Key Notes

- BNB price fell 9.6% but held above $1.000, on Saturday, outperforming rival large-cap cryptocurrencies.

- Data shows traders favored BNB and BTC in “flight-to-safety” trades amid $19 billion in liquidations.

- The exchange token sector proved more resilient, declining only 5.4% versus the 9% global crypto market drop.

BNB price held above $1,130 on Saturday, October 11, declining 9.6% in line with the broader market crash that wiped out $19 billion from the global crypto liquidation in 24 hours. Yet, key market data shows BNB displayed stronger resilience and remains better positioned for an early rebound than rival layer-1 tokens.

BNB and BTC Cut Losses to Single Digits Amid Flight-to-Safety Bets

BNB retraced from all-time highs of $1,330 on Monday to a weekly low of $1,043 during Friday’s crash before rebounding to $1,132 at press time. Notably, BNB’s 9.6% intraday loss outpaces its modest 7-day decline of only 1.7%, signalling strong buying pressure re-emerging at key psychological levels as weak hands exited.

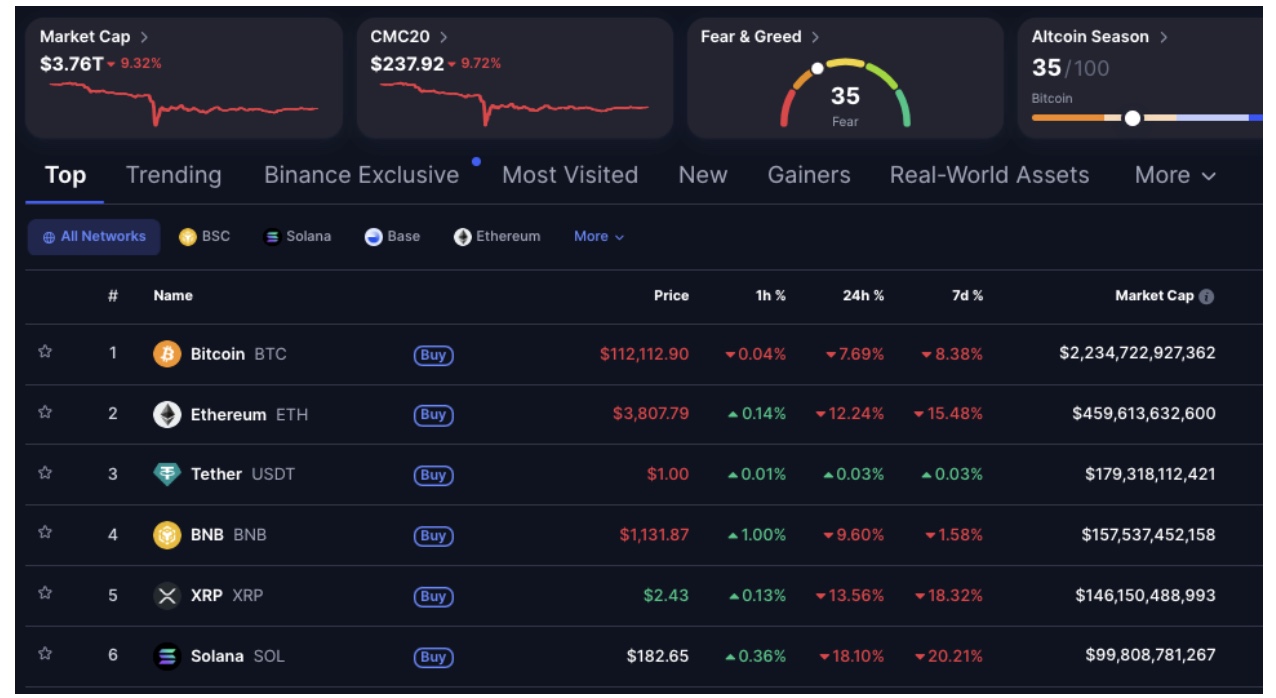

Top 6 Cryptocurrencies performance on October 11, 2025 | Source: CoinMarketCap

Beyond that, Coinmarketcap data shows BNB’s limited drawdown places it alongside Bitcoin (-7.69%) as one of the only top-five cryptocurrencies keeping daily losses in single digits, despite market liquidations exceeding $19 billion in the past 24 hours. This highlights active “flight-to-safety” rotation toward BTC and BNB during the ongoing market dip.

Why Is BNB Price Holding Above $1,000?

BNB’s successful defence of the $1,000 during the crypto crash on October 11 can be attributed to improved sentiment after setting new all-time highs in three consecutive weeks, and incidental demand from the market turbulence.

As the native token of Binance, the world’s largest crypto exchange and second-largest DeFi ecosystem , BNB benefits from multiple demand catalysts, from trading fee discounts to increasing network revenue during heightened volatility.

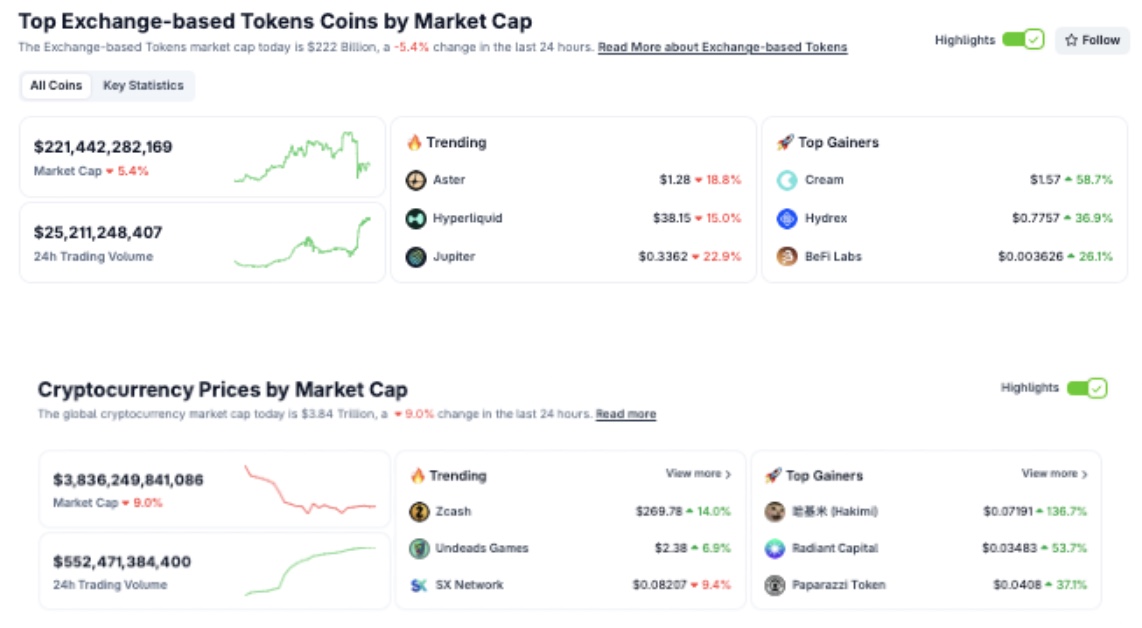

Exchange Token Sector dips 5.4% as Global Crypto Market Cap plunges 9% on October 11, 2025 | Source: Coingecko

This dual function makes BNB an attractive hedge during market stress. Coingecko’s aggregate data on the crypto exchange tokens sector further reflects this narrative on Saturday. As seen above, the exchange token sector declined by only 5.4% to $221.4 billion in aggregate market capitalization on Saturday, outperforming the broader crypto market’s 9% contraction to $3.8 trillion.

next