RippleX Unveils XRPL DeFi Roadmap: Will it Attract Institutional Capital?

RippleX has announced the next phase of its XRPL Institutional DeFi roadmap. The update focuses on compliance, lending, and privacy. It signals a clear push to bring regulated players on-chain. RippleX is Ripple’s developer and innovation arm. It supports the XRPL (XRP Ledger) ecosystem, funds projects, and develops features like tokenization and DeFi tooling. Roadmap

RippleX has announced the next phase of its XRPL Institutional DeFi roadmap. The update focuses on compliance, lending, and privacy. It signals a clear push to bring regulated players on-chain.

RippleX is Ripple’s developer and innovation arm. It supports the XRPL (XRP Ledger) ecosystem, funds projects, and develops features like tokenization and DeFi tooling.

Roadmap Highlights

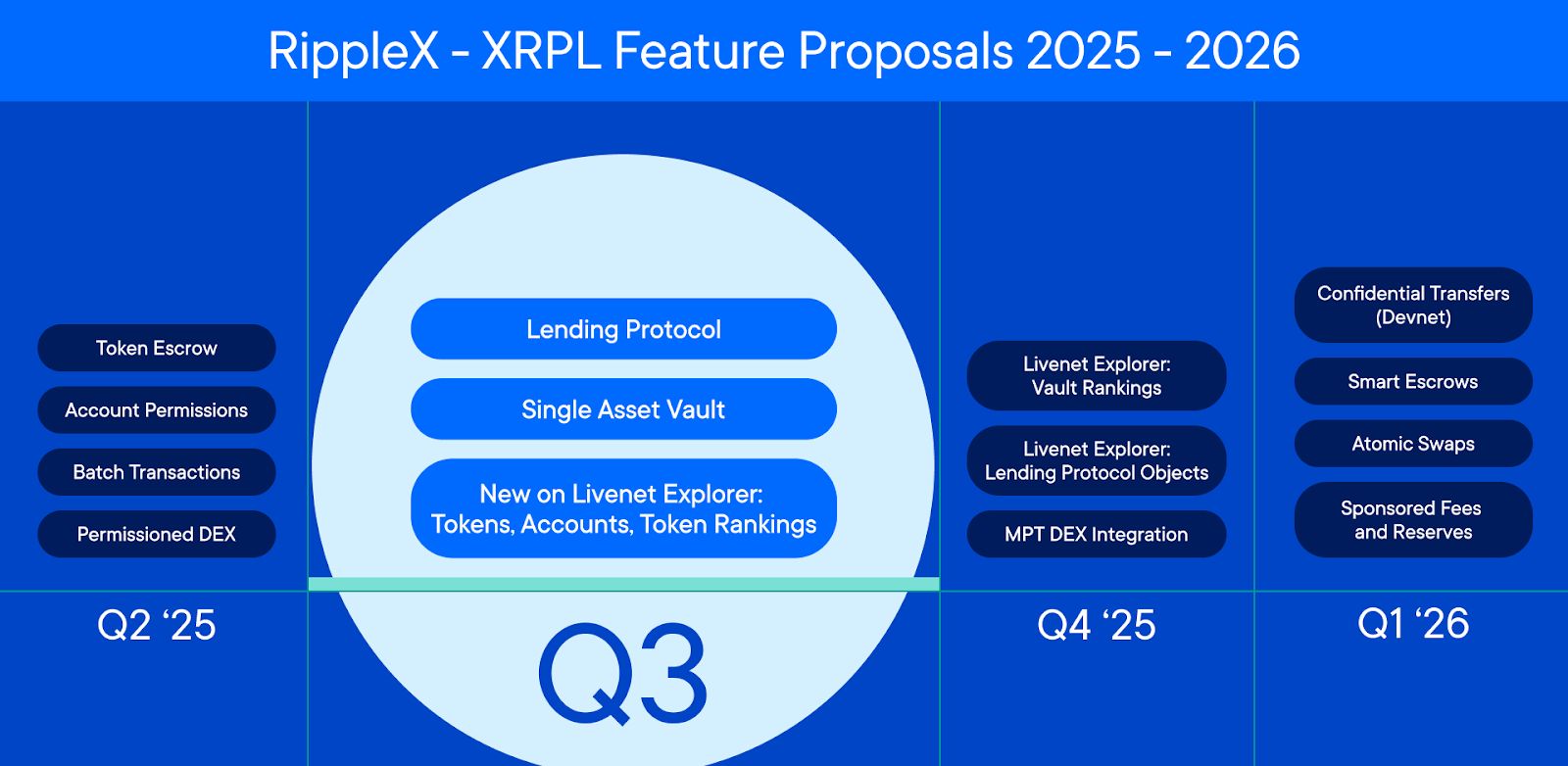

The roadmap outlines three pillars for growth. First, compliance features like Credentials and Deep Freeze are already live. Second, a native lending protocol will launch with XRPL Version 3.0.0 later this year.

Third, zero-knowledge proof (ZKP) integrations are in development. These will enable confidential transactions while keeping regulators satisfied. RippleX expects confidential Multi-Purpose Tokens (MPTs) in early 2026.

RippleX XRPL Roadmap. Source: RippleX

RippleX XRPL Roadmap. Source: RippleX

XRPL has recorded over $1 billion in monthly stablecoin volume. It now ranks in the top 10 chains for real-world asset activity. RippleX sees these milestones as proof that institutional DeFi is scaling fast.

“This momentum underscores XRPL’s evolution into a leading blockchain for real-world finance. The ledger is increasingly positioned to power two of the most significant use cases in global markets today: stablecoin payments and collateral management, with tokenization providing the essential foundation. What began as an ambitious vision for regulated, on-chain finance is now rapidly becoming industry standard,” RippleX said in a press release shared with BeInCrypto.

This shift mirrors what we have seen in tokenization markets. BeInCrypto recently reported on the US Department of Commerce’s plans to put macroeconomic data like GDP and PCE Index on the blockchain, highlighting growing mainstream adoption of digital assets. XRPL’s Multi-Purpose Token (MPT) standard is part of that same wave, aiming to give issuers tools for regulated on-chain finance.

We also covered the rise of compliance-first DeFi platforms earlier this year. Ripple’s permissioned DEX launch was one example of how chains are adapting to regulatory pressure. The new roadmap continues that theme, with Credentials and Deep Freeze reinforcing XRPL’s compliance focus.

The Challenge Ahead

Ethereum and its L2s still dominate DeFi. Solana and Avalanche are also targeting tokenization and institutional adoption. RippleX must prove its compliance-heavy approach can attract liquidity.

The lending protocol is the next major test. If successful, it could create low-cost, compliant credit markets at scale. But institutions will only commit if liquidity follows.

RippleX has placed institutional DeFi at the heart of XRPL’s future. The roadmap reflects a clear strategy built on compliance, credit, and confidentiality. The next year will show if institutions embrace it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.