Solana beats Ethereum with $2.85B in yearly revenue

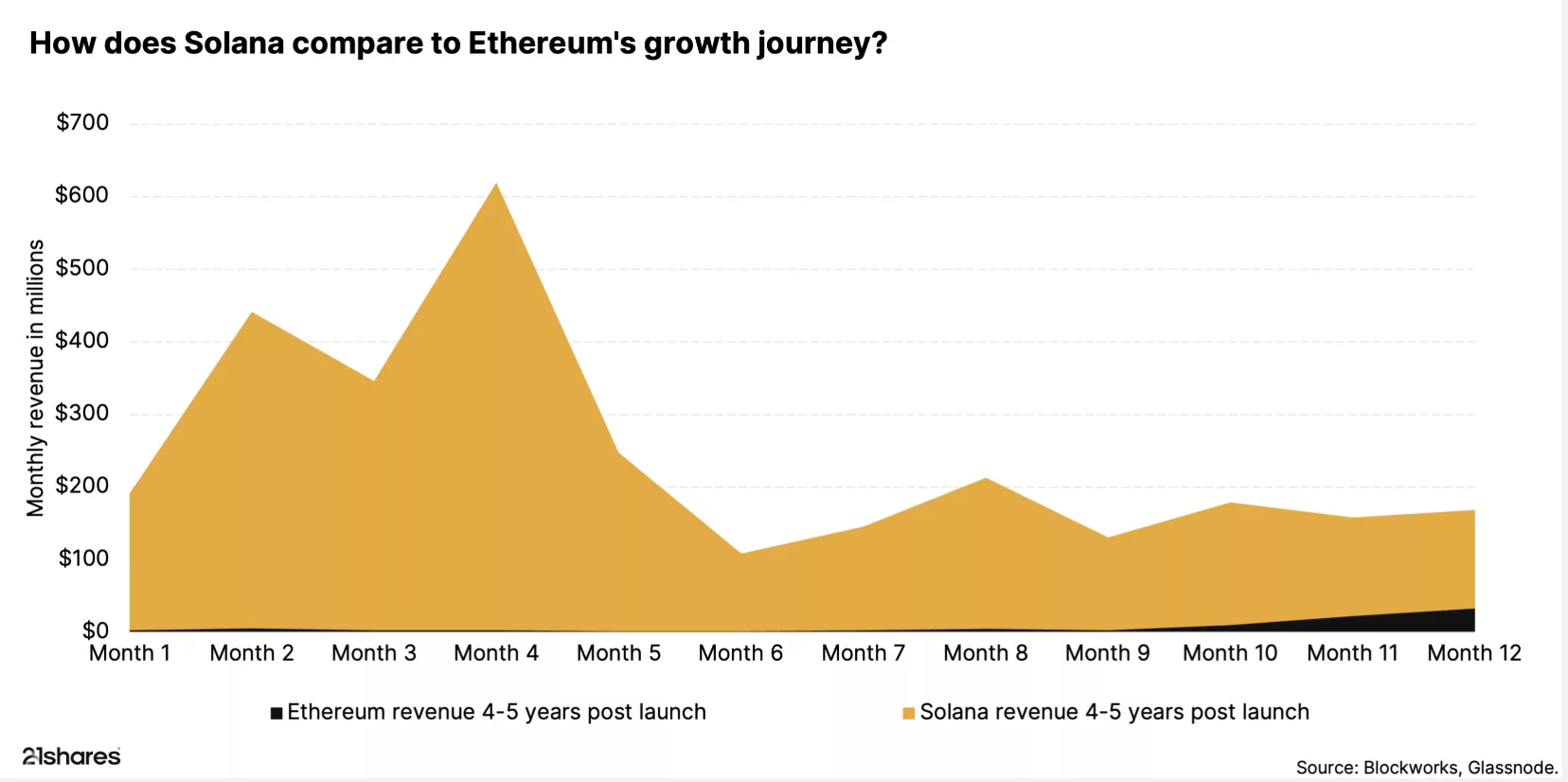

Solana is outpacing Ethereum’s early growth, generating $2.85 billion in revenue over the past year—more than 20 times what Ethereum earned at a comparable stage in its lifecycle.

- Trading tools drove $1.12 billion (39% of total revenue), with January 2025 hitting a record $616 million in monthly revenue.

- Solana now averages 1.2–1.5 million daily active addresses, far exceeding Ethereum’s 400,000–500,000 during a similar stage.

According to a recent report by 21Shares , Solana ( SOL ) generated $2.85 billion in revenue over the past year, with trading tools alone contributing $1.12 billion, or 39% of the total.

Platforms like Photon and Axiom, which offer faster swaps and advanced execution features, drove much of that growth — generating as much as $260 million in a single month during the peak of the memecoin craze in January (which was the network’s highest monthly revenue on record, with total revenue exceeding $616 million.)

Even after the January spike, Solana continued to generate $150 million–$250 million per month, reflecting strong and sustained demand for its low-cost, high-speed infrastructure.

Source:

Source:

Solana’s growth outpaces Ethereum

By comparison, Ethereum ( ETH ), at a similar stage in its lifecycle, generated far less revenue. Between 2019 and 2020, roughly 4 to 5 years after its launch, Ethereum’s monthly revenue averaged under $10 million, constrained by lower adoption, network congestion, and gas fees. Daily active addresses on Ethereum during that period hovered around 400,000–500,000, significantly below Solana’s current 1.2–1.5 million.

According to the 21Shares report, this comparison underscores just how quickly Solana has scaled its ecosystem and monetized network activity. While Ethereum was the pioneer of smart contracts and DeFi, Solana’s high throughput and ultra-low fees have allowed it to capture a far wider range of activity earlier in its lifecycle.

Looking ahead, upcoming technical upgrades — including the Firedancer validator client and Alpenglow finality improvements — are set to further increase throughput and reduce transaction times, positioning Solana to handle even larger volumes of activity.

“Solana’s story is no longer one of resilience, but of readiness. Its ecosystem has moved from potential to execution, with real-world use cases now fully operational. Together, these developments are cementing Solana’s role as a scalable and commercially viable digital economy,” the report concluded.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

OpenAI Ordered to Hand Over 20M ChatGPT Logs in NYT Copyright Case

Unprecedented "burn rate"! Wall Street estimates: Before turning profitable, OpenAI will have accumulated losses of $140 billion.

According to data cited by Deutsche Bank, OpenAI may accumulate losses exceeding 140 billions USD before reaching profitability, with computing power expenses far surpassing revenue expectations.

VIPBitget VIP Weekly Research Insights

Morning Brief | Ethereum completes Fusaka upgrade; Digital Asset raises $50 million; CZ's latest interview in Dubai

Overview of major market events on December 4.