Nubank plans stablecoin integration for credit card transactions

Nubank, Latin America’s largest digital bank, is reportedly planning to integrate dollar-pegged stablecoins and credit cards for payments.

The move was disclosed by the bank’s vice-chairman and former governor of Brazil’s central bank, Roberto Campos Neto. Speaking at the Meridian 2025 event on Wednesday, he highlighted the importance of blockchain technology in connecting digital assets with the traditional banking system.

According to local media reports, Campos Neto said Nubank intends to begin testing stablecoin payments with its credit cards as part of a broader effort to link digital assets with banking services.

"What the data shows is that people aren't buying to transact, they're buying as a store of value, he reportedly said. “And we need to understand why this is happening. I think it's changing a bit, but we need to understand it."

He also noted that the challenge for banks is finding a way to accept deposits in tokenized forms and use these assets to issue credit for clients.

Founded in São Paulo in 2013, Nubank is a Brazilian digital bank serving more than 100 million customers across Brazil, Mexico and Colombia. The bank first entered the digital asset space in 2022 by allocating 1% of its net assets to Bitcoin and rolling out crypto trading for its customers.

In March 2025, Nubank broadened its crypto lineup with the addition of four altcoins, giving customers access to Cardano (ADA), Cosmos (ATOM), Near Protocol (NEAR), and Algorand (ALGO).

Related: Nubank to launch loyalty tokens on the Polygon blockchain

Stablecoin adoption surges in Latin America

Stablecoin adoption has been surging in Brazil. In February, the president of the Central Bank of Brazil told attendees at a Bank for International Settlements event that 90% of crypto activity in the country was linked to stablecoins.

Dollar-pegged digital assets have also gained traction in Argentina, where inflation has exceeded 100% in recent years.

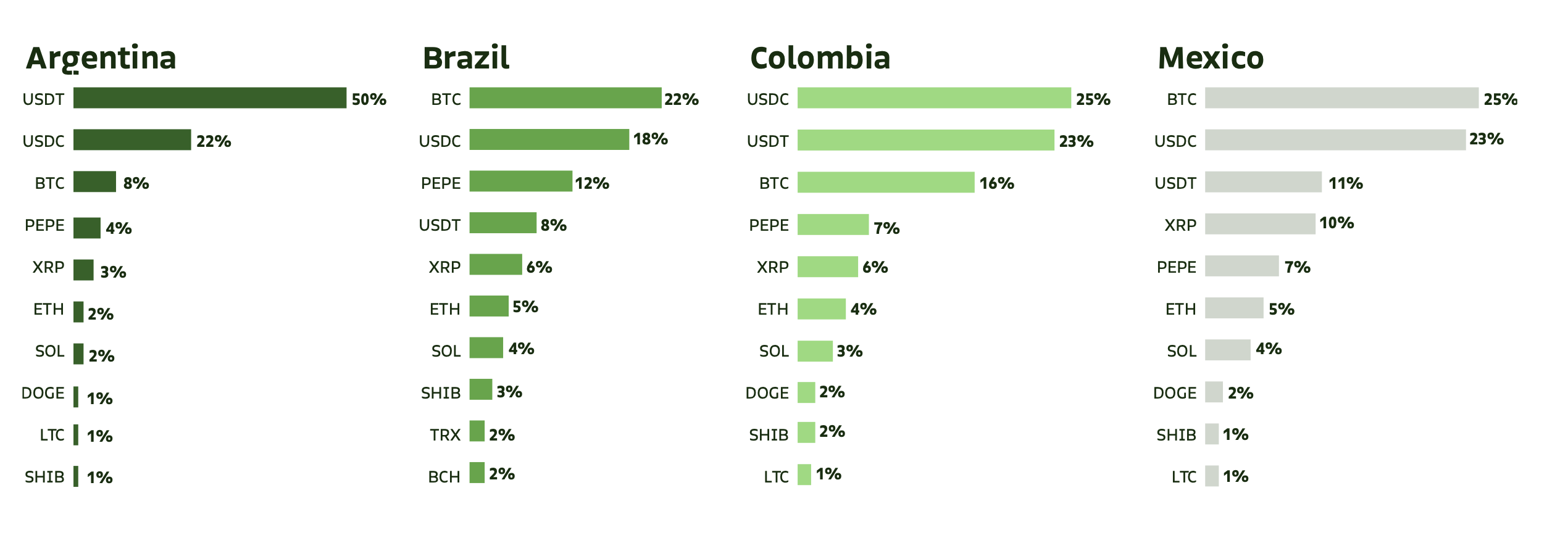

According to a March 2025 report from Bitso, USDt (USDT) and USDC (USDC) accounted for 50% and 22% of all cryptocurrency purchases in the country in 2024, respectively. The same report found that stablecoins made up 39% of all purchases on its platform across the region in 2024.

Stablecoin adoption has also been growing in other Latin American countries.

In July 2025, the Central Bank of Bolivia signed an agreement with El Salvador to promote crypto as a “viable and reliable alternative” to fiat. Since lifting its crypto ban in June 2024, Bolivia has allowed banks to process Bitcoin and stablecoin transactions.

In Venezuela, where inflation hit 229% in May, stablecoins like USDt have started to replace the bolívar in daily commerce, from groceries to salaries. Chainalysis data shows they made up 47% of all crypto transactions under $10,000 in 2024.

Magazine: Legal Panel: Crypto wanted to overthrow banks, now it’s becoming them in stablecoin fight

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Disney CEO meets top Chinese official as 'House of Mouse' navigates US‑China tensions

Evernorth, Doppler Partner to Deploy Institutional Liquidity on XRPL