A New Bitcoin All-Time High Could Come As Early As Next Week | US Crypto News

Standard Chartered’s Geoff Kendrick predicts Bitcoin could hit $135K as US shutdown risks and ETF inflows fuel a breakout toward new all-time highs.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as markets brace for another pivotal moment. From Washington’s shutdown to deep-pocketed crypto whales pushing leverage, forces are converging that could propel Bitcoin (BTC) into uncharted territory. Analysts find themselves split on whether this strength is solid or fragile.

Crypto News of the Day: Geoff Kendrick Sees Bitcoin Ready for $135,000 as Shutdown Looms

Bitcoin may be on the brink of a fresh all-time high, according to Standard Chartered’s Head of Digital Assets Research, Geoff Kendrick.

In an exclusive email to BeInCrypto, Kendrick said he expects Bitcoin to “print a fresh all-time-high next week” and push toward his long-held Q3 target of $135,000, reported in a recent US Crypto News publication.

The catalyst, he argues, lies in the dynamics of the US government shutdown.

“The shutdown matters this time around. During the previous Trump shutdown (December 22, 2018, to January 25, 2019), Bitcoin was in a different place than it is now, so it did little. However, this year, Bitcoin traded with US government risks, as best shown by its relationship to US treasury term premium,” Kendrick explained.

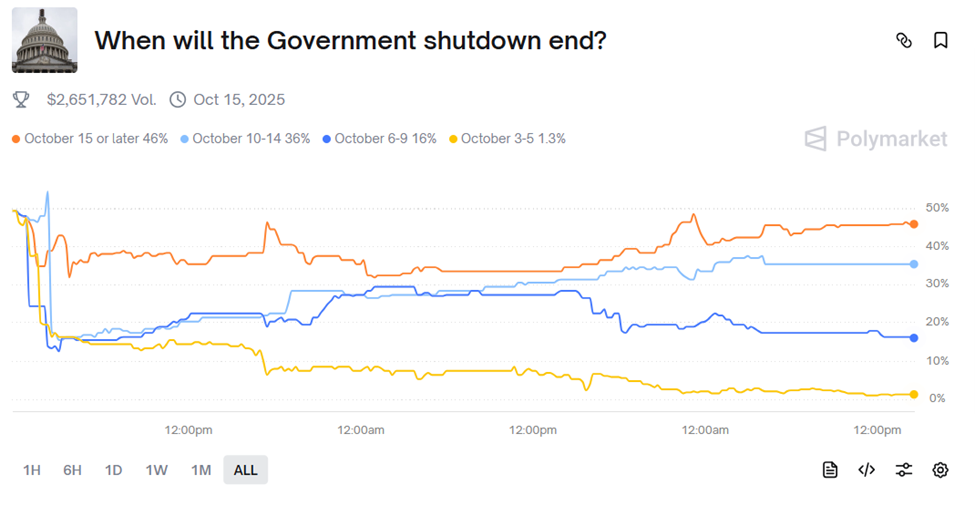

On Polymarket, traders are pricing a 60% probability that the shutdown lasts between 10 and 29 days, suggesting no quick resolution.

US Government Shutdown Timeline Probabilities. Source:

Polymarket

US Government Shutdown Timeline Probabilities. Source:

Polymarket

For Kendrick, this creates an extended environment in which Bitcoin can outperform as a hedge against fiscal gridlock and US credit stress.

The other key driver lies in ETF flows. Gold has been outperforming Bitcoin ETFs in recent weeks, but Kendrick expects that trend to reverse.

“Net Bitcoin ETF inflows are now at USD58bn, of which USD23bn has been in 2025. I would expect at least another $20 billion by year-end, a number which would make my $200,000 year-end forecast possible,” he said.

With Uptober underway and liquidity dynamics turning in Bitcoin’s favor, Kendrick believes the market is set to reward holders with a new peak in the coming days.

Perp Whales Drive Aggressive Longs, Raising Both Hopes and Risks

While macro tailwinds dominate headlines, on-chain and derivatives data indicate growing momentum for Bitcoin’s next breakout. Analysts at CryptoQuant and other firms highlight a surge in perpetual futures activity led by perp whales.

“Bitcoin perp whales went long heavily on OKX, Bybit, HTX. The taker buy ratio on OKX is the highest since January 2023,” wrote Ki Young Ju, founder and CEO of CryptoQuant.

According to Ki, the current setup marks the fourth attempt to break Bitcoin’s ATH, only this time, perp whales are on the frontline.

4th attempt to break Bitcoin ATH, but this time with perp whales.

— Ki Young Ju (@ki_young_ju) October 3, 2025

Supporting this, analyst Maartunn observed that since the monthly open, taker buy volume has exceeded sell volume by roughly $1.8 billion.

“Futures buyers are stepping up…clear sign of aggressive long positioning,” Maartunn stated.

This activity has fueled speculation that a leveraged rally may be in the works. In a recent analysis, Maartunn explained that rallies powered primarily by borrowed capital rather than long-term spot accumulation are inherently fragile.

“It might look impressive for a little while, but it’s incredibly unstable and just waiting for a reason to fall over,” he warned.

The risk is that heavy long positioning could trigger cascading liquidations if momentum falters, suppressing spot demand even as prices rise.

This makes current valuations more speculative than sustainable. Still, with whale positioning aligned with macro catalysts like the government shutdown and ETF flows, the conditions appear ripe for Bitcoin to finally clear its all-time high barrier.

Chart of the Day

Bitcoin Taker Buy Sell Ratio. Source:

CryptoQuant

Bitcoin Taker Buy Sell Ratio. Source:

CryptoQuant

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.