Against the backdrop of the Federal Reserve pause, U.S. Treasury supply is being well absorbed by the market

Jinse Finance reported that interest rate strategists at Société Générale stated in a report that despite the U.S. government being in a shutdown, the market's focus remains on the supply of U.S. Treasury bonds, and the absorption of this supply by the market has been good. They pointed out that U.S. Treasury yields have continued to trade within a narrow range, while swap spreads have continued to widen. According to Tradeweb data, U.S. Treasury yields declined during the Asian trading session, with the two-year Treasury yield falling by 1.2 basis points to 3.586%; the ten-year and thirty-year Treasury yields both dropped by 1.9 basis points, to 4.128% and 4.714% respectively. (Golden Ten Data)

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

S&P 500 index futures rise 0.2%

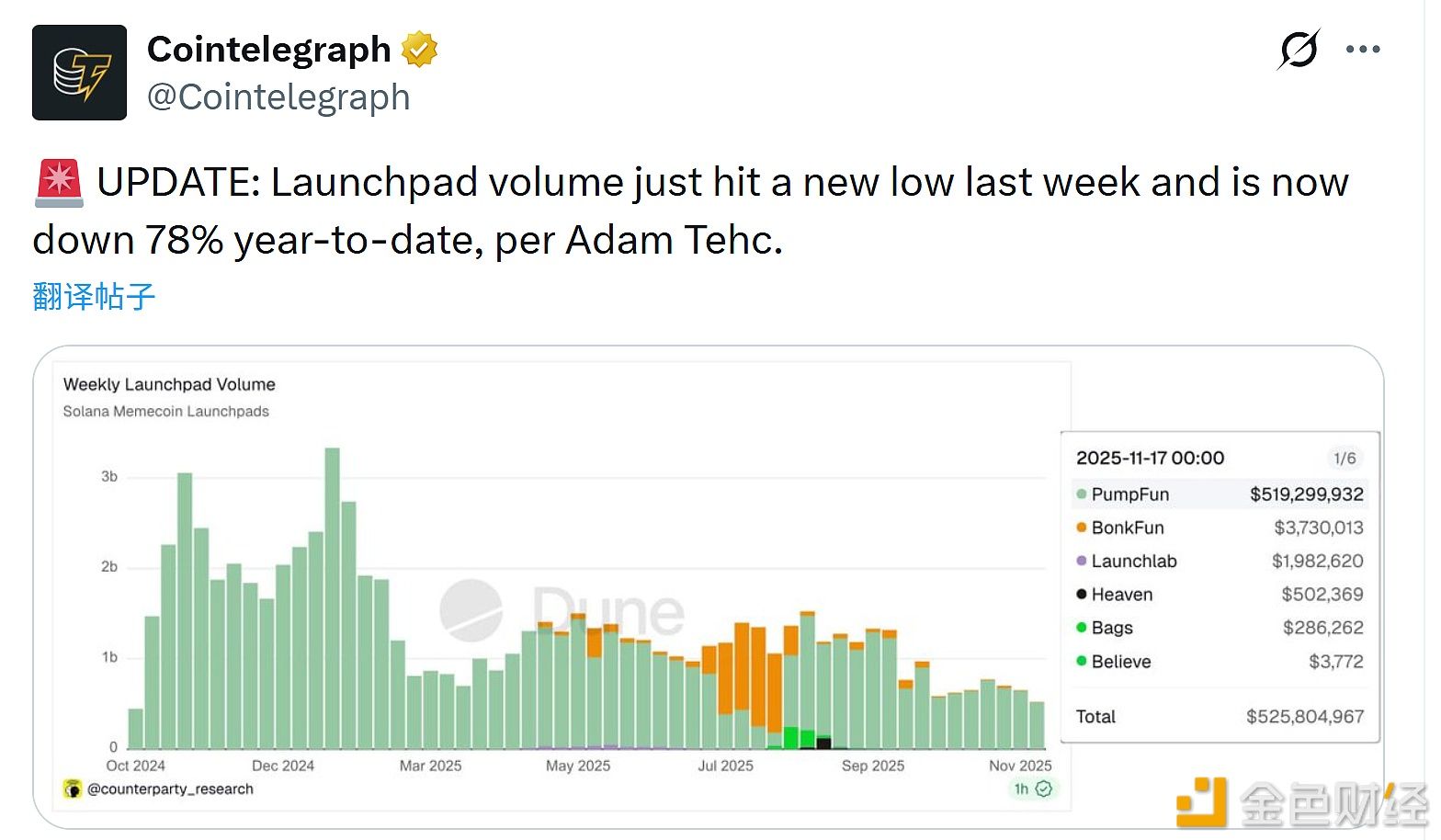

Adam Tech: Launchpad trading volume hit a new low last week

Data: Hyperliquid platform whales currently hold $4.576 billions in positions, with a long-short ratio of 0.93