Federal Reserve Rate Cuts Drive $1,900,000,000 in Weekly Inflows to Crypto Products: CoinShares

Digital asset management firm CoinShares believes the crypto markets responded positively to last week’s “hawkish” Federal interest rate cuts.

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto exchange-traded product (ETP) investors initially reacted cautiously to last week’s rate cuts before finishing the week strong.

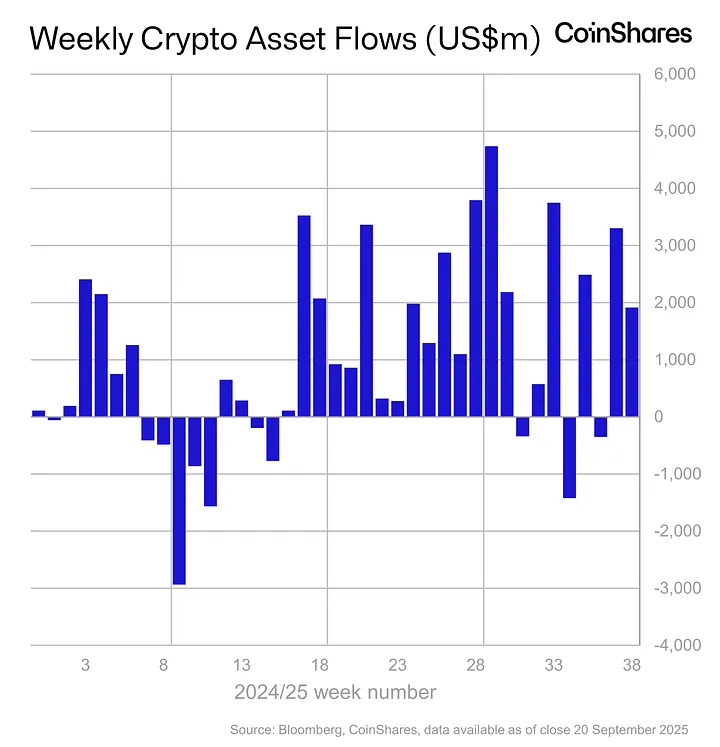

“Digital asset investment products recorded a second consecutive week of inflows, totaling US$1.9bn. After months of speculation, the US Federal Reserve cut interest rates last week.

Although investors initially reacted cautiously to the so-called “hawkish cut”, inflows resumed later in the week, with US$746m entering on Thursday and Friday as markets began to digest the implications for digital assets.”

Source: Rekt Capital/X

Source: Rekt Capital/X

Regionally, the US led globally with $1.8 billion in inflows. Following up the United States were Germany, Switzerland and Brazil, adding inflows of $51.6 million, $47.3 million and $9.3 million.

“Sentiment was broadly positive, though Hong Kong saw minor outflows of US$3.1m.”

King crypto Bitcoin ( BTC ), per usual, enjoyed the lion’s share of inflows at nearly $1 billion.

“Bitcoin attracted the largest share of inflows at US$977m last week. Short-bitcoin investment products continued to struggle, posting US$3.5m in outflows and bringing total AuM down to a multi-year low of US$83m.”

Ethereum ( ETH ) products enjoyed $772 million in inflows, followed by Solana ( SOL ) with $127.3 million in inflows and XRP with $69.4 million in inflows.

Generated Image: DALLE3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.