Deutsche Börse and Circle Partner to Expand Stablecoin Use in Europe

Europe’s largest exchange operator is moving to put stablecoins inside its market infrastructure. The step is designed to push the euro closer to relevance in digital finance. Deutsche Börse Group said it will work with Circle Internet Financial to deploy the issuer’s euro- and dollar-backed tokens under the EU’s new crypto rulebook. The initiative also

Europe’s largest exchange operator is moving to put stablecoins inside its market infrastructure. The step is designed to push the euro closer to relevance in digital finance.

Deutsche Börse Group said it will work with Circle Internet Financial to deploy the issuer’s euro- and dollar-backed tokens under the EU’s new crypto rulebook. The initiative also follows recent pilots where Circle’s USDC and EURC were used by Visa to test faster cross-border settlement for businesses.

Deutsche Börse and Circle target MiCA-regulated adoption

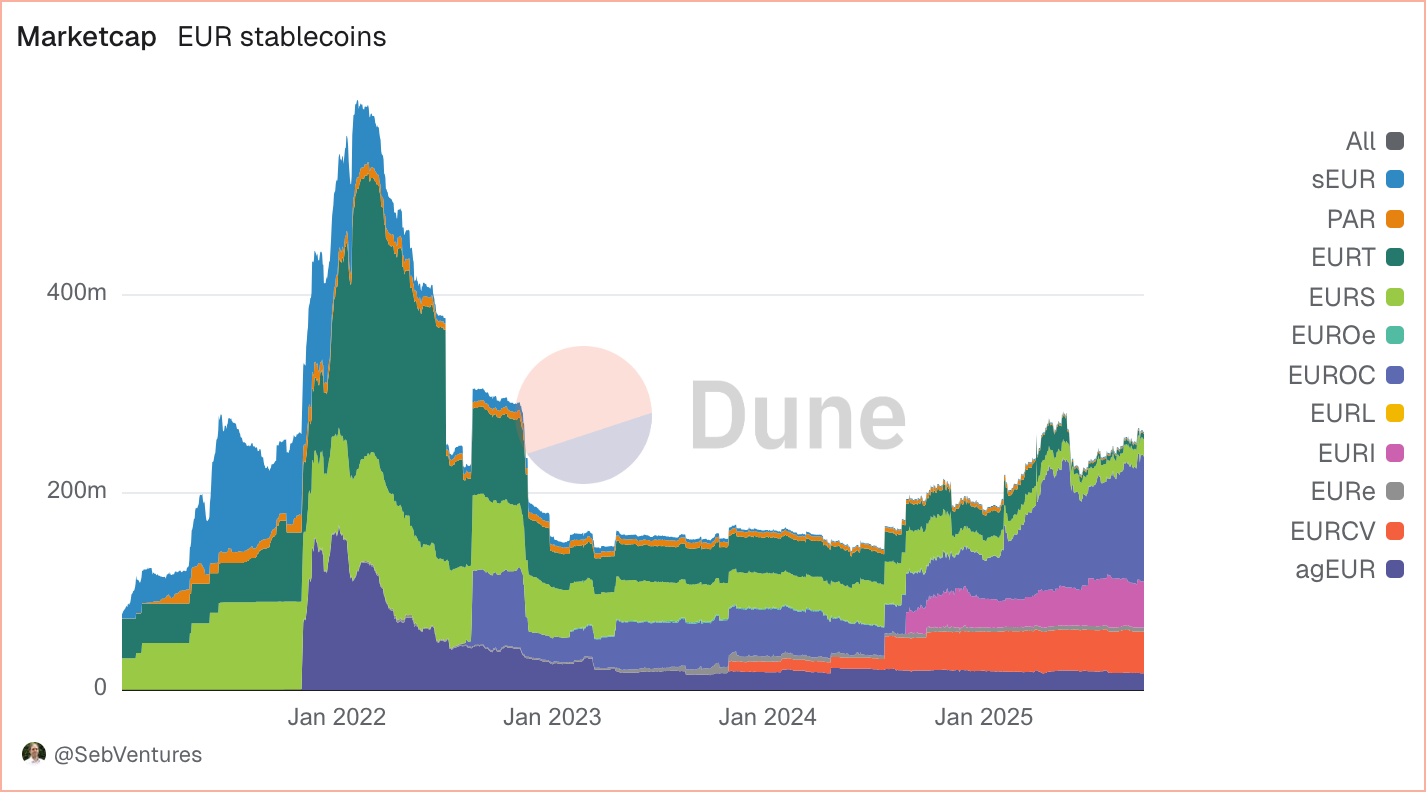

The partnership comes as euro stablecoins remain marginal. Their combined value is below €350 million compared with more than $160 billion for dollar tokens.

By integrating Circle’s EURC and USDC into its 360T trading platform, institutional broker Crypto Finance, and Clearstream’s custody network, Deutsche Börse aims to narrow that gap. Circle stressed it was the first global issuer to achieve compliance with the EU’s Markets in Crypto-Assets Regulation (MiCA).

Source:

Dune Analytics

Source:

Dune Analytics

Market capitalization of euro-denominated stablecoins from 2021 to 2025 shows fragmentation among issuers. The market remains under €500 million compared with more than $160 billion in dollar-backed tokens.

“Digital assets have the potential to reshape financial markets by enhancing efficiency and security. Through this collaboration, we are taking a decisive step toward integrating stablecoins into trusted infrastructure,” Stephanie Eckermann, Deutsche Börse board member said.

Regulators cautious as rivals intensify competition

The move intensifies competition. Nine European banks, including ING and UniCredit, formed a consortium to issue a euro token by 2026, subject to Dutch regulatory approval. Meanwhile, Société Générale’s Forge has already launched its own euro-denominated coin on Stellar.

Policymakers remain divided. The European Central Bank has warned MiCA may be too lenient. In contrast, the European Commission is preparing to loosen rules. EU officials have cautioned that unchecked U.S. tokens could undermine the stability of the euro.

In addition, experts highlight shortcomings in cross-border issuance. A BeInCrypto report called the framework incomplete. ECB adviser Jürgen Schaaf argued in an ECB blog that sovereignty could erode without a strategic response, though disruption might also strengthen the euro.

Resistance persists. Tether CEO Paolo Ardoino has mocked the digital euro and rejected MiCA compliance. Meanwhile, consumer advocates warn that non-transparent issuers risk exclusion from EU markets.

For Deutsche Börse and Circle, the bet is that embedding regulated stablecoins in mainstream systems could redraw Europe’s financial plumbing. It may also define the euro’s role in global digital finance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

Crypto: Fundraising Explodes by +150% in One Year