This is not the end, but a bear market trap: Cycle psychology and the prelude to the next bull run

The recent market performance has left many investors confused. Bitcoin remains stagnant, Ethereum has entered a consolidation phase after a brief rise, and altcoins lack sustained liquidity. For many, this seems like a signal of the "end of the bull market," but in reality, this is a classic Bear Trap.

1. Historical Bear Traps

Every crypto cycle has similar moments:

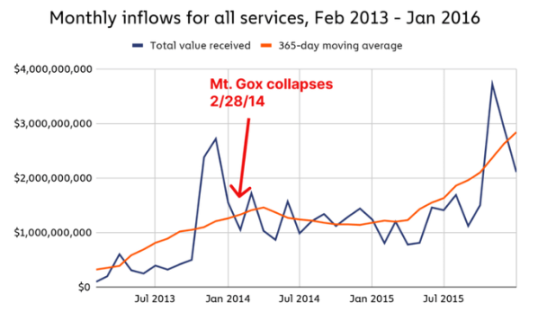

2011 and 2013: The Mt.Gox collapse triggered massive panic;

2017: Bitcoin’s first sharp drop caused a large number of investors to exit the market;

2021: As cryptocurrencies entered the mainstream, the fear triggered by market declines became even more intense.

These phases are often accompanied by 50%-80% pullbacks, each time being considered the "end" of crypto, but in fact, they have proven to be merely the prelude to a new round of surges.

2. The Market’s Psychological Cycle

The market operates according to a fixed psychological sequence:

Euphoria

Sharp Correction

Panic

Exit of Weak Hands

Final Impulse

This pattern is almost unchanged, whether in crypto or traditional financial markets.

3. Current Market Signals

Although short-term sentiment is sluggish, data shows the market has not lost its vitality:

ETF inflows remain stable, indicating institutional interest has not waned;

The Altseason Index is climbing;

The M2 liquidity index is rising;

**BTC.D (Bitcoin Dominance)** is slightly declining, which means funds are gradually preparing to flow into altcoins.

This is more like an "endurance race," where whales create fear and exhaustion to force retail investors to sell, thus accumulating at lower prices.

4. How Should Investors Respond?

At times like this, emotions are often the biggest enemy. The correct approach is to:

Stay calm and not be swayed by short-term fluctuations;

Develop and stick to a clear trading plan;

Focus on core assets: BTC, ETH, SOL (SOL’s performance is often a precursor to altcoin rotations);

Track macro data and key market indicators.

Conclusion

The current market is not the end of the bull market, but a classic Bear Trap within the cycle. Its essence is to drive out impatient investors through fear and exhaustion, while the real rally often erupts after this cleansing.

For rational investors, now is:

The stage to accumulate at low levels, not panic sell;

A time to test patience and discipline;

An opportunity to build up for the final strong rally.

The real winners are not those who go with the emotional flow, but those who can endure fear, resonate with the market, and reap the rewards in the final celebration.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Has the four-year cycle of Bitcoin failed?

The various anomalies in this cycle—including waning sentiment, weakening returns, disrupted rhythms, and institutional dominance—have indeed led the market to intuitively feel that the familiar four-year cycle is no longer effective.

At an internal Nvidia meeting, Jensen Huang admitted: It's too difficult. "If we do well, it's an AI bubble," and "if we fall even slightly short of expectations, the whole world will collapse."

Jensen Huang has rarely admitted that Nvidia is now facing an unsolvable dilemma: if its performance is outstanding, it will be accused of fueling the AI bubble; if its performance disappoints, it will be seen as evidence that the bubble has burst.

After a 1460% Surge: Reassessing the Value Foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.

The demise of a DAT company

The $1 billion Ethereum DAT plan led by Li Lin and others has been shelved due to the bear market, and funds have been returned. This "going with the flow" approach may reflect consideration of investor sentiment.