Morgan Stanley recommends up to 4% crypto exposure in growth portfoliosMorgan Stanley calls Bitcoin “digital gold”

Morgan Stanley has outlined new allocation limits for cryptocurrencies in client portfolios as it prepares to open the door for retail crypto trading next year.

- Morgan Stanley analysts are recommending up to 4% crypto allocation in select client portfolios.

- The financial services giant said Bitcoin can be considered as digital gold.

- Morgan Stanley is looking to offer retail crypto trading via its subsidiary E-Trade.

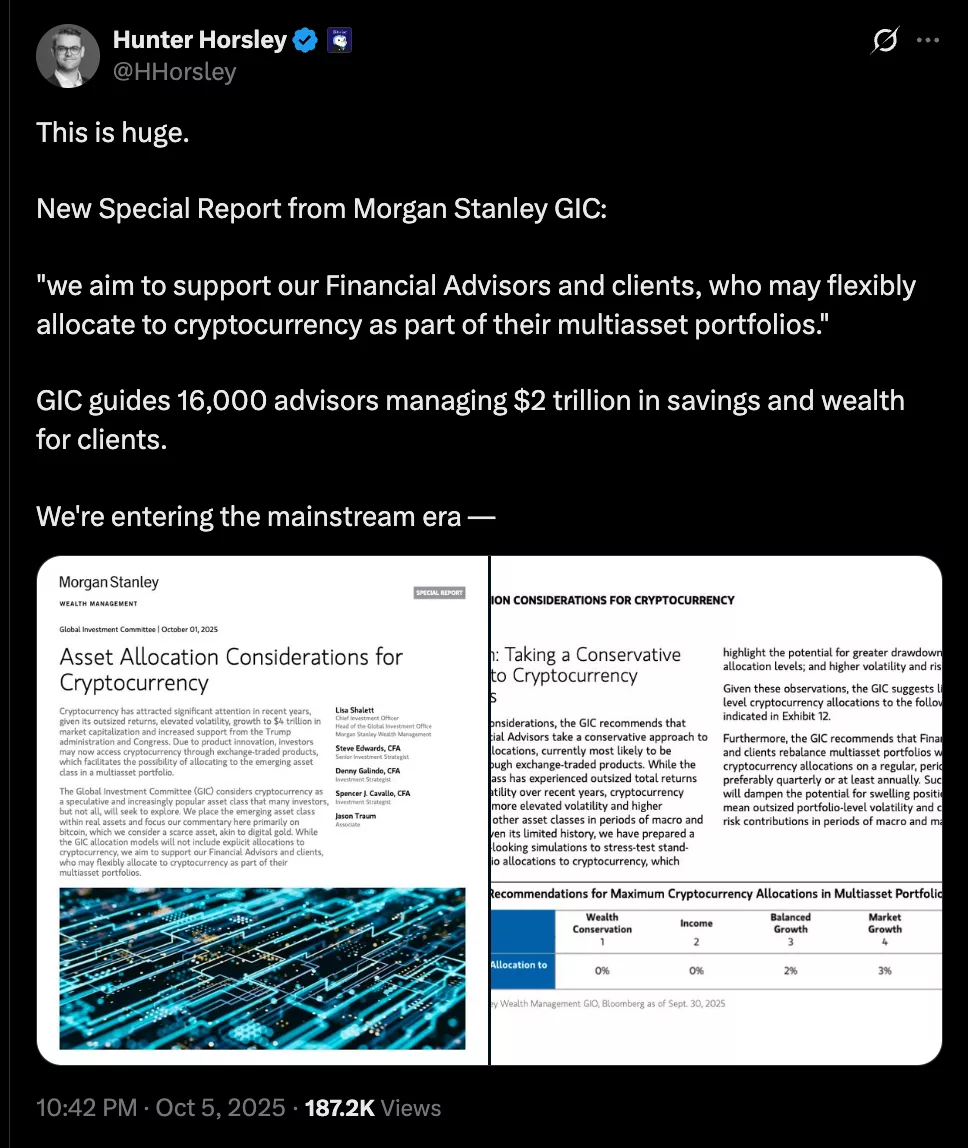

In an October Global Investment Committee report, Morgan Stanley analysts recommended conservative exposure for its model portfolios of 1% to 2% for income and balanced growth strategies, and up to 4% for portfolios focused on “opportunistic growth.”

“While the GIC allocation models will not include explicit allocations to cryptocurrency, we aim to support our Financial Advisors and clients, who may flexibly allocate to cryptocurrency as part of their multi-asset portfolios,” the report said.

Morgan Stanley calls Bitcoin “digital gold”

Morgan Stanley analysts are primarily focused on Bitcoin, as they believe it is a scarce asset that is “akin to digital gold,” offering long-term value in diversified portfolios. At the same time, they advised financial advisors to take a “conservative approach” given the asset class’s history of volatility and its tendency to move in step with broader markets during times of stress.

“GIC recommends that Financial Advisors and clients rebalance multi-asset portfolios with cryptocurrency allocations on a regular, periodic basis: preferably quarterly or at least annually,” the authors wrote, adding that rebalancing could help keep risk in line with portfolio objectives and prevent outsized exposure to a single asset class over time.

Commenting on the development, Bitwise CEO Hunter Horsley noted that cryptocurrencies were entering the “mainstream era,” calling the report a “huge” development.

Bitwise CEO Hunter Horsley on the Morgan Stanley GIC report | Source: Hunter Horsely on X

Bitwise CEO Hunter Horsley on the Morgan Stanley GIC report | Source: Hunter Horsely on X

Morgan Stanly eyes crypto trading in 2026

Morgan Stanley has called for a measured allocation and disciplined portfolio management approach, as institutions are increasingly embracing Bitcoin as a treasury asset and a long-term store of value. The flagship cryptocurrency has recently hit a new all-time high above $125,000, driven by this institutional demand, and retail investors haven’t hesitated to follow.

The financial services giant is also working on plans to capitalize on this demand and is working to introduce crypto trading through its discount brokerage platform E-Trade, which it acquired in 2020.

To develop the platform, Morgan Stanley has partnered with crypto startup Zerohash, but the exact details of the integration and product rollout timeline have yet to be finalized. Initial reports suggest a 2026 launch.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.