Author: Spicy Rich

Translation: TechFlow

Why did the stock market and cryptocurrencies crash today? — Bitcoin, Dow Jones Index, S&P 500 Index, and Nasdaq Index all plummeted.

The worst day since April.

Here are the main reasons behind the current market pain.

Main Triggers

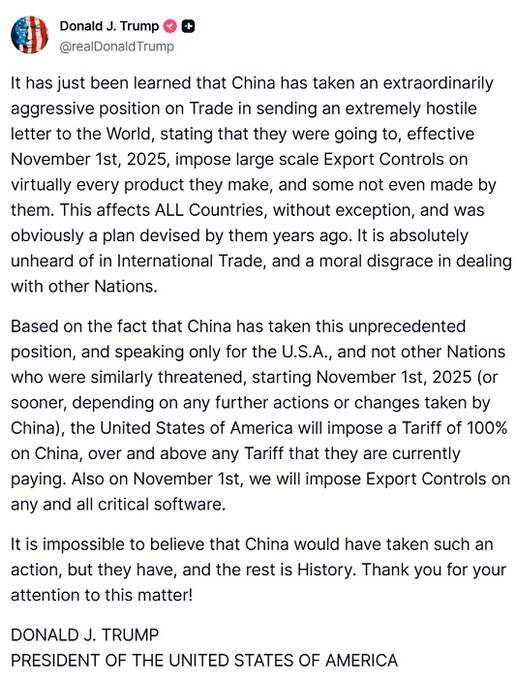

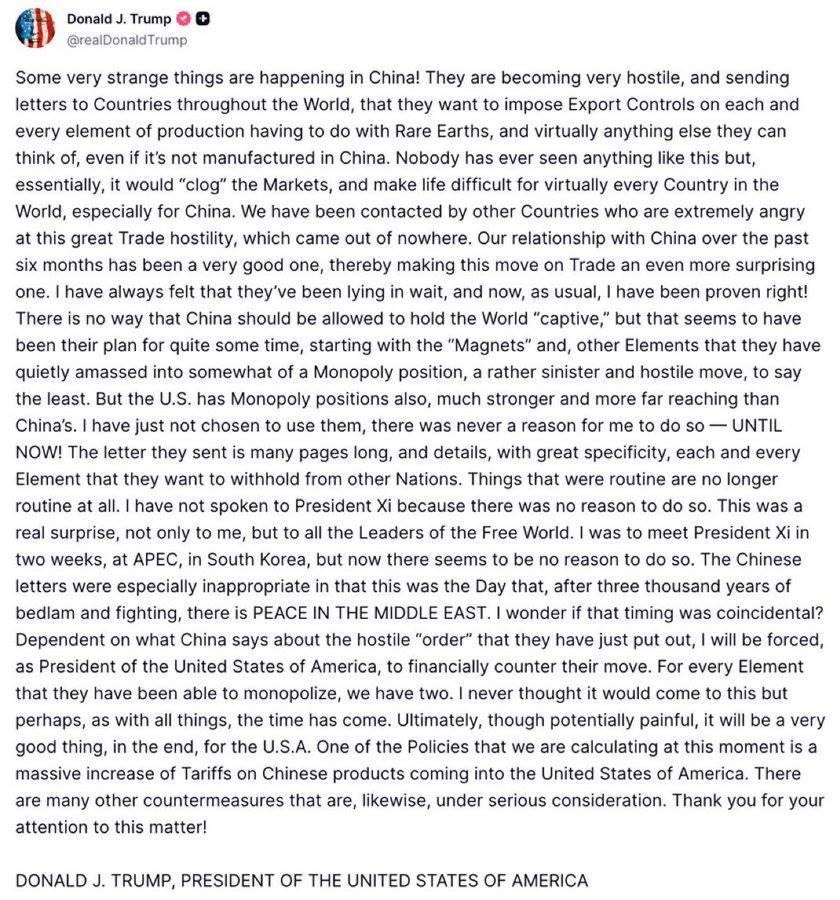

US President Trump posted on the social platform Truth Social, mentioning the possibility of imposing "massive" new tariffs on goods from China.

At first, I thought all of this was over.

We all know, tariffs = stock market/cryptocurrency crash.

But unfortunately, it’s not over yet.

Tariffs are like an extra tax on imported goods, which makes it more expensive for American consumers to buy products.

Trump stated that these tariffs could reach as high as 60%, and even up to 100% for certain goods. He also mentioned the possibility of canceling a meeting with Chinese President Xi Jinping.

This news frightened investors, as it sounded like the start of another major trade war between the US and China.

Why did Trump say this?

This is a response to actions taken by China.

China has introduced new regulations restricting the export of rare earth minerals—these rare earths are crucial materials for manufacturing tech products such as computer chips, electric vehicle batteries, and even weapons.

Additionally, since October 14, China has imposed fees on US ships docking at its ports, launched an antitrust investigation into Qualcomm, and stopped purchasing US soybeans.

These moves have made US companies worry that their supply chains could be affected.

Many US tech companies rely on Chinese components to produce products like smartphones, computers, and electric vehicles.

If rare earth minerals become harder to obtain, production will slow down, costs will rise, and innovation will be hampered.

This has made investors worry about future profits, leading them to sell off stocks in these industries.

Broader Economic Impact

Tariffs could trigger inflation—because companies will pass on the extra costs to consumers, causing prices to rise.

If trade shrinks, companies may reduce hiring or investment, and economic growth could slow down.

In the worst-case scenario, if the situation escalates, it could lead to a recession.

Another Contributing Factor

The US government shutdown has entered its 10th day, which also adds to the uncertainty.

Without funding, key services are forced to pause, and important economic data (such as employment reports) will also be delayed.

This makes it difficult for investors and the Federal Reserve to make informed decisions, further exacerbating overall concerns.

Why This Drop Was Especially Severe

Trading mechanisms played a role in this.

When bad news arrives, automated trading systems and large investors quickly start selling.

This triggers "stop-loss orders"—automatic sell orders used to limit losses—which then causes a chain reaction, amplifying the market decline.

Short selling increased, algorithms triggered stop-loss orders, and options expiration further intensified the drop.

The rapid unwinding of concentrated positions in tech stocks—a classic momentum reversal—occurred after the post-election market surge.

What Happens Next?

This could be a negotiation tactic ahead of the leaders' meeting.

If the issues are resolved, the market may rebound.

But if tensions persist, expect continued market volatility, rising costs affecting everyone, and pressure on global economic growth.