1.5 years). According to Black-Scholes (vol 100%, rate 4%) and factoring in a 40% liquidity discount, each warrant is worth about $14.

Black-Scholes is a mathematical model proposed by Fischer Black and Myron Scholes in 1973, which won them the Nobel Prize in Economics. It solves the problem of “how much should an option that can only be exercised at expiration be worth today under given conditions.” The calculation formula involves several set parameters. Kerrisdale set the volatility (vol) at 100% (since such stocks are highly volatile) and the risk-free rate at 4%, calculating that each warrant in BitMine’s September 22 offering was worth about $14.

Therefore, if the value of the two $14 warrants is excluded, BitMine’s actual financing is only $220 millions, meaning the actual issue price per share is only $42, about a 31% discount to the closing price that day. Kerrisdale believes that while this deal may not be a loss for investors, if a DAT company needs to raise funds at an actual discount, one of the necessary conditions for the flywheel to turn has already failed, further indicating that BitMine’s model is showing signs of fatigue.

DAT Is No Longer Scarce

The report states that when MicroStrategy launched its bitcoin treasury strategy in 2020, the market lacked compliant and convenient crypto asset investment tools, and DAT became a “leveraged alternative.” Today, more than 150 companies in the US have announced similar strategies, with planned fundraising totaling nearly $100 billions. Meanwhile, the SEC has simplified the ETF approval process, and an “ETF tsunami” is expected, with lower-cost, higher-liquidity Ethereum investment channels likely to quickly capture the market.

Kerrisdale notes that even the oldest Strategy’s mNAV premium has dropped from a yearly high of 2.5x to 1.4x, indicating shaken market confidence in the DAT model. Even Strategy itself suddenly canceled its promise in August to only issue new shares at a 2.5x premium rate. Once this trust and discipline collapses, it is difficult to restore. So, if the market and even Strategy itself lack confidence, imitators will inevitably collapse first.

Kerrisdale already gave the best summary at the beginning of the report: We are not shorting Ethereum, but the idea that “investors should still pay a premium for ETH.” If you want to hold ETH, just buy, stake, or buy an ETF. BMNR’s selling point is “worth more than ETH itself,” but its strategy is mediocre, competition is fierce, disclosures are opaque, per-share ETH growth is slowing, and so-called “premium financing” is actually dilution (plus there is no scarcity). Against this backdrop, BMNR’s premium is bound to continue to decline.

Kerrisdale’s “Love” of Shorting and the Controversial DAT

Kerrisdale Capital is one of Wall Street’s most active “long-short hedge + event-driven” funds, known for its bombastic public shorting. In recent years, it has focused its firepower on “valuation disconnected from reality” sectors such as crypto concepts, quantum technology, and SPACs. From late 2023 to early 2024, Kerrisdale targeted Marathon Digital and Cipher Mining, causing single-day drops of 5% to 8%. Besides crypto-related stocks, Kerrisdale shorted quantum computing concept stocks IonQ and D-Wave Quantum in the first half of the year, but both only saw small declines on the day the short report was released and then rallied sharply afterward.

Kerrisdale Capital founder and Chief Investment Officer Sahm Adrangi started his career at Deutsche Bank in high-yield bonds and leveraged loan debt financing, and served as a bankruptcy and out-of-court restructuring advisor for creditor committees at Chanin Capital Partners. Later, Adrangi was an analyst at Longacre Management, a $2 billions distressed debt hedge fund.

Sahm Adrangi became famous for shorting and exposing fraudulent Chinese companies in 2010 and 2011, including China Marine Food Group, China-Biotics, Lihua International, and others. His short targets China Education Alliance and ChinaCast Education Corp were later investigated and penalized by the SEC.

Kerrisdale is not a fund company that only shorts and never goes long, but recently its main focus has been on overvalued companies, with DAT being the latest target. As mentioned at the beginning, such a confident naked short must have identified a fundamental logical flaw. Kerrisdale’s shorting performance this year has not been outstanding, as most companies it shorted rebounded after a brief drop, but we still cannot ignore its unique insights into the DAT company model.

This year, although many US-listed companies have begun experimenting with the DAT company model for bitcoin, Ethereum, and even other altcoins, and well-known investors have cheered them on, Web3 industry figures including Vitalik have expressed concerns. In retrospect, these concerns are not unfounded. In a hot market with ample liquidity, DAT company stock prices can indeed soar, but this bubble-driven rise is ultimately unsustainable.

We do not deny that when the market as a whole is bullish, DAT companies can add fuel to the fire, but when the bubble bursts, whose eyes will be clouded by the ashes of this already-charred firewood?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.

Balancer Rallies to Recover and Redistribute Stolen Funds After Major Cyber Attack

In Brief Balancer plans to redistribute $8 million to users after a massive cyber theft. The recovery involved crucial roles by white-hat researchers rewarded with 10% incentives. Unclaimed funds will undergo governance voting after 180 days.

Bitcoin Faces Renewed Selling Pressure as Whale Deposits Spike and Market Fear Deepens