Chainlink's LINK Tumbles 4% as Selling Pressure Mounts

The native token of oracle network Chainlink LINK$21.80 encountered substantial institutional selling pressure over the 24-hour trading session, tumbling to its weakest price in more than a week.

LINK tumbled 4% to a session low of $21.30, reversing over 8% from Monday's local high, CoinDesk data shows. The decline happened in line with weakness in the broader crypto market. The CoinDesk 20 Index, a benchmark for that broader market market, was also down around the same amount.

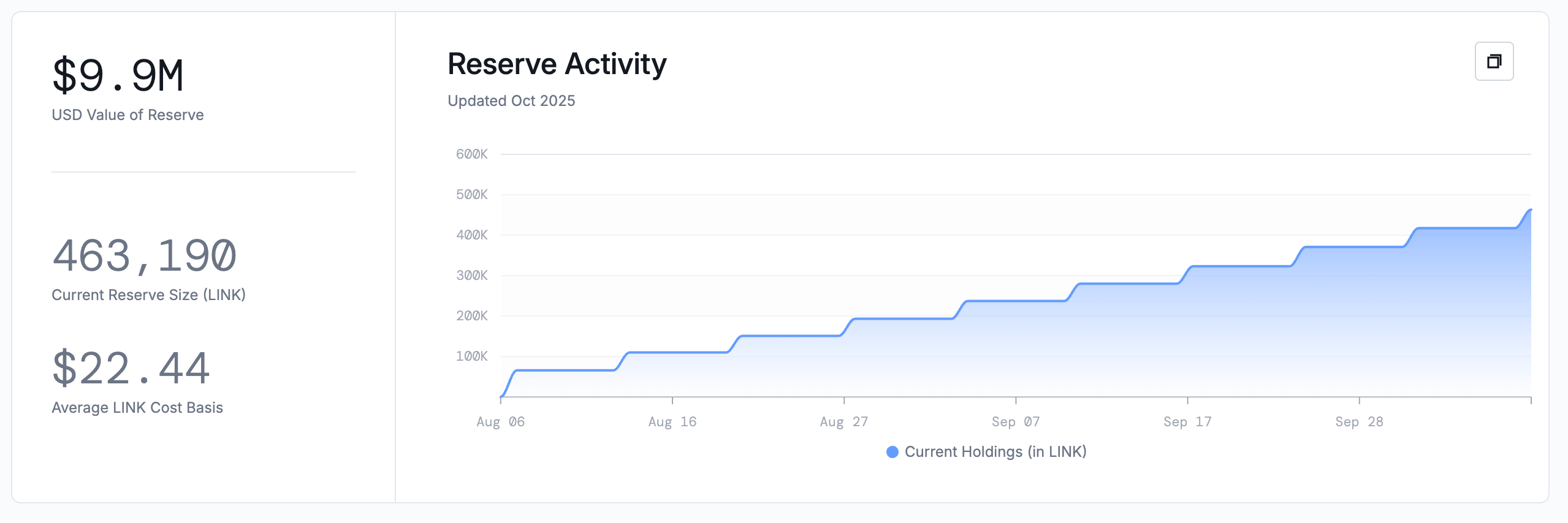

Meanwhile, the Chainlink Reserve, a facility that purchases tokens on the open market using income from protocol integrations and services, kept its weekly habit, buying another 45,729 LINK worth nearly $1 million on Thursday. The reserve currently holds nearly $10 million worth of tokens.

Thursday's decline, however, meant that the vehicle is now underwater with LINK trading below the average cost basis of $22.44, the dashboard shows.

Key technical indicators

CoinDesk Research's technical model pointed out bearish momentum, underscoring the weakening investor sentiment.

- The token's trading range expanded to $1.05, representing 5% volatility between the session low of $21.53 and peak of $22.68.

- Technical resistance materialized at the $22.68 level, where the token reversed course on exceptionally heavy volume of 1,981,247 units.

- Additional resistance formed at the $21.92 level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Will Zcash's ZEC return to $500 or higher before 2026?

Bitcoin's ‘bear flag pattern’ targets $67K as BTC spot demand slumps

Bitcoin Hash Ribbons flash ‘buy’ signal at $90K: Will BTC price rebound?

How to achieve an annualized return of 40% through arbitrage on Polymarket?

By demonstrating arbitrage structures with live trading, this provides a clear reference for the increasingly intense arbitrage competition in the current prediction markets.