IOTA Research Highlights Blockchain’s Role in Circular Economy at Product End-of-Life

- IOTA’s research highlights blockchain’s strong roles in enabling the circular economy solutions, especially at the critical End-of-Life stage of products.

- Thus, the market trends and staking dynamics suggest IOTA may be undervalued, with price growth potential tied to regulatory shifts and enterprise adoption.

According to aresearch paper published, new IFAC-PapersOnLine paper by the IOTA Foundation and University College Dublin, blockchain can help close material loops at a product’s End-of-Life (EoL) by improving traceability and certifying which parts should be reused, refurbished, remanufactured, or recycled.

In addition, a newly published paper in IFAC PapersOnLine (an Elsevier journal) has thrust IOTA back into the spotlight, demonstrating how distributed ledger technology (DLT) like IOTA’s Tangle can transform waste into value, ensuring transparency, accountability, and efficiency in remanufacturing, refurbishing, and de-manufacturing processes. As the authors stated:

Digital technologies, such as blockchain, have demonstrated significant potential in addressing critical EoL challenges, including providing proof of origin for proper handling and ensuring traceability of product performance.

In addition, the study that was co-authored by IOTA researchers Masood Ahmad, Pezhman Ghadimi, Vincent Hargaden, and Nikolaos Papakostas from University College Dublin, dives deeper into the challenges of product EoL management.

But, in contrast, the traditional linear economies conservatively often treat products as disposable once their initial use cycle ends, leading to massive resource waste and environmental degradation. A circular economy, on the other hand, emphasizes closing the loop through reuse, recycling, and regeneration.

Market Implications for IOTA’s Price

Previously, Crypto News Flash (CNF) reported that IOTA expanded its TWIN Initiative with a focus on customs, taxes, and trade digitization. As IOTA establishes its niche in real-world utility, far beyond speculative DeFi, the token (MIOTA) stands to benefit from sustained demand.

According to some market data watchers, IOTA might see a 15–25% price boost in the next few months, especially if new European rules on digital product passports (DPP) move forward quickly. In the past, similar sustainability-focused events have helped push IOTA’s value higher.

Also, with prices now sitting around $0.15–$0.20, many view it as an undervalued project with real long-term potential, especially as it links into the huge circular economy market worth trillions of dollars.

As of now, CoinMarketCap data shows that IOTA trading at around $0.1657 USD, up 2.29% over the past week, with a market cap of about $675 million. While these figures update in real time, they highlight that IOTA remains a mid-sized cryptocurrency with room to grow as enterprise pilots expand and on-chain activity increases. See IOTA price chart below.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.

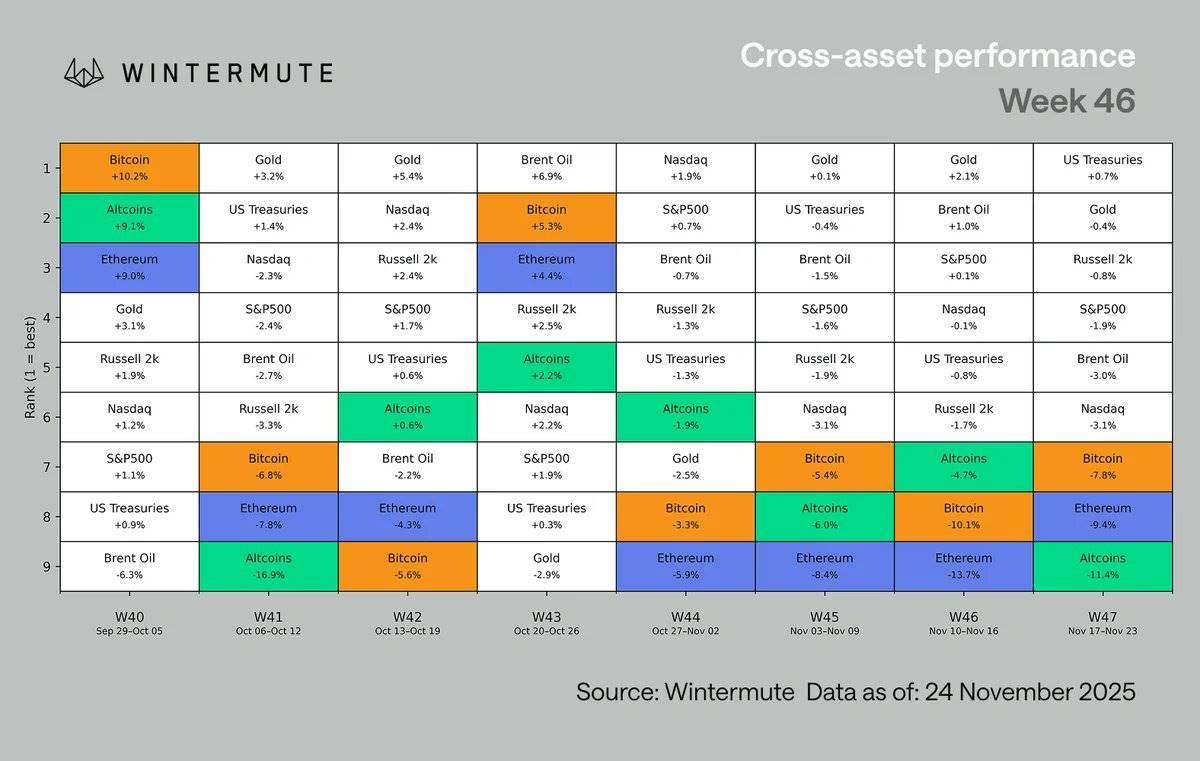

Wintermute Market Analysis: Cryptocurrency Falls Below $3 Trillion, Market Liquidity and Leverage Tend to Consolidate

This week, risk appetite deteriorated sharply, and the AI-driven stock market momentum finally stalled.

Former a16z Partner Releases Major Tech Report: How AI Is Eating the World

Former a16z partner Benedict Evans pointed out that generative AI is triggering another ten-to-fifteen-year platform migration in the tech industry, but its final form remains highly uncertain.