Date: Thu, Oct 09, 2025 | 06:30 PM GMT

The cryptocurrency market is shifting its focus toward DeFi and privacy-based tokens, as projects like Aster and Hyperliquid witness strong growth in trading volume. Meanwhile, the privacy sector is catching fire — especially Zcash (ZEC) , which has gone vertical with a stunning +400% surge over the last 60 days.

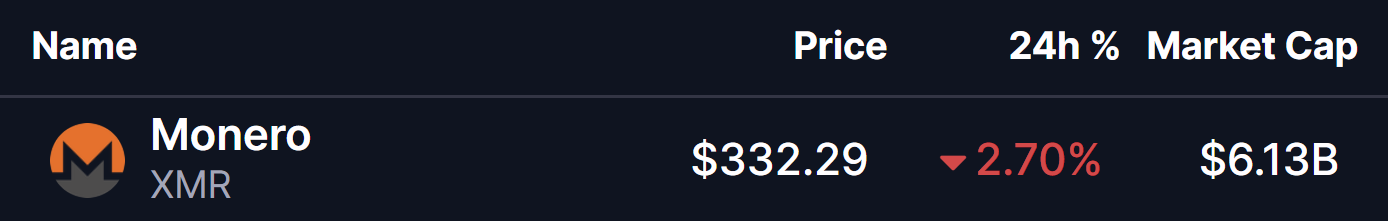

Amid this, another major privacy coin, Monero (XMR) , has been trading slightly in the red today, but its latest technical setup is hinting at a potential bullish structure—one that closely mirrors Zcash’s explosive rally—suggesting that a similar surge could be brewing.

Source: Coinmarketcap

Source: Coinmarketcap

XMR Mirrors ZEC’s Breakout Pattern

A comparison of XMR and ZEC on the daily chart reveals a striking structural resemblance, indicating a potential fractal repetition — where XMR could follow a similar price behavior that ZEC displayed earlier.

Recently, ZEC completed a falling wedge breakout, reclaimed its 100-day moving average, and cleared multiple resistance levels. This sequence triggered a massive 418% rally, lifting its price from the breakout zone around $41 to today’s high near $213.

ZEC and XMR Fractal Chart/Coinsprobe (Source: Tradingview)

ZEC and XMR Fractal Chart/Coinsprobe (Source: Tradingview)

Now, XMR appears to be repeating that same setup. The token has already broken out of its falling wedge pattern, reclaimed the 100-day MA, and initiated a short-term rally before the current minor retracement.

What’s Next for XMR?

If XMR continues to follow ZEC’s fractal structure, the current pullback may act as a launchpad for the next major rally.

The next resistance levels to watch are at $337 and $384. A decisive breakout above these zones would likely confirm renewed bullish momentum and open the path toward the $750 region — aligning with the magnitude of ZEC’s recent explosive move.

However, it’s important to note that fractal patterns do not guarantee identical outcomes. Market sentiment, volume, and broader trends will play crucial roles in confirming this setup.