Ethereum (ETH) Price Could Dip 6% Before Rallying Toward New Highs — Here’s Why

Ethereum’s latest chart setup hints that a short correction may come before its next rally. While retail traders take profits, whales are adding steadily, and on-chain signals suggest conviction remains strong. A brief dip toward $4,400 could set the stage for Ethereum’s next major breakout.

Something interesting is brewing on Ethereum’s chart. After weeks of steady gains, the Ethereum price seems to be pausing near $4,700, but not in a way that signals weakness. Instead, the data and patterns suggest a small drop could be exactly what ETH needs before it moves higher again.

A pullback toward $4,410, roughly a 6% dip, could complete a classic reversal setup — one that often appears before major rallies. But first, on-chain data shows why traders are cautious in the short term.

Exchange Flows Ease as Whales Stay Cautious

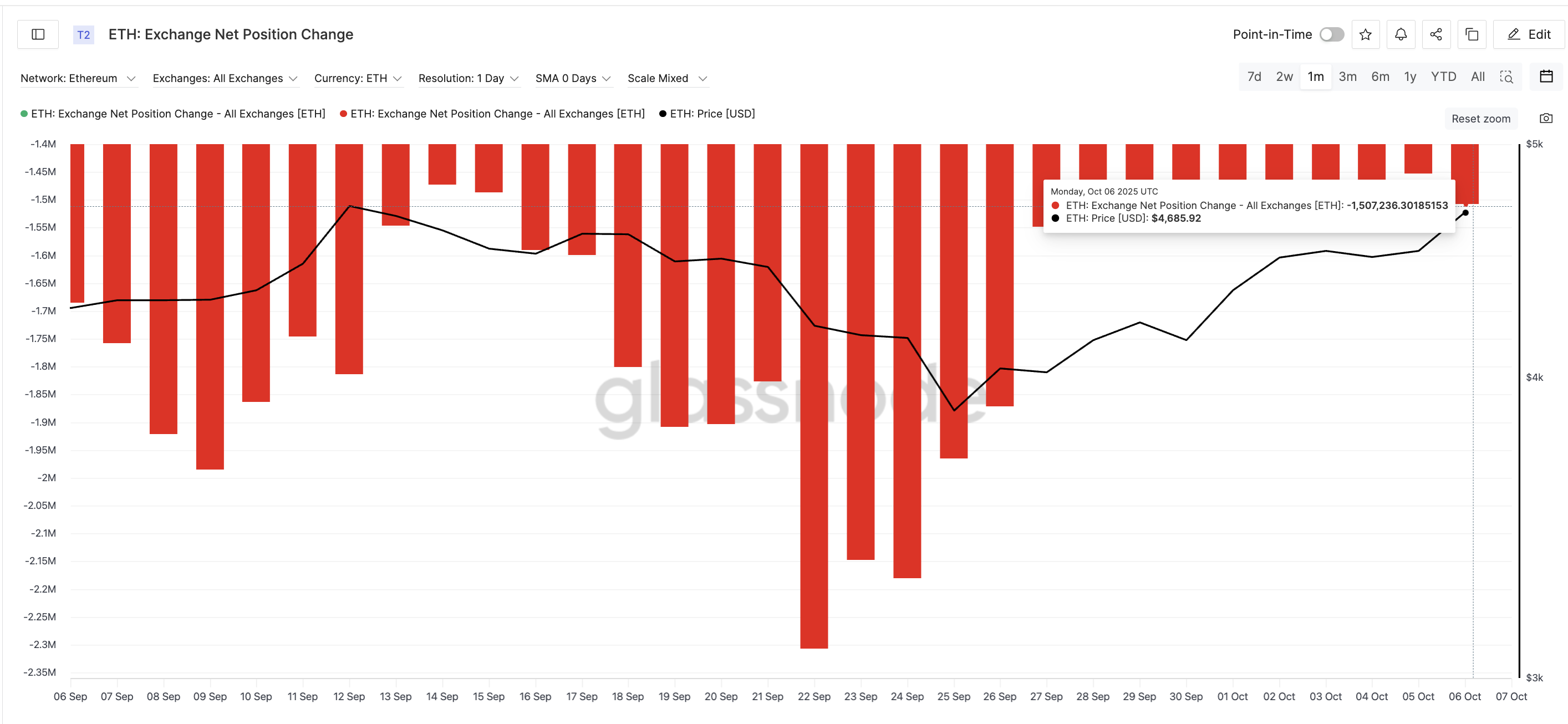

Ethereum’s exchange net position change — which measures how many coins move in or out of centralized exchanges — shows a slowdown in buying activity. When this number is deeply negative, more coins are being withdrawn, meaning investors are holding. As it becomes less negative, traders are sending more coins to exchanges, usually to take profits.

As of October 6, ETH’s net position change stands at –1.5 million, up from –2.3 million on September 22, a 35% shift towards selling pressure. The smaller negative value means fewer withdrawals and slightly more deposits, showing that some traders might be interested in taking profits after the recent climb.

Ethereum Sellers Gaining Ground:

Ethereum Sellers Gaining Ground:

However, whale wallets holding large amounts of ETH are still showing conviction. Over the past two days, their combined holdings have increased from 99.16 million to 99.26 million ETH, roughly $470 million, according to Santiment data.

That’s a slow but steady sign of confidence, even as some traders book gains, possibly retail.

Ethereum Whales Continue Buying:

Ethereum Whales Continue Buying:

This mix of light retail selling and cautious whale buying usually signals that markets are waiting for a better entry — often right before a short-term price correction.

Ethereum Price Chart Points to Temporary Dip Before Next Move Higher

On the daily chart, Ethereum trades inside an inverse head-and-shoulders pattern, a structure that often forms before bullish breakouts. The “head” sits lower, while the neckline aligns around $4,740.

For the pattern to complete, Ethereum might need to dip toward $4,410 to form the right shoulder, a 6% move on the downside from the current levels. The Relative Strength Index (RSI), which tracks buying momentum, supports this setup. Between September 12 and October 7, RSI made a higher high while prices made a lower high — a hidden bearish divergence that often precedes a correction.

Ethereum Price Analysis:

Ethereum Price Analysis:

If the pullback happens, a bounce near $4,410 could set Ethereum up for a breakout above $4,740. A confirmed daily candle above that level would open the door to $4,950 (near the previous all-time high), and possibly new highs beyond it.

On the flip side, if Ethereum skips the correction and closes above $4,740 now, the immediate dip thesis would be invalidated, confirming continued strength. A more bearish scenario, however, would unfold only if the Ethereum price falls below $4,270, which would delay the bullish pattern and extend the consolidation.

Either way, Ethereum’s broader uptrend remains intact — this pause just might be the calm before another strong push upward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.