Key Notes

- Major financial institutions unite to bring blockchain infrastructure into mainstream global payment systems.

- The initiative aims to enhance settlement speed, reduce costs, and improve liquidity through stablecoin technology.

- Growing momentum follows Trump's Genius Act and Europe's similar euro stablecoin project launching in 2026.

Goldman Sachs Group Inc., Deutsche Bank AG, Bank of America Corp., and Banco Santander have joined forces in a nine-bank coalition to explore the creation of blockchain-based digital money. The initiative marks another major step by traditional financial institutions to integrate cryptocurrency infrastructure into global payment systems.

The consortium also includes BNP Paribas, Citigroup Inc., MUFG Bank Ltd, TD Bank Group, and UBS Group AG. Together, they plan to investigate the issuance of a 1:1 reserve-backed form of digital money available on public blockchains, with an initial focus on G7 currencies.

Goldman, Santander Among Banks Exploring Blockchain-Based Money

According to Bloomberg reports on Friday, the banks are in active discussions with regulators and supervisors in relevant jurisdictions. With the objective to create a new class of digital money, the project could improve payment efficiency and deliver the advantages of blockchain to mainstream finance.

This development comes as the global banking sector accelerates its blockchain adoption efforts. Stablecoins, cryptocurrencies pegged to fiat currencies like the US dollar or euro, have witnessed increased corporate demand over the past year.

While stablecoins remain primarily used in crypto trading, banks now see them as promising tools for instant settlement, cost reduction, and improved liquidity management.

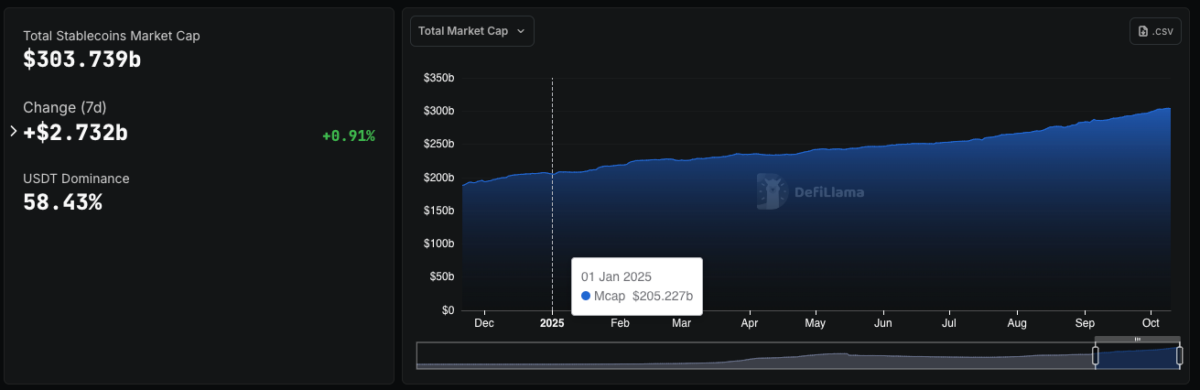

Global stablecoin circulation supply hits $303 billion, Oct. 10, 2025 | Source: DeFillama

DeFillama data shows the global stablecoin sector valuation has hit $303 billion at press time, increasing by nearly $100 billion in 2025 alone.

Trump’s Genius Act Sparks Global Stablecoin Adoption

US President Donald Trump’s signing of the Genius Act into law in July has intensified global momentum toward digital currency adoption, accelerating regulatory clarity and institutional participation.

In September, nine European banks, including ING, UniCredit, and Danske Bank, announced a similar initiative to develop a euro-denominated stablecoin compliant with the EU’s Markets in Crypto-Assets (MiCAR) framework . The “ Euro Stablecoin ” project aims to launch in the second half of 2026 as a strategic European alternative to dollar-based systems.

Meanwhile, this week, in the United States, North Dakota became the first state to announce plans for a state-backed “Roughrider Coin” for interbank payments and local business transfers.

next